Submitted By

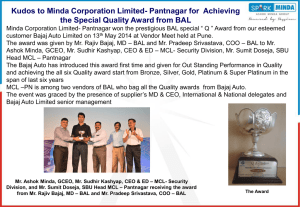

advertisement