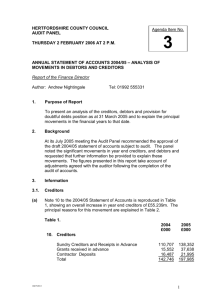

Credit Reporting

advertisement

The Fair Trading Act and Credit 2011 Service Alberta Service Alberta • Responsible for consumer protection in Alberta, which includes a number of regulatory measures related to consumer and creditor rights. • Investigates consumer complaints, audits licensed businesses, oversees delegated regulatory organizations, and provides consumer education materials. • For creditors, the key Acts Consumer Services is responsible for are the Debtors’ Assistance Act and Fair Trading Act. Debtors’ Assistance Act • The Province delegates responsibility for the Orderly Payment of Debts Program (Part X of the Bankruptcy Act) to the Debtors’ Assistance Board. • Money Mentors (formerly Credit Counselling Services of Alberta) offers credit counselling, administers the OPD program and offers financial literacy to consumers and businesses on behalf of the Debtors’ Assistance Board. • Assisted 4,400 clients in 2010 and returned $9.8 million to creditors with an 82% OPD success rate. Credit related FTA Regulations • Collection and Debt Repayment Practices Regulation • Cost of Credit Disclosure Regulation • Credit and Personal Reports Regulation • Payday Loans Regulation Cost of Credit Disclosure • Recent amendments: – definition of high-ratio mortgages (20%) – APR disclosure on open credit • National: – pressure on credit card liability limits – financial literacy receiving increasing attention • FAQs: – cost of credit disclosure applies to any credit transaction entered into in/from Alberta, there are no exceptions (though federal financial institutions are subject to federal jurisdiction) Credit Reporting • Work is ongoing on harmonizing national credit reporting standards. • Alberta Finance is reviewing the use of credit reports for insurance purposes. • FAQs: – Express (verifiable) consent is a requirement prior to requesting a credit report – Business debts should not be reported unless the individual has a personal obligation for the debt (partnership, guarantee, sole proprietorship, etc.) – Businesses/collection agencies that file inaccurate information or refuse to remove information as a way to punish a consumer can be subject to enforcement action Collection Practices • Third party collection agencies and debt purchasers (debts in arrears) are regulated and must be licensed. • Original creditors, most direct finance companies and agencies operating as first party receivables do not require a licence. • Lawyers are exempt from the regulatory framework while they engage in the practice of law. • Licensed collection agencies are responsible for any actions taken by lawyers that breach the regulations. Collection Agencies and Creditors • Collection agencies that receive monies from debtors are required to place all monies in trust. • Requirement for an accountants’ report by an independent auditor/accountant annually to confirm handling and liability of trust. • Collection agencies provide a security to Service Alberta that may cover a portion of creditor losses. Debt Repayment Agencies • Agencies acting on behalf of a debtor in negotiations with creditors must be licensed. • Regulated fee caps for services provided to consumers tied to successful negotiations with creditors. No up-front fees are allowed for settlement negotiations. • Lawyers are exempt from the regulatory framework while they engage in the practice of law. • Monies must be held in trust prior to disbursement to creditors. Annual accountants’ report required. Educational Materials • A wide variety of tipsheets, including: – Bill Collection and Debt Repayment – What Creditors Can Do If You Don’t Pay – Your Credit Report • Other resources: – Identity theft resources – Reality Choices (young adults) – Payday Loan Calculator Contact Information Darren Thomas Director of Fair Trading (as delegated) Phone: 780 422 8046 Fax: 780 427 3033 Email: darren.thomas@gov.ab.ca