Chapter 2: Introduction to Financial Statements

advertisement

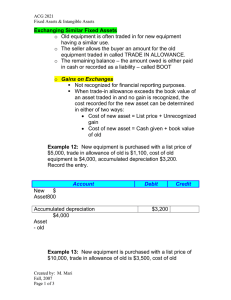

1 Further Look At Financial Statements Objective of financial reporting: provide info useful in making decisions To be useful information must be: Relevant: do you care? Reliable: can you count on it? Comparable: to my foreign competitors? Consistent: prepared same way last year? 2 Further Look At Financial Statements Accounting constraints Materiality: does it matter? Waste basket: asset or expense? Same for every company? Conservatism: Don’t overstate income or assets What about liability and expenses? 3 Further Look At Financial Statements Uses of financial ratios Intracompany comprisons Ford 2010 sales versus 2009 Intercompany comparisons Wal-Mart versus Target profit margin Industry comparisons McDonalds profit margin versus other restaraunts 4 Further Look At Financial Statements Financial ratios Liquidity: can I pay my bills now? Short-term creditors Long-term creditors Stockholders Solvency: can I pay my bills in the future? Profitability: am I making money? 5 Further Look At Financial Statements Financial ratios Liquidity: Current ratio: CA/CL Working capital: CA – CL Quick: (CA – Inv)/CL Debt: Debt/Assets Free cash flow: Operating cash flow – capital expenditures – dividends ROA: Net income/Assets ROE: Net income/Stockholders Equity Profit Margin = Net Income / Sales What is current asset? Current liability? Solvency Profitability: 6 Further Look At Financial Statements Depreciation Cost of asset / estimated useful life Guess Could property increase in value? Different amount on tax return? Not a cash expense Accumulated depreciation: total Cost – accumulated depreciation = ???