70120 * Legal Method and Research

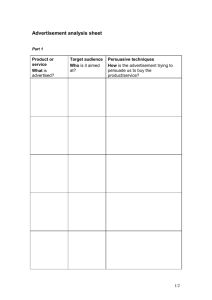

advertisement

UTS: FACULTY OF LAW 70120 – Legal Method and Research Legislation Exercise Johanan Ottensooser 1/1/1900 70120 - Legislation Exercise An analysis of s 53c of the Trade Practices Act 1974 Task 2 Discuss whether the amended provision has overcome the deficiencies of the original provisions. Explain how this has been done. The purpose of the Trade Practices Act 1974 (“the TPA”)1, is “enhance[ing] the welfare of Australians through the promotion of competition and fair trading and provision for consumer protection,”2 Part V, which includes section 53c, dealing with consumer protection. In the light of this, section 53C of the TPA seems to elucidate a requirement for simplicity in pricing for the protection of consumers.3 This purpose is further clarified in the Trade Practices Act Revision Bill 1986,4 where section 53C was said to aim to reduce low deposit advertising with obscured total costs. 5 However, there were flaws in the legislation which left it ineffective. Subsequent cases revealed these, with the court allowing exceptions to single pricing, “loopholes” in the legislation.6 These flaws are derivative of the limited scope of the older legislation. The Trade Practices Amendment (Clarity in Pricing) Act 2008 (the “Amendment Act”),7 attempted to increase the scope of this act and better define the parameters of the legislation. It expanded the single subsection of the pre Amendment Act‘s section 53C to 7 subsections, including a definitions subsection. 8 The legislative thoroughness of the revised section 53C is further complemented by a swathe of new extrinsic sources, including new second reading speeches, explanatory memorandums, digest, etc. of the Amendment Act. 9 In concert, the new legislation and the related extrinsic sources prove to effectively stop the loopholes which, under the old TPA, allow for separate pricing. As such, many of these loopholes have been removed. For example, the exemption allowed in ACCC v Dell10 has been removed: total price (where quantifiable) must now always be shown11. However, there are flaws which remain. Whilst the Amendment Act more strongly delineates a requirement for an all-inclusive price, there are exceptions: under subsection (2), delivery costs seem to 1 Trade Practices Act 1974 (Cth). Ibid. s 2. 3 This view is supported by the Pincus J’s statement in Trade Practices Commission v Autoways Pty Ltd (1990) ATPR 41-051. Where the purpose of the section was to “cause advertisers to tell the whole story” Ray Steinwall, Trade Practices Act (2007) 380. 4 Trade Practices Act Revision Bill 1986 (Cth). 5 Ray Steinwall, Trade Practices Act (2007) 380-381. 6 Split pricing was approved where the total product price and auxiliary costs were clearly delineated, even given that delivery was compulsory, Australian Competition & Consumer Commission v Dell Computer Pty Limited [2002] FCAFC 434. However, this was limited to clearly defined auxiliary costs (i.e. “plus GST” was not acceptable but “plus GST of $10” was acceptable) in Australian Competition and Consumer Commission v Signature Security Group Pty Ltd (2003) 52 ATR 1. Extracted from Steinwall, above n5, 381. 7 With the last schedule (“Schedule 2”) commencing 25 May 2009: Trade Practices Amendment (Clarity in Pricing) Act 2008 (Cth). 8 Ibid. s 1.7. 9 Trade Practices Amendment (Clarity in Pricing) Bill 2008 (Cth). 10 A single price with a prominent secondary price attached, see footnote 6: Australian Competition & Consumer Commission v Dell Computer Pty Limited [2002] FCAFC 434. 11 Where before “$79 + charges of $45” was allowable (Ibid.) under the new legislation, it would have to be displayed as “$79 + $35 taxes fees and charges for a total price of $114” Trade Practices Amendment (Clarity in Pricing) Bill 2008 (Cth) Explanatory Memorandum p 5. 2 2/6 Johanan (Yochi) Ottensooser – 10873305 Tutor: Tracey Boothe be excluded; under subsection (6), section 53C only goods and services ordinarily supplied to “personal, domestic or household use or consumption.”12 Furthermore, subsection (7) narrowly defines single price as only including “quantifiable” charges, thus allowing for leeway for some charges13. Regarding the “worst offenders” to this legislation (the airline and auto industries) this legislation does minimise complex pricing, requiring flat charges (such as airport taxes and compulsory third party insurance, etc.) to be integrated into prices. However, they are left some leeway, since other costs (less quantifiable taxes14, options15, etc.) are left