Chp. 17

advertisement

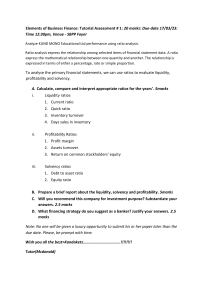

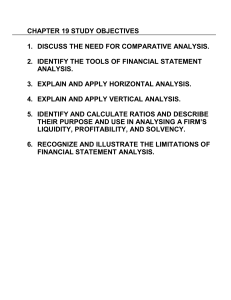

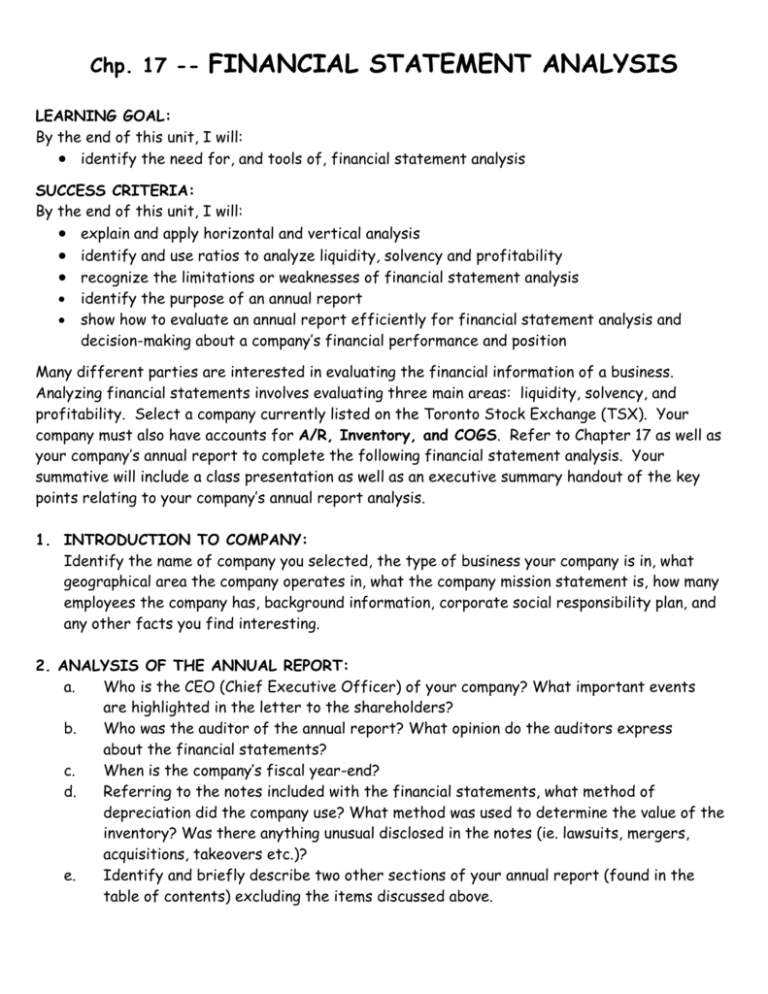

Chp. 17 -- FINANCIAL STATEMENT ANALYSIS LEARNING GOAL: By the end of this unit, I will: identify the need for, and tools of, financial statement analysis SUCCESS CRITERIA: By the end of this unit, I will: explain and apply horizontal and vertical analysis identify and use ratios to analyze liquidity, solvency and profitability recognize the limitations or weaknesses of financial statement analysis identify the purpose of an annual report show how to evaluate an annual report efficiently for financial statement analysis and decision-making about a company’s financial performance and position Many different parties are interested in evaluating the financial information of a business. Analyzing financial statements involves evaluating three main areas: liquidity, solvency, and profitability. Select a company currently listed on the Toronto Stock Exchange (TSX). Your company must also have accounts for A/R, Inventory, and COGS. Refer to Chapter 17 as well as your company’s annual report to complete the following financial statement analysis. Your summative will include a class presentation as well as an executive summary handout of the key points relating to your company’s annual report analysis. 1. INTRODUCTION TO COMPANY: Identify the name of company you selected, the type of business your company is in, what geographical area the company operates in, what the company mission statement is, how many employees the company has, background information, corporate social responsibility plan, and any other facts you find interesting. 2. ANALYSIS OF THE ANNUAL REPORT: a. Who is the CEO (Chief Executive Officer) of your company? What important events are highlighted in the letter to the shareholders? b. Who was the auditor of the annual report? What opinion do the auditors express about the financial statements? c. When is the company’s fiscal year-end? d. Referring to the notes included with the financial statements, what method of depreciation did the company use? What method was used to determine the value of the inventory? Was there anything unusual disclosed in the notes (ie. lawsuits, mergers, acquisitions, takeovers etc.)? e. Identify and briefly describe two other sections of your annual report (found in the table of contents) excluding the items discussed above. 3. ANALYSIS OF THE FINANCIAL STATEMENTS: a. b. c. d. Comment Complete a Horizontal (Trend) Analysis for Sales, Gross Profit, Expenses, on key Net Income, Current Assets, and Current Liabilities. (five years if data available) numbers in each Complete a Horizontal (Comparative) Analysis for the balance sheet. (most recent two years) analysis Complete a Vertical (Common-size) Analysis for the income statement. (most recent year) Ratio Analysis--Using the formulas from Chp. 17 and the annual report with financial statements, conduct a ratio analysis that would shed light on the success of the business from the point of view of the following parties, Short-term Creditors, Long-term Creditors, and Shareholders. Identify each ratio clearly with its formula and show all calculations used to determine the ratio answer. Include ratios on your summary handout. i. SHORT-TERM CREDITORS, such as the bank, who are mostly interested in the ability of the borrower to pay obligations when they come due. Short-term creditors look to measure liquidity ratios. Calculate the following liquidity ratios: current ratio, acid-test (quick) ratio, accounts receivable turnover, collection period, inventory turnover, and operating cycle. Does the company look like a good credit risk in the short-term? Explain your reasons with reference to your liquidity ratio analysis. ii. LONG-TERM CREDITORS, such as bond, mortgage, or notes holders, look to measure solvency which indicate a company’s ability to survive over a long period of time. Long-term creditors consider such measures as the amount of debt in the company’s capital structure and its ability to meet interest payments. Calculate the following solvency ratios: debt to total assets ratio and equity to total assets ratio. Do you feel that the company represents a good investment over the long-term? Explain why based on your solvency ratio analysis. iii. SHAREHOLDERS are usually interested in the profitability of the business. They want to assess the likelihood of dividends and the growth potential of their shares. Calculate the following profitability ratios: gross profit margin, profit margin, asset turnover, return on assets, return on equity, and earnings per share (EPS) of common stock. Do you feel that the company represents a good investment for shareholders? Explain why by referring to your profitability ratio analysis. e. Complete a Stock Analysis, including current share price, dividend, share trends, and a 1 year graph. 4. EXECUTIVE SUMMARY: a. Complete a SWOT (Strengths/Weaknesses/Opportunities/Threats) Analysis. Include reference to the company’s financial data analysis. b. Conclude with a final summary of your opinion of the company you analyzed. Would recommend investing in this company based on your financial statement analysis? key specific data to support your opinion. you Include EVALUATION: This summative will be evaluated on rubric elements including: preparation and efficient use of available time and resources, overall presentation and content executive summary handout (max one page both sides, 12 font size) proper works cited hard copy printouts (ppt print layout as handout, financial analysis & statements, executive summary)