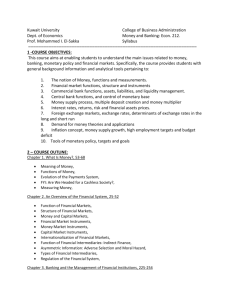

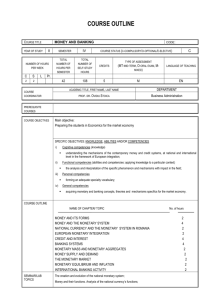

MONEY AND BANKING (ECON 212-57)

advertisement

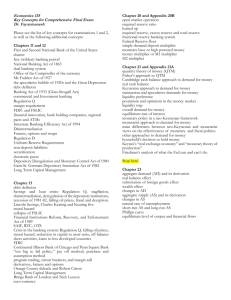

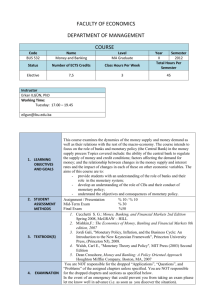

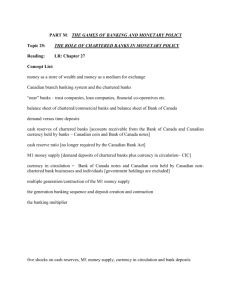

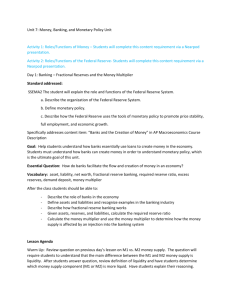

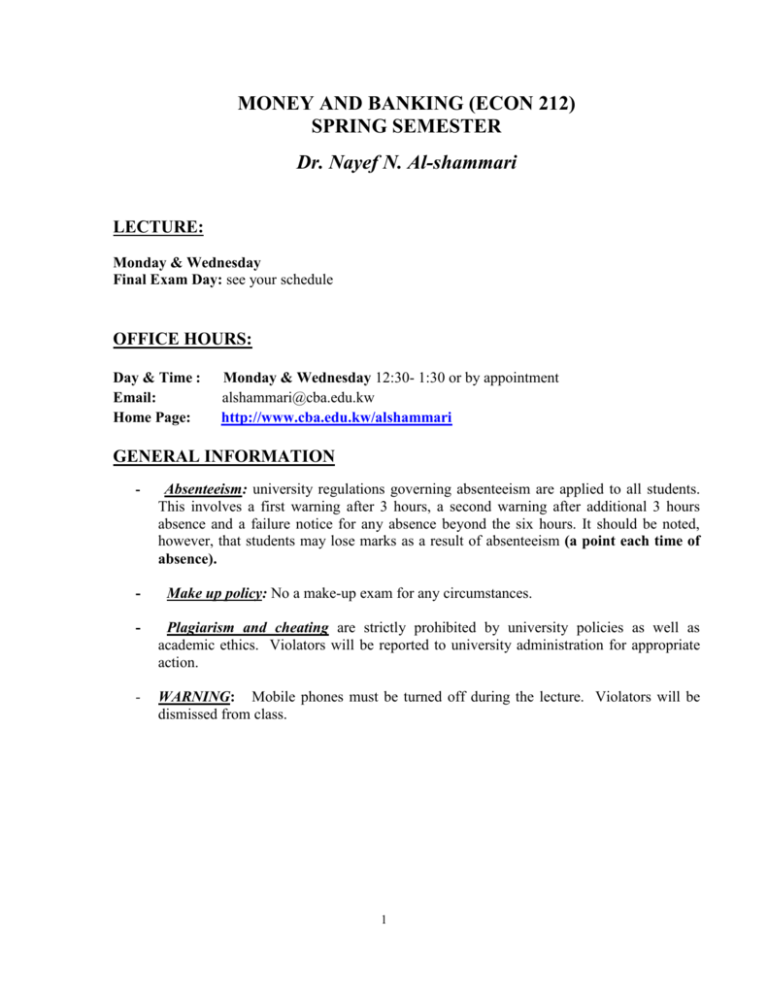

MONEY AND BANKING (ECON 212) SPRING SEMESTER Dr. Nayef N. Al-shammari LECTURE: Monday & Wednesday Final Exam Day: see your schedule OFFICE HOURS: Day & Time : Email: Home Page: Monday & Wednesday 12:30- 1:30 or by appointment alshammari@cba.edu.kw http://www.cba.edu.kw/alshammari GENERAL INFORMATION - - Absenteeism: university regulations governing absenteeism are applied to all students. This involves a first warning after 3 hours, a second warning after additional 3 hours absence and a failure notice for any absence beyond the six hours. It should be noted, however, that students may lose marks as a result of absenteeism (a point each time of absence). Make up policy: No a make-up exam for any circumstances. - Plagiarism and cheating are strictly prohibited by university policies as well as academic ethics. Violators will be reported to university administration for appropriate action. - WARNING: Mobile phones must be turned off during the lecture. Violators will be dismissed from class. 1 Schedule of Exams and Grade Distribution & Scale Category Weight Midterm Exam* 30% Quizzes* 10% Final Exam* 50% Other Activities** 10% Total 100% Grading Scale Total Point Scale Grading 95≥ TP 90≥TP>95 87≥TP>90 83≥TP>87 80≥TP>83 77≥TP>80 73≥TP>77 70≥TP>73 65≥TP>70 60≥TP>65 TP<60 A AB+ B BC+ C CD+ D F *No make-up exams will be administered ** these include attending (5%) and class participation (5%) COURSE OBJECTIVES: This course aims at enabling students to understand the main issues related to money, banking, monetary policy and financial markets. Specifically, the course provides students with general background information and analytical tools related to: The Money, Financial market, Commercial bank functions, Central bank, Money supply process, multiple deposit creation and money multiplier , Interest rates, returns, risk and financial assets prices, Foreign exchange markets, exchange rates, Demand for money, Inflation concept, money supply growth, high employment targets and budget deficit, Tools of monetary policy, targets and goals, IS/LM analysis and general equilibrium. REFERENCES: Frederich, S. Mishkin “The Economics of Money, Banking, and Financial Markets “Addison Wesley, 8th ed. (Required). Course Outline This course is mainly concerned with the economic issues of money, monetary policy, central banking, the banking system and financial markets. The course covers the following topics: 2 1. Introduction: (Chapter 1) - General Information. - Why study Money, Banking, and Financial Markets. 