out of the “single price”. Task 3 What would you include in any advice to a car dealer about what should be included in an advertisement? I would advise a car dealer to take the TPA16 into consideration when creating advertisements. Section 53C of the TPA aims at creating a single price for consumers, but allows for certain exceptions, notably, non-quantifiable price elements and options. In order to fulfil this criteria, I would recommend that the car dealer include all costs of the base model (including questionable areas, such as dealer delivery and tax) in the advertisement (to remain competitive, it could be listed as a “drive away” price), being careful to list the advertisement as a “from” price, to allow for the cost of extras. Finally, whereas section 53C deals specifically with pricing, sections 52 and 57, and, indeed the whole of Part V of the TPA deal with advertising, and, as such, should be taken into consideration when advertising. If the advertiser allows for all components of the price of the base model, which are in stock17, uses “from” language and is not purposefully misleading, than the advertising should be legal under the TPA. Task 4 Consider the text of advertisements below and assess to what extent they comply with the law: Part a Honda CRV Sport ‘Free Rego, CTP (Compulsory Third Party insurance), Stamp Duty and Dealer Delivery’ $40,990 drive away; metallic or pearlescent paint $325 extra [NB all available CRV colours are either metallic or pearlescent paint except white]. This scenario seems to be within the parameters of section 53C of the TPA. It does not contravene subsection (1), since it does specify a single figure price for the good sold18. Furthermore, this single price is within the definition outlined in subsection (7), whereby the price is, indeed the “minimum quantifiable consideration” for the good sold19. The $325 option for other paint colours is displayed, 12 Trade Practices Act 1974 (Cth) ss 53C(2), (6). Ibid. s 53C(7). 14 Allowed for in Ibid. s 53C(7)(c). 15 Allowed for in Ibid. s 53C(7)(a). 16 Ibid. s 53C. 17 In order to comply with s 57 on “bait pricing” Ibid. s 57. 18 Ibid. s 53C(1). 19 Ibid. s 53C(7). 13 3/6 Johanan (Yochi) Ottensooser – 10873305 Tutor: Tracey Boothe and allowed to be kept separate under paragraph (7)(a): “other than a charge that is payable at the option of the relevant person [in this case, the customer].”20 This paragraph does not differentiate between majority options (like this case) and options less likely to be selected. However, this is incongruent with the purpose of the act, and if the case went to court, a judge might choose, either to allow for a standard interpretation in context21, or to redefine “option” as “likely option”22. A redefinition of “option” is unlikely, since the provision is not obscure23. Part b Honda CRV Sport ‘Free Rego, Free CTP’ [NB there is no reference in this ad to stamp duty or dealer delivery, there are also no prices mentioned in the ad]. This scenario seems not governed by section 53C of the TPA. Subsection (1) does not state that a price must be mentioned in an advertisement, only that a price, if mentioned, must be the whole price24. However, the explanatory memoranda of the Trade Practices Amendment (Clarity in Pricing) Bill 2008 states that the purpose of non-component pricing is so that consumers can easily compare products.25 Furthermore, this advertisement states that “rego” and “CTP” are “free”. A judge favouring a purposive interpretation based on contextual and extrinsic sources26 might state that this is outside the law, since “free” is the same as a component price of $0, thus requiring a total price to be displayed. Part c Jaguar XF from only $108,350 [and then in small print] price does not include dealer delivery or statutory charges [NB Jaguars are luxury cars usually bought as company cars]. This advertisement would ordinarily contravene subsection 53C(1) of the TPA, since it is not displaying a “single price”, but rather, a price with undefined surcharges27. However, there are three subsections which complicate the matter. Firstly, subsection (3) states that “subsection (1) does not apply if the representation is made exclusively to a body corporate.”28 Here, the advertisement, whilst made primarily to “bodies corporate,”29 is not exclusively aimed at these bodies, and, as such, subsection (3) does not apply. Secondly subsection (6) defines “goods or services” as “goods or services of a kind ordinarily acquired for personal, domestic or household use.”30 The Jaguar, being ordinarily used for business, seems to fall outside of this section’s definition of “goods or service” and is, therefore not bound by this legislation. However, subsection (6) does not state that the specific good is for personal use, but be “of a kind ordinarily” for personal use (i.e. a sedan, rather than a specific Jaguar), leaving the advertisement in breach. 