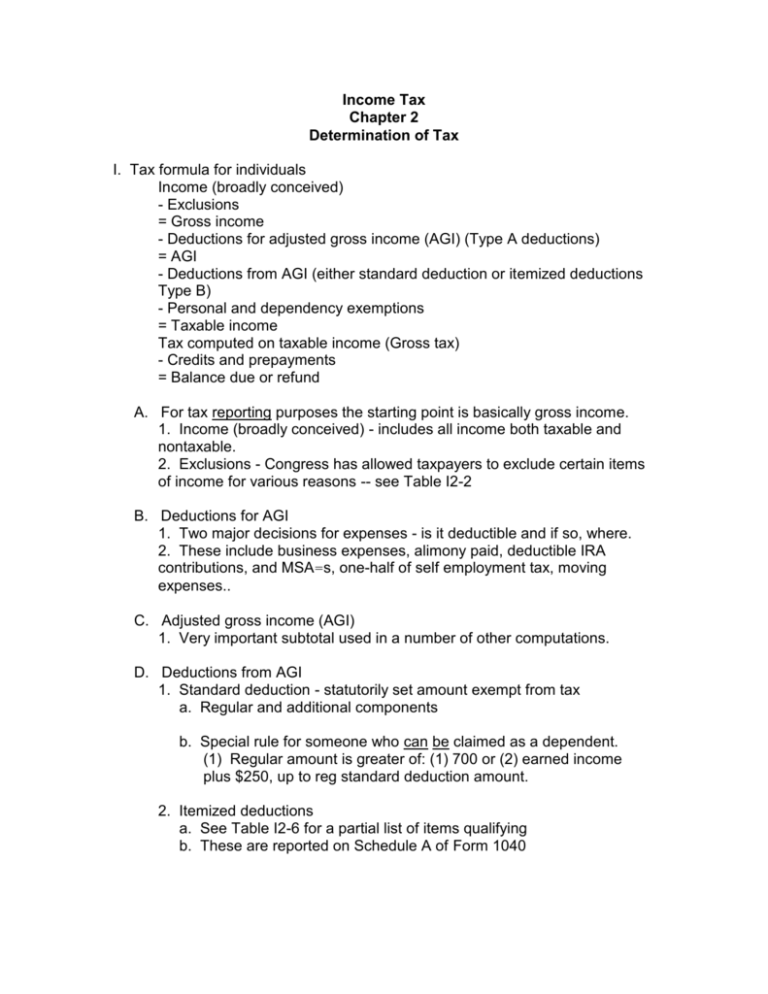

Chapter 2

advertisement

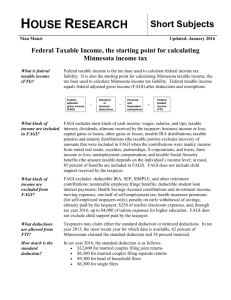

Income Tax Chapter 2 Determination of Tax I. Tax formula for individuals Income (broadly conceived) - Exclusions = Gross income - Deductions for adjusted gross income (AGI) (Type A deductions) = AGI - Deductions from AGI (either standard deduction or itemized deductions Type B) - Personal and dependency exemptions = Taxable income Tax computed on taxable income (Gross tax) - Credits and prepayments = Balance due or refund A. For tax reporting purposes the starting point is basically gross income. 1. Income (broadly conceived) - includes all income both taxable and nontaxable. 2. Exclusions - Congress has allowed taxpayers to exclude certain items of income for various reasons -- see Table I2-2 B. Deductions for AGI 1. Two major decisions for expenses - is it deductible and if so, where. 2. These include business expenses, alimony paid, deductible IRA contributions, and MSA=s, one-half of self employment tax, moving expenses.. C. Adjusted gross income (AGI) 1. Very important subtotal used in a number of other computations. D. Deductions from AGI 1. Standard deduction - statutorily set amount exempt from tax a. Regular and additional components b. Special rule for someone who can be claimed as a dependent. (1) Regular amount is greater of: (1) 700 or (2) earned income plus $250, up to reg standard deduction amount. 2. Itemized deductions a. See Table I2-6 for a partial list of items qualifying b. These are reported on Schedule A of Form 1040 3. The greater of the total standard deduction or itemized deductions will be subtracted in determining taxable income. 4. Certain taxpayers must itemize. 5. If AGI exceeds a specific amount, itemized deductions are limited E. Personal and dependency exemptions 1. Subtracted in determining taxable income - $28000 each for 2000 2. Personal exemption - for yourself a. Not available if you are eligible to be claimed as a dependent on another's return 3. Dependency exemptions - must meet 5 tests a. Support - must furnish over one-half of individuals support (1) Multiple support agreements - exception to above (2) Custodial parent in divorces after 1984 - get deduction even if support test not met. (Can waive right to deduction) b. Relationship or member of household c. Gross income -generally must be less than exemption amount (1) This test is waived for child under age 19 or child who is a full time student under age 24 d. Joint return - generally must not file a joint return e. Citizenship or residency 4. Personal and dependency exemptions are phased out if AGI is greater than a specified amount based on filing status. F. Tax Computation--based on taxable income 1. Use of tax table - taxable income < $100,000 2. Use of tax rate schedule 3. Tax rates -- progressive rate structure a. Marginal, effective, average tax rates 4. Amount of tax is dependent upon filing status a. Single b. MFJ c. MFS d. Head of Household (1) Abandoned spouse rules e. Surviving Spouse 5. Special "Kiddie Tax" calculations a. Unearned income of children under age 14 is taxed at parents rate. (1) At least $1400 is exempt from taxation at parents rate (2) Net unearned income: Unearned income - $700 - greater of 1) $700 or (2) allowable itemized deductions directly connected with the production of unearned income. b. Under certain conditions, the child's income may be reported on the parents return (Form 8814) G. Tax due or refund 1. Compare tax liability to tax credits and prepayments a. Common tax credits = Table I2-5. b. Refundable vs. Nonrefundable credit. II. Who must file? A. Based on gross income level. See page 2-29. B. Must file if self-employment earnings are $400 or more. C. Special rules for those claimed as a dependent -- must file if: - has earned income only and that income exceeds standard deduction - has unearned income only and gross income exceeds $700 (+ additional standard deduction) - has both earned and unearned income and gross income exceeds the greater of $700 (+ additional standard deduction), or the sum of earned income plus $250 (+ additional standard deduction) III. Property transactions - basic rules A. Amount realized - adjusted basis = realized gain or (loss) 1. Not all realized gains are recognized 2. Realized losses on sale of personal use assets are never recognized. B. Capital Gains and Losses -- arise from sale/exchange of capital assets. 1. Definition - all assets other than inventory, A/R, depreciable property or real estate used in a business. 2. Long term vs. short term (Sales after 1/1/98) a. Held one year or less = ST b. Held for more than 12 months = LT 3. Netting process: LTCG STCG LTCL STCL NET NET a. Continue offsetting as long as positive and negative amounts remain. 4. Capital gain treatment a. ST gains taxed at ordinary rates b. AAdjusted net capital gains@ is subject to a maximum rate of 20%. If taxpayer has a 15% marginal rate, the gains are subject to a 10% tax rate. c. Special rates pertain to gains from the sale of Acollectibles@ (28%) and certain depreciable real property (25%) d. AAdjusted net capital gain@--defined. 1. Net long-term capital gain determined without regard to --gain from sale/exchange of collectibles --unrecaptured section 1250 gain --gain on sale of small business stock excluded from income under Section 1202 5. Treatment of capital losses a. Deduction is limited to $3,000 per year b. Use short-term losses first c. Any excess capital losses can be carried forward indefinitely.