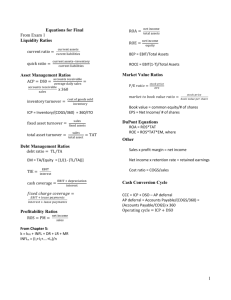

Final Exam Equations Sheet Equations from Exam 1 Liquidity Ratios

advertisement

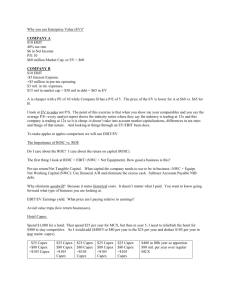

Final Exam Equations Sheet Equations from Exam 1 Liquidity Ratios current assets curent liabilities ROCE = EBIT(1-T)/Total Assets current assets−inventory current liabilities Asset Management Ratios accounts receivable ACP = DS0 = average daily sales accounts receivable x 360 sales inventory turnover = = cost of goods sold inventory fixed asset turnover = sales fixed assets total asset turnover = sales total asset = TAT Data Management Ratios debt ratio = TL/TA 𝑠𝑡𝑜𝑐𝑘 𝑝𝑟𝑖𝑐𝑒 𝐸𝑃𝑆 𝑚𝑎𝑟𝑘𝑒𝑡 𝑡𝑜 𝑏𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑟𝑎𝑡𝑖𝑜 = 𝑠𝑡𝑜𝑐𝑘 𝑝𝑟𝑖𝑐𝑒 𝑏𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 Book value = common equity/# of shares EPS = Net Income/ # of shares DuPont Equations ROA = ROS*TAT ROE = ROS*TAT*EM, where EM =TA/Equity = [1/(1- (TL/TA))] Other Sales x profit margin = net income Net income x retention rate = retained earnings Cost ratio = COGS/sales EBIT interest cash coverage = Market Value Ratios P/E 𝑟𝑎𝑡𝑖𝑜 = ICP = Inventory/(COGS/360) = 360/ITO TIE = net income equity BEP = EBIT/Total Assets current ratio = quick ratio = ROE = EBIT + depreciation interest 𝑓𝑖𝑥𝑒𝑑 𝑐ℎ𝑎𝑟𝑔𝑒 𝑐𝑜𝑣𝑒𝑟𝑎𝑔𝑒 = 𝐸𝐵𝐼𝑇 + 𝑙𝑒𝑎𝑠𝑒 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 + 𝑙𝑒𝑎𝑠𝑒 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 Profitability Ratios ROS = net income sales ROA = net income total assets Cash Conversion Cycle CCC = ICP + DSO – AP deferral AP deferral = Accounts Payable/(COGS/360) = (Accounts Payable/COGS) x 360 Operating cycle = ICP + DSO From Chapter 4: (4.3) k = kPR + INFL + DR + LR + MR (4.4) INFLn = (I1+I2+….+In)/n 1 Simplified “Textbook” Financial Statements Sales -COGS Gross Margin -(Other) Expenses EBIT = Operating Income -Interest EBT -Taxes Net Income = EAT -DIV Retained Earnings 1. Sales -VC Gross Profit -Fixed Cost EBIT -I EBT -T NI -DIV RE Assets Cash (Net) Accounts Rec. Inventory Current Assets = Gross Working Capital Net Fixed Assets Total Assets Liab. & O.E. Accounts Payable Accruals Notes Payable Current Liabilities Long term debt Total Liabilities Net working capital = CA-CL Par value Stock Paid in excess or surplus +Retained Earnings Total Liab. and O.E. Equity Equations/Formulas from AGEC 424: Exam 2 PV = PMT EBIT 1 - tax rate K ROCE = 14. Constant growth model: debt + equity 2. Contribution = P – V P0 3. Contribution margin = CM = (P-V)/P 4. Operating breakeven quantity: D1 D (1 g) 0 Ks g Ks g In general, if the constant growth model is applied after time zero then: QB/E = FC / (P – V) 5. Financial breakeven quantity: QBE= (FC+I)/(P - V) 16. MRP = KM – KRF n 17. Mean: SB/E = FC / CM S - VC S - VC – Fc k̂ p i k i i 1 Gross Profit = EBIT 8. %ΔEBIT = DOL x %ΔSales 18. Variance: 𝜎 2 = ∑𝑛𝑖=1 𝑝𝑖 (𝑘𝑖 − 𝑘̂) 2 EBIT 9. DFL = EBIT - Interest 19. Standard deviation: 𝜎 = √𝜎 2 𝜎 20. CV = ̂ 𝑘 10. %ΔEPS = DFL x %ΔEBIT 21. Portfolio beta: 𝛽𝑝 = ∑𝑛𝑖=1 𝛽𝑖 𝑤𝑖 11. DN Ks g 15. SML: Ks = KRF + (KM – KRF)s 6. SB/E = QB/E(P) 7. DOL = PN 1 Sales VC DTL DOLxDFL EBIT Interest 12. %ΔEPS = DTL x %ΔSales 22. Portfolio expected return: 𝑛 𝑘̂𝑝 = ∑ 𝑘̂𝑖 𝑤𝑖 𝑖=1 13. PV of a perpetual annuity: 2 23. Effective Annual interest rate: n i EAR 1 1 n 24. current yield on a bond = (annual coupon interest)/ (current bond price) 25. YTM = current yield + capital gains yield (If you know the YTM and the current yield on a bond, you can subtract to get the expected capital gains.) 26. The required return on a stock is equal to the dividend yield plus expected capital gains yield. 27. capital gains yield = (Pt - Pt-1)/Pt-1 28. Dividend yield = D1/P0 “Equation” Sheet from AGEC 424 Exam 3 Net Salvage Value (NSV) Calculation Selling price Tax on SV: Adjusted Basis: -Tax on SV NSV Selling Price Initial Basis -Adjusted Basis -Accumulated dep. Taxable gain (loss) Adjusted Basis x tax rate Tax (tax “credit” if neg.) Replacement Investmenta (we will do the third column) Buy a new machine Keep your old machine Replacement = Buy new minus keep oldb Initial outlay -Cost of new machine -/+ NWC - Current NSV old machine -Cost of new machine - /+NWC + Current NSV old machine Depreciation old machine Change in depreciation is used in the modified income statement to get operating cash flow Operating cash flow Depreciation new machine Terminal Cash Flow + NSV new machine +/-NWC offset + ending NSV old machine + NSV new machine - ending NSV old machine +/-NWC offset a In AGEC 424 we always do replacement problems where the life is the same for the new and for the old. If the life is different one needs to take the net present values of “new machine” and “keep old” separately and then compute the equivalent annual annuity before comparing. b There are three items in bold. These are the three differences between a new investment problem and a replacement investment problem. n 29. SML: ks = kRF + s (kM – kRF) 30. Mean or expected value: k̂ p i k i i 1 3