File

advertisement

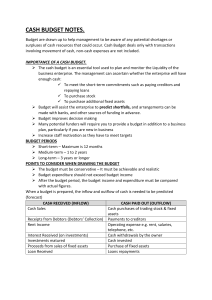

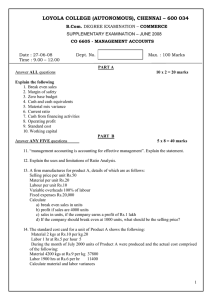

Cash Budgets Definition of a Cash Budget To achieve maximum profits planning and control is necessary. A cash budget is the formal plan for the future of a business regarding the expected inflow and outflow of cash. The cash budget reflects the expected bank balance during the budgeted period. Purpose of a Cash Budget Shows inflow and outflow of cash Reflects expected bank balance Shows possible future financial position of the business Basic idea of the cash Budget Opening bank balance + Total receipts – Total payments= Closing bank balance Important A separate schedule called the Debtors collection Schedule is drawn up to record the expected collections from debtors. Similarly the Creditors Payment Schedule is drawn up to record expected payment to creditors. The total cash collections for the budgeted period are carried through to the cash budget. Consequences of not preparing a cash budget The business may not achieve desired profits The business may have cash problems The business may experience problems with purchases and sales Always remember....the CASH budget deals only with hot CASH. Depreciation, loss on sale of asset, bad debts are NOT in the cash budget as they are noncash items. Exercise You are required to draw up the Debtors Collection Schedule and the Creditors Collectors Schedule of “Bangladesh Clothing Stores”. As well as prepare the Cash Budget for the first 3 months of the financial year 2010. a) Actual Sales 2009 October..............R 20 000 November...........R 23 000 December...........R 24 000 b) It is expected that all sales will increase by 5% from the previous month after December. c) 30% of Sales will be for credit d) Debtors are allowed up to 3 months maximum credit. Credit terms 30% pay within month of sale 50% pay in the course of the next month 10% pay during the next 2 months The remainder pays in the 3rd month. --Outstanding debtors in December 2009 amounts to R18 000 e) Cost of Sales is 60% of turnover. f) Credit purchases of trading stock will be 30%. g) Creditors allow the business 60 days credit h)Operating expenses are to remain at R10 000 i) The owner’s drawings is R1000 in December . In January his wife has a baby and his drawings is expected to increase by R400 every month thereafter h) The business had a profit of R30 000 in the month of December.