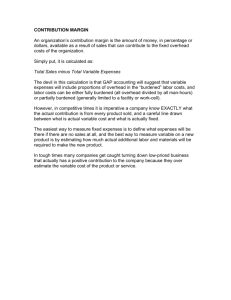

Variable Costs - Cloudfront.net

advertisement

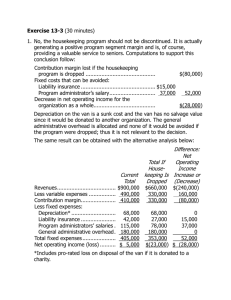

Developing Financial Projections for a Business Plan Dave Ziler February 10, 2016 Agenda • Basic Income Statement formats • Testing the business concept • Tying data & assumptions to the financial projections • Developing Year 1 • Projecting Years 2 & 3 Three Disclaimers • There is no “right way”. What is contained in this presentation is a proven approach. It may not be consistent with courses you’ve taken or approaches expressed by other business professionals. • The method shown to account for cash is not proper accounting. It’s simply an approach to help think through the use of the funds. What Is An Income Statement? A financial statement that reports revenues and expenses for a fiscal period as a means of determining how well a company has performed in creating profit. Definition + Revenue The amount a company expects to receive upon the sale of goods and/or services - Costs directly associated with generating revenues Variable Cost = Contribution Margin Revenue minus Variable Cost - The sum of all direct and indirect selling expenses and all general and administrative expenses of a company Sales, General, & Administrative (SG&A) = Operating Profit* Contribution Margin minus SG&A + Earned Interest Interest earned on investments - Corporate tax Taxes = Net Income Income retained by the company * Also known as Earmings Before Interest & Taxes (EBIT) Income Statement Example 2015 Operating Plan ($K) Q1 Q2 Q3 Q4 2015 Revenue 637 640 544 663 2,485 Variable Cost Cost of Goods Sold-Hdwe Variable Labor Cost Sales Commission Total Variable Cost 19 86 32 136 19 86 32 137 22 100 27 149 7 33 33 73 67 304 124 495 Contribution Margin CM% 501 79% 504 79% 395 73% 590 89% 1,990 80% SG&A Compensation & Benefits Salary Taxes 401K Health/Life Insurance Total Personnel Exps 212 24 10 22 269 206 23 10 22 262 194 24 10 22 250 281 25 11 22 340 895 96 42 88 1,120 Operating Expenses Facility Cost General Insurance IT Professional Fees Travel Expenses Depriciation & Amort Marketing Other Operating expenses Total Operating Exps 61 9 8 33 17 11 4 11 155 61 9 8 20 17 11 4 11 142 61 9 8 20 17 11 4 11 142 61 9 8 20 17 11 4 11 142 245 36 32 94 67 45 15 46 580 Operating Profit OP% 78 12% 100 16% 3 1% 109 16% 290 12% Comments Key variable cost line items • Parts & supplies to produce the product • Labor to build equipment • Sales commissions Compensation & Benefits • Usually the largest SG&A component • OK to estimate benefits • For startups • ~1.10 * salaries w/o benefits • ~1.25 * salaries w/benefits Operating Expenses • Consider applicable line items • Minimize costs to the extent practical • Avoid “Other” in your business plan Summary of Income Statements • Demonstrates profitability • Typically used for two purposes: • Results…..up and running businesses • Projections…..your focus for the BYOBB • Vary from business to business at the detailed level • Projections must be tied to valid & logical assumptions • Don’t get sidetracked on Variable Cost vs. SG&A • Be thorough on all projected costs • There is no “standard” format for a type of business • There are some items that will be the same (marketing, facilities, etc) Testing The Business Concept An approach to the “back of the envelope Excel test” 1. Assume you are going to win the BYOBB ($40K cash) 2. Assume $0 revenue for year 1…. unless you already have sales 3. Start the income statement by listing all cost line items • Don’t be concerned about variable vs. SG&A • Be exhaustive….salaries, channel costs, marketing, & more 4. How much cash is remaining after year 1? 5. Can you generate enough revenue in year 2 to break even? 6. Will you be profitable in year 3? Aligning the Plan With The Financials Include a summary statement that describes the use of the funding Quantitative Examples Qualitative Examples • Win BYOBB = $40K cash • Target market segment • Market share • Resource additions • Development costs • Channel partners • Hosting costs • Marketing approach • Office equipment & supplies • Advertising approach Developing Year 1 Beginning Cash Revenue Variable Cost Cost 1 Cost 2 Cost 3 Total Variable Cost 2015 $ 40,000 2016 2017 Beginning Cash • Assumes winning the BYOBB Grand Prize Variable Costs • Zero in Year 1 unless there are sales Contribution Margin CM% SG&A Salaries & Benefits Advertising & Marketing General Insurance Professional Fees Cost 4 Cost 5 Cost 6 Cost 7 Total Operating Exps Operating Profit OP% Taxes Net Income Sales, General, & Administrative • These 4 are the most common • Be thorough • Include all lines….even if Y1 = 0 Net Income • A Y1 loss is acceptable Estimating Years 2 & 3 Beginning Cash Revenue Variable Cost Cost 1 Cost 2 Cost 3 Total Variable Cost Contribution Margin CM% SG&A Salaries & Benefits Advertising & Marketing General Insurance Professional Fees Cost 4 Cost 5 Cost 6 Cost 7 Total Operating Exps Operating Profit OP% Taxes Net Income 2015 $ 40,000 2016 2017 Cash Estimates (does not consider cash flow) • Y2 = $40K + Y1 Net Income • Y3 = Y2 Beginning Cash + Y2 Net Income • Don’t forget about taxes! • May assume that you acquire additional funding Revenue • Tie to price & market share assumptions • Must be realistic Variable Costs • Consider channel costs & sales commission • Raw material examples: • Ingredients for a restaurant • Materials to make clothing • Inventory for a beauty supply shop Sales, General, & Administrative • Tie resource add timing to assumptions • Plan for ongoing costs Net Income • Profitability in Y2 or Y3 • May be negative if additional funding is raised Summary • Be thorough when considering costs…the best place to start • Assumptions to construct the financials need to be consistent with the business plan • Financial projections need to be consistent with the assumptions • They are estimates……do they make sense?