2. Money (Chapter 3) - The meaning of money - The functions of money - Measuring money - The Evolution of Payment System - Application for the case of Kuwait (CBK-Publication) 3. Fundamentals of Financial Markets (Chapter 2) - The functions of financial markets - The structure of financial markets: * Debt and equity markets * Primary and secondary markets * Money and capital markets - Financial Market Instruments: * Capital market instruments * Money market instruments - Function and types of Financial Intermediaries - Regulation of the Financial System 4. Commercial Banks (Chapter 9) - The functions of commercial banks - The bank balance sheet - Application for the case of Kuwait (commercial banking in Kuwait) - Bank assets, liability, liquidity and capital management - Credit risk management - Interest rate risk management - Off-Balance sheet activities 5. Multiple Deposit Creation and the Money Supply Process (Chapter 13) - The four players in the money supply process. * Central bank * Financial intermediaries (commercial banks ... etc.) * Depositor * Borrowers - Multiple deposit creation: A simple model - Determinants of the money supply - The money multiplier: Factors that affect the money multiplier - The empirical definition of money: M1, M2, and other definitions 3 6. Central Banks & the Determinants of the Money Supply (Chapter 14) - The functions of central banks - The central bank balance sheet and the monetary base - Factors that affect the monetary base - The Money Supply Model and the Money Multiplier. - Factors that Determine the Money Multiplier. - Overview of the Money Supply Process. 7. Tools of Monetary Policy (Chapter 15) - The Market for Reserves and the Inter-bank Rate - Open Market Operations - Discount Policy - Reserve Requirements 8. Conduct of Monetary Policy - Goals of Monetary Policy - Central Bank Strategy: Use of Targets - Choosing the Targets - Some Applications (Chapter 16) 9. The Foreign Exchange Market (Chapter 17) - Foreign Exchange Market - Exchange Rates in the Long-term - Exchange Rates in the Short-term - Explaining Changes in Exchange Rates 10. The Demand for Money (Chapter 20) --------(If time permits) - The quantity theory of money - The Cambridge approach to money demand - Keynes’ liquidity preference theory - Recent developments in the Keynesian approach - Friedman’s modern quantity theory of money 4