Unit 7 Money, Banking, and Monetary Policy

advertisement

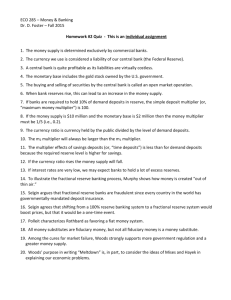

Unit 7: Money, Banking, and Monetary Policy Unit Activity 1: Roles/Functions of Money – Students will complete this content requirement via a Nearpod presentation. Activity 2: Roles/Functions of the Federal Reserve- Students will complete this content requirement via a Nearpod presentation. Day 1: Banking – Fractional Reserves and the Money Multiplier Standard addressed: SSEMA2 The student will explain the role and functions of the Federal Reserve System. a. Describe the organization of the Federal Reserve System. b. Define monetary policy. c. Describe how the Federal Reserve uses the tools of monetary policy to promote price stability, full employment, and economic growth. Specifically addresses content item: “Banks and the Creation of Money” in AP Macroeconomics Course Description Goal: Help students understand how banks essentially use loans to create money in the economy. Students must understand how banks can create money in order to understand monetary policy, which is the ultimate goal of this unit. Essential Question: How do banks facilitate the flow and creation of money in an economy? Vocabulary: asset, liability, net worth, fractional reserve banking, required reserve ratio, excess reserves, demand deposit, money multiplier After the class students should be able to: - Describe the role of banks in the economy Define assets and liabilities and recognize examples in the banking industry Describe how fractional reserve banking works Given assets, reserves, and liabilities, calculate the required reserve ratio Calculate the money multiplier and use the money multiplier to determine how the money supply is affected by an injection into the banking system Lesson Agenda Warm Up: Review question on previous day’s lesson on M1 vs. M2 money supply. The question will require students to understand that the main difference between the M1 and M2 money supply is liquidity. After students answer question, review definition of liquidity and have students determine which money supply component (M1 or M2) is more liquid. Have students explain their reasoning. Work Time: Seque from warm up into lesson by asking. Where would you likely go to liquidate a check someone gave you? Hopefully students will say “a bank.” If not, guide them there. Briefly discuss with students: What is a bank? Why do banks exist? What is their goal? Students should come to the realization that banks are businesses driven to make profit. Ask students: Why do people use banks? Allow students to discuss a variety of reasons. Tell students that one of the primary roles that banks play in the economy is something called “fractional reserve banking.” Have students break down the term to see if they can infer a definition. Tell students to fully understand fractional reserve banking, they must understand the terms assets and liabilities. Have students determine definitions. Show balance sheet of how assets and liability must balance. Use balance sheet design to show visual process of how fractional reserve banking works, addressing terms such as demand deposit, required reserves, and excess reserves. Use consistent questioning to relate back to assets and liabilities. Student Practice: Give students a balance sheet with demand deposits, loan amounts, and reserve amounts. Students must calculate the required reserve ratio. Ask students: Can we figure out how much impact this $10,000 injection into the bank will have on the economy as a whole? Yes! We just need a multiplier! Give the multiplier equation. Have students determine the impact on the economy from the previous example. Give student practice handout. Circulate to help students while they work on it. Review any problems that people were having trouble with as a class. Closing: Lesson recap. Run through notebook slides hitting big ideas. Assign Edmodo exit quiz. Day 2: Money Market Macroeconomic Graphs 1) Warm Up: What is the difference between compound and simple interest? 2) Review money multiplier problems from previous day if students have questions. 3) Intro to three monetary graphs: Money Market Model, Investment Demand Model, Loanable Funds Market – develop and discuss 4) Practice Application Problem 5) Closing: Discuss application problem Day 3: Money Market Macroeconomic Graphs Practice 1) Warm Up: Students will complete a Socrative quiz on fractional reserve banking, the money multiplier, and monetary graphs. Information will be used to identify any misunderstandings and review key points. 2) Students will work on a practice assignment where they will use the money multiplier and graphs to show changes in an economy. Students will be grouped based on information collected in Socrative. Students who are struggling will be grouped with those who have a slightly better grasp. 3) Closing: We will review the practice activity as a class, focusing not only on correct answers, ut how to convey the answers on the AP exam. Day 4: Macro Graph Assessment 1. Warm Up: Group review on each of the macro graphs. 2. Individual FRQ quiz using money market graphs. 3. Closing: Review problems as a class. Day 5: Tools of the Federal Reserve 1. Warm Up: Graph and Formula Challenge: Give students a list of graphs and formulas. Put five minutes on a timer. Students complete as many as they can. Review each graph and formula so students can check their work. 2. Introduction to the tools of Monetary Policy a. Tools of the Federal Reserve b. How are the tools applied? 3. Closing: Socrative Exit Ticket Day 6: Practice Applying Tools of Monetary Policy 1. Warm Up: Monetary Policy Review – Who makes monetary policy? If the economy is experiencing a recession, how can these tools be used to promote economic growth? 2. Students work in pairs to applying the tools of monetary policy. 3. Review practice on applying monetary policy. 4. Closing: Socrative Exit Ticket Day 7: Monetary Policy and Models Practice 1. Warm Up: Graphic Organizer differentiating between monetary and fiscal policy. 2. Monetary Policy and Macro Graphs Practice 3. Closing: Review Practice Assignment as a class. Day 8: Monetary Policy Test Review 1. Warm Up: Graph challenge – macro graphs only. 2. In small groups, students work to analyze practice multiple choice questions. Teacher will circulate to help explain and give assistance. 3. Closing: Review Key Points from unit Day 11: FRQ Test Day 12: MC Test Day 13: Corrections