The Role of Managerial Accounting and The IMA

advertisement

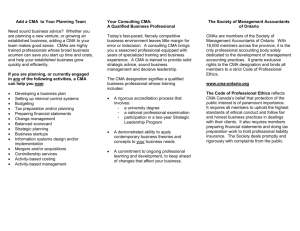

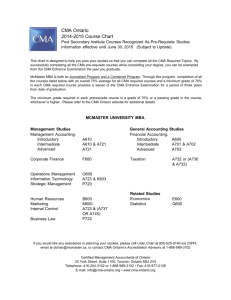

The Role of Managerial Accounting and The IMA Great Time to Be entering Accounting Profession The employment of accountants and auditors is expected to grow through the year 2016 according to the 2008-2009 Occupational Outlook Handbook from the US Department of Labor Why Expected Need for Accountants and Auditors? Corporate governance reforms, an increasingly global business environment, and rapidly changing technologies are fueling a need for accounting and finance professionals with advanced skills and up-to-date knowledge The best job prospects will be for accountants and auditors who have a college degree or any certification What is Management Accounting? Management Accounting is a professional discipline that has an integral role in formulating and implementing the organization’s strategy Who are Management Accountants? Management Accountants are part of the management team, working within the organization at many levels: from top-level management to support-level accounting and finance professionals. Management Accountants apply their knowledge and experience in accounting and financial reporting, budgeting, decision support, risk and performance management, internal control, and cost management. Management Accountants The vast majority of accounting majors will ultimately end up in private or governmental accounting at some point during their career American Institute of Certified Public Accountants (AICPA) indicates that over 140,000 CPAs- more than 40% of its membership –practice accounting in business and industry Certifications RHI (Robert Half International) Guide to Certifications lists 42 certifications for accounting, finance, and operation management What Distinguishes IMA? IMA is the exclusive organization that promotes and offers the CMA certification. About IMA Founded 1919 Mission-To provide a dynamic forum for management accounting and finance professionals to develop and advance their careers through certification, research, and practice development, education, networking and the advocacy of the highest ethical and professional practices More About IMA Vision: The worlds leading association for management accounting and finance professionals Nearly 60,000 Members 85% U.S. 15% International Certification-It Pays IMA 19th Annual Survey (Strategic Finance June 2008 coauthored by Karl Reichardt, Dean Valparaiso University and Calumet Chapter IMA member) found that IMA members who have a certification receive a higher average salary and compensation than those that don’t have a certification. Certification Keeps Paying The differences in compensation continue to grow throughout an individual’s career On average, an accountant with CMA certification will make 25% more than accountants without certification On average, an accountant with both CMA and CPA Certifications will make 32% more than accountants without certification What is CMA? CMA= Certified Management Accountant CMA certification targets corporate finance professionals requiring the skills related to management accounting CMA certification indicates proven knowledge of a variety of business-related topics, which allows finance professionals to act more as strategic business partners than as “number crunchers” More about CMA The CMA is a rigorous certification that requires demonstration of the CMA body of knowledge through a four part exam and through educational and experience requirements. CMA certification also requires a commitment to continuing professional education. CMA EXAM TOPICS Part 1 Business Analysis Part 2 Management Accounting and Reporting Part 3 Strategic Management Part 4 Business Applications Part I Business Analysis 110 Multiple Choice Questions Business Economics (25%) Global Business(20%) Internal Controls(15%) Quantitative Methods(15%) Financial Statement Analysis (25%) Three hours allotted to complete Waiver available if CPA, CIA or CFA Part 2 Management Accounting and Reporting 140 Multiple Choice Questions Budget Preparation (15%) Cost Management (25%) Information Management (15%) Performance Measurement (20% External Financial Reporting (25%) Four hours allotted to complete Part 3 Strategic Management 110 Multiple Choice Questions Strategic Planning (15%) Strategic Marketing (15%) Corporate Finance (25%) Decision Analysis (25%) Investment Decisions Analysis (20%) Three hours allotted to complete Results No penalty for incorrect answers A score report is available immediately after parts 1-3 Scaled Scores from 200-700 500 passing If a passing score not received in 2-3 weeks will receive a detail of performance report Part 4 Business Applications Between 3-7 written essays and quantitative responses Organization Management Organization Communications Ethical Consideration Capstone Case Studies of parts I-III Three hours allotted to complete Graded by Subject Matter Expert (SME) Pass Fail-Results in about 30 days When is the CMA offered? Parts 1,2 and 3 are offered January-February May-June September-October Parts 4 offered 3 times per year (Must pass parts 1-3 to take part 4) April August December To Take the CMA Exam Join the Institute of Management Accountants Student Membership $39.00 If join as student $15.00 membership registration fee waived Can join online at http://www.imanet.org Education Requirements for CMA Bachelors Degree in any area from an accredited college or university All transcripts must be submitted in english and show the official seal of the college or university OR Score in the 50th percentile or higher on either the Graduate Management Admission Test (GMAT) or the Graduate Record Examination (GRE). OR EDUCATIONAL REQUIREMENTS CMA Professional Qualification comparable to the CMA – Charted Financial Analyst (CFA) Certified Internal Auditor (CIA) Certified Public Accountant (CPA) CAN TAKE THE EXAM AS A STUDENT NO 150 hour requirement Experience Requirements for CMA 2 continuous years of professional experience in management accounting or financial management Qualifying experience consists of positions requiring judgments regularly made employing the principles of management accounting and financial management. Such employment includes financial analysis, budget preparation, management information system analysis, financial management, management accounting, and auditing in government, finance or industry, management consulting, auditing in public accounting, research, teaching or consulting related to management accounting or financial management CMA Fees $200 Certification Entrance Fee Includes Credential review for educational qualification Credential review for experience qualification Electronic access to the CMA Resource guide to exam preparation Access to the Certification Listserv for peer-to peer networking Final Score Report Also Include in Certification Entrance Fee Personalized numbered Certificate Congratulatory notification to employer or others if desired Maintenance of continuing education records CMA Assessment tool for 6 months Printable Q & A Electronic books Retired Questions Discounts for Students and Faculty Certification Entrance Fee for students in US, Canada and Mexico= $75.00 Each Exam part is $190.00. For Students 50% off = $95.00 Faculty Members first time Free, 2nd time around $95.00 Where to take the CMA Exam Prometric Testing Centers West 81st Street, Merrillville, IN. 17936 South Halsted Street, Homewood, IL. 606 After Become a CMA 30 hours of Continuing Professional Education (CPE) required each year 2 of the 30 hours must be in ethics Must maintain membership in IMA A good source of CPE and networking opportunities- local chapters Calumet Chapter IMA Serves Northwest Indiana and Southern Suburbs of Chicago Approximately 80 members Monthly Technical Meetings SeptemberMay excluding December Student Nights in October and March Students welcome at any meeting at reduced price