20 Ibid. s 53C(7)(a). As allowed for in Interpretation Act 1987 (NSW) s 6. 22 By taking extrinsic material (i.e. the purpose of the act as extracted from the Trade Practices Amendment (Clarity in Pricing) Bill 2008 (Cth).) into consideration as allowed for in Acts Interpretation Act 1901 (Cth) s 15AB(1)(b)(ii). 23 Acts Interpretation Act 1901 (Cth) s 15AB(1)(b)(i). 24 “a corporation must not ... make a representation with respect to an amount that ... would constitute a part of the consideration [total price]” Trade Practices Act 1974 (Cth) s 53C(1). 25 Trade Practices Amendment (Clarity in Pricing) Bill 2008 (Cth) Explanatory Memoranda p3. 26 See Task 4, Part A. 27 Trade Practices Act 1974 (Cth) s 53C(1). 28 Ibid. s 53C(3). 29 “usually bought as company cars” 30 Trade Practices Act 1974 (Cth) s 53C(6). 21 4/6 Johanan (Yochi) Ottensooser – 10873305 Tutor: Tracey Boothe Finally, subsection (7) defines “single price” as “the minimum quantifiable consideration ... including each of the following ... that is quantifiable”31. The Jaguar dealer could, thus, state that dealer delivery and other statutory charges are not quantifiable. However, a “minimum quantifiable” (i.e. lowest estimate) charge is required32, and, since no such minimum estimate exists in the advertisement, it is still in breach of section 53C of the TPA. As such, even though there are some subsections which seem to allow the Jaguar dealer leeway, it is indeed in breach of section 53C of the TPA. Part d Porsche Cayenne $120,000 drive away, [and then in small print] vehicle featured in photo includes $13,400 in optional extras which are not included in drive away price. This advertisement appears to be within the allowance of s 53C of the TPA, since there is a single drive away price listed. However, there are two issues put forth. Firstly, that the photo is not the same as the price of the model advertised. Section 53C does not require any such parallels, and any breach would be against section 52, “misleading or deceptive conduct”33. Secondly, there is the issue of the prominence of the disclaimer. Section 53C only requires that the price be displayed “in a prominent way and as a single figure”, and that it is “at least as prominent as the most prominent of the [component prices]”. There is no discussion of prominence of any disclaimer or other object. As such, this is advertisement is not in breach of S53C of the TPA. Part e Mazda 3 SP3 $28,990 drive away [and then in small print] 08 compliance plate; only applies to vehicles currently in stock. This advertisement is within section 53C of the TPA, since it does display a single price for the goods sold. However, if the ’08 compliance plate (and, therefore, rego) have expired, than it infringes on s 53C(1)34 and 5235 of the TPA. If the plates have not expired than the advertisement is within the law, but against the purpose of the legislation36. Furthermore, if the stock is not sufficient, and the dealer knows such, than this advertisement would be in breach of s 57 of the TPA, since this advertisement would be an example of bait advertising. There is, given that the ’08 plates are still current, no breach of S 53C of the TPA. 31 charges and taxes/levies are included in “the following”: Ibid. ss 53C(7), (7)(a), (c). As opposed to “only quantifiable amounts are required” 33 Trade Practices Act 1974 (Cth) s 52. 34 Since it is no longer a single price. 35 Since it is deceptive and misleading. 36 To protect consumers, see footnote 1. 32 5/6 Johanan (Yochi) Ottensooser – 10873305 Tutor: Tracey Boothe Bibliography Articles – Books Steinwall, Ray, Trade Practices Act (2007). Cases Australian Competition & Consumer Commission v Dell Computer Pty Limited [2002] FCAFC 434. Australian Competition and Consumer Commission v Signature Security Group Pty Ltd (2003) 52 ATR 1. Trade Practices Commission v Autoways Pty Ltd (1990) ATPR 41-051. Bills Trade Practices Act Revision Bill 1986 (Cth). Trade Practices Amendment (Clarity in Pricing) Bill 2008 (Cth) (and explanatory memorandum). Legislation Acts Interpretation Act 1901 (Cth). Interpretation Act 1987 (NSW). Trade Practices Act 1974 (Cth). Trade Practices Amendment (Clarity in Pricing) Act 2008 (Cth). 6/6 Johanan (Yochi) Ottensooser – 10873305 Tutor: Tracey Boothe