Ch 7 International Parity Conditions.ppt

advertisement

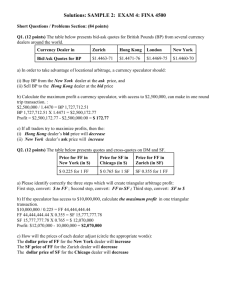

Chapter 7 International Parity Conditions Table of Contents • Foreign Exchange Theories – – – – – Purchasing Power Parity (PPP) Fisher Effect (FE) International Fisher Effect (IFE) Interest Rate Parity (IRP) Forward Rates as Unbiased Predictor of Future Spot Rate (UFR) 2 What is a Parity Condition? • Some fundamental questions managers of MNEs, international portfolio investors, importers, exporters and government officials must deal with every day are: – What are the determinants of exchange rates? – Are changes in exchange rates predictable? • The economic theories that link exchange rates, price levels, and interest rates together are called international parity conditions. • Parity condition defines a relationship between economic variables that is predicted to hold on the basis of a rational economic behavior. • These international parity conditions form the core of the financial theory that is unique to international finance. 3 Theoretical Economic Relationships • Five key theoretical economic relationships result from arbitrage. i. Purchasing power parity (PPP) – for prices in two countries to be equal, the exchange rate between the two countries must change by the difference between the domestic and foreign rates of inflation. ii. Fisher effect (FE) – If expected real interest rates differ between the home and foreign countries, capital will flow to the country with the higher real rate until the real rates in both countries are equal and equilibrium is reached. iii. International Fisher effect (IFE) – combines the conditions underlying PPP and FE; if real interest rates differ between the home and foreign countries, capital will flow to the country with the higher real rate until the exchange-adjusted returns are equal in both countries and equilibrium is reached. iv. Interest rate parity (IRP) – in an efficient market with no transaction costs, the interest rate differential between two countries should approximate the forward differential. v. Forward rates as unbiased predictors of future spot rates (UFR) – Equilibrium is achieved when the forward differential equals the expected change in the spot rate. Note: In the absence of market imperfections, risk-adjusted expected returns on financial assets in different markets should be equal. 4 PURCHASING POWER PARITY (PPP) 5 Purchasing Power Parity (PPP) • The forecasted change in exchange rates between two countries is related to the forecasted difference in inflation rates. • The currency with the higher rate of inflation will depreciate against the currency with the lower rate of inflation. • The theory of purchasing power parity (PPP) attempts to quantify this inflation - exchange rate relationship. 6 Purchasing Power Parity: Rationale • When one country’s inflation rate rises relative to that of another country, decreased exports and increased imports depress the country’s currency. • Suppose U.S. inflation > U.K. inflation. • U.S. imports from U.K. and U.S. exports to U.K., so £ appreciates & $ depreciates. • This shift in consumption and the appreciation of the £ will continue until • price U.K. goods price U.S. goods 7 Exchange Rate for High Inflationary Countries 8 Two Versions of PPP • Absolute Form of PPP: without international barriers, consumers shift their demand to wherever prices are lower. Prices of the same basket of products in two different countries should be equal when measured in common currency. (“Law of One Price”) • Relative Form of PPP: Due to market imperfections, prices of the same basket of products in different countries will not necessarily be the same, but the rate of change in prices should be similar when measured in common currency 9 Law of One Price • If the identical product or service can be: – sold in two different markets; and – no restrictions exist on the sale; and – transportation costs of moving the product between markets are equal, • then – the products price should be the same in both markets; and – Big Mac should cost the same (once you convert money) no matter where you go; and – an asset must have the same value regardless of the currency in which value is measured. • This is called the law of one price. • This is called “absolute” version of PPP. 10 Law of One Price • Prices should be equal in all countries except for – Restrictions on the movement of goods – Costs of transporting goods from one country to another • Law of One Price (Price in US) (Indirect Spot Rate, £/$) = Price in Country Y (Price in US) / (Direct Spot Rate, $/£) = Price in Country Y • The exchange rate between two currencies should equal the ratio of the countries’ price levels: • For example, if an ounce of gold costs $300 in the U.S. and £150 in the U.K., then the price of one pound in terms of dollars should be: P$ S($/£) = P £ P$ $300 S($/£) = P = £150 = $2/£ £ 11 Law of One Price - Illustrated • Price of a Big Mac in the United States = $3.57 • US Exchange Rate with China = Yuan6.83/$. • The Implied Price of a Big Mac in China = PYuan = SYuan/$ x P$ = (6.83)(3.57) = Yuan24.38 • However, the actual price of Big Mac in China is Yuan 12.5. – Either Hamburger is undervalued in China, or – Chinese Yuan is undervalued. • Yuan is undervalued by (24.38-12.5)/24.38=48.7% 12 Law of One Price - Illustrated 13 The McCurrency Menu—the Hamburger Standard, 2008 14 Selected Rates from the Big Mac Index, 2011 15 Comparing Incomes Across Countries : Example • Comparing Incomes in New York and Tokyo – Two offers: $100,000 in NY versus ¥15,000,000 in Tokyo – Incorporating purchasing power – you will be spending yen in Japan not $’s, and also you will be consuming only Bic Mac (nothing else), so – Working with the PPP rate (¥160/$), not actual market rate – see how much NY job is worth in ¥ – $100,000 * ¥160/$ = ¥16,000,000.You will be underpaid by ¥1,000,000 in Japan. – Or, Tokyo pay is worth of $93,750 (=¥15,000,000/ ¥160/$). You will be underpaid by $6,250 (=1,000,000/160) in Japan. – New York job is worth more 16 Interpretations of PPP • The absolute form of PPP, or the “law of one price,” suggests that similar products in different countries should be equally priced when measured in the common currency. – By comparing the prices of identical products denominated in different currencies, we could determine the “real” or PPP exchange rate that should exist if markets were efficient. • The relative form of PPP relax assumptions of the absolute version of PPP, and accounts for market imperfections like transportation costs, tariffs, and quotas. – RPPP holds that the absolute version of PPP is not particularly helpful in determining what the spot rate is today, but – The relative change in prices between two countries over a period of time determine the change in the exchange rate over that period. 17 Law of One Price A Basket of Goods or Price Indices • Suppose instead of one item, we look at the price of a basket of goods. • Price of basket of goods in the United States = $120,000 • Price of same basket of goods in Europe = € 100,000 • Exchange Rate that equalizes the price of the basket of goods is $120,000/ €100,000 = $1.20/ € • Price Indices such as the Consumer Price Index and the Wholesale Price Index are calculated from the prices of a basket of goods. • We can relate changes in price indices to changes in exchange rates. • This relationship is the Relative Form of Purchasing Power Parity 18 Price Level, Price Indexes, and PPP • Calculating the price level – cost of living • Calculating a price index – ratio of price levels at two different times P(t ,$) N w P ( t , i ,$) i i 1 P(t k ,$) 100 PI (t k ,$) P(t ,$) w P(t k , i,$) 100 w P(t, i,$) N i 1 i N i 1 i 19 Price Indexes for the G7 Countries, 1960–2010 20 Price Level, Price Indexes, and PPP Calculating annual inflation PI (t 1) P(t 1) [1 (t 1)] PI (t ) P(t ) where π(t+1) = (P(t+1) – P(t))/P(t) From the Table: Italy, 1990-1991 ((139.8/131.2) – 1) * 100 = 6.55% Calculating cumulative inflation 1/ N PI (t N ) PI (t ) where N=last-base year From the Table; U.S., 1985-2005 (179.4/100)1/20 = 1.0297 or compound annual rate of <3% 21 Assumptions – Relative PPP • At the beginning of 2013 – PUS, the US price index, is 100. – PGP, the British price index, is 100. – The spot exchange rate is USD 1.80/GBP – Suppose a Digital Video Disk Recorder (DVDR) costs USD180 in the U.S. or GBP100 in the U.K. at the beginning of 2013. • At the beginning of 2014 – PUS, the US price index, is estimated to be 121 (21% of inflation). – PGP, the British price index, is estimated to be 110 (10% of inflation). 22 The Cheap DVD Recorder - RPPP • At the beginning of 2014 the cheap DVDR now costs 180(1.21) = $217.80 in the U.S. (21% inflation). • At the beginning of 2014 the cheap DVDR would cost 100(1.10) = £110 in U.K. (10% inflation). • The Law of One Price would say that the new exchange rate should be 217.80/110 = USD1.9800/GBP Let’s verify. GBP100(1+10%)*USD1.9800/GBP=USD180(1+21%) USD217.80=USD217.80 • The DVDR basically stands for the basket of goods whose prices are measured in the Consumer or Wholesale Price Index 23 Working out the Relative PPP PI 0UK (1 UK ) (1 eUS /UK ) PI 0US (1 US ) 1 eUS /UK PI 0US (1 US ) , UK UK PI 0 (1 ) (1 US ) (1 UK ) 1 eUS /UK where because St 1 (1 US ) 1 ( 1) , UK St (1 ) St 1 or, (1 US ) St , UK (1 ) eUS /UK eUS /UK in general, eUS / UK is the %Δ in FX rate PI 0US PI 0UK 100 since St eUS /UK St 1 1 St (1 US ) St (1 UK ) St 1 St (1 US ) ( US UK ) 1 UK St (1 ) (1 UK ) St 1 St US UK , St if 1 π UK can be ignored, 24 The Cheap DVD Recorder - RPPP • The British pound appreciated 10% against the USD, because the rate of inflation in Great Britain was lower than the rate of inflation in the United States. • Let πUS stand for the US inflation rate and πGB stand for the British inflation rate. • The forecasted rate of appreciation of the British pound against the US dollar is (πUS – πGB)/(1+ πGB) = (0.21-0.10)/1.10 =0.10 = 10%. (From $1.80/£ to $1.98/£, which is 10% appreciation of £) 25 Relative Purchasing Power Parity • Relative PPP states that the rate of change in the exchange rate is equal to the differences in the rates of inflation: St+1 = St (1 + $) (1 + £) or, (St+1 - St) / St ≈ $ – £ If U.S. inflation is 5% and U.K. inflation is 8%, the pound should depreciate by 2.78% or around 3% (=5% - 8%). Suppose S1 = $1/£. Then, S2 = 1x(1.05/1.08) = $.9722/£ “If the spot exchange rate between two countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal but opposite change in the spot exchange rate.” Logic is that inflation lowers the purchasing power of money. A change in the nominal exchange rate to compensate for different levels of inflation should occur 26 Relative Purchasing Power Parity (PPP) 27 RPPP Rate using Multi-Year Inflation • If US and Switzerland is running annual inflation rates of 5% and 3% respectively, and the spot rate is $0.75/SFr, t • Then, implied PPP rate after three years is $0.7945/SFr. • What does all this mean? • Three years ago, you can buy a junior mac for $0.75 in US, or SFr 1 in Switzerland. • Now, a junior mac costs $0.868219 (=.75*1.053) in US, and SFr 1.092727 (=1*1.033). • 0.868219/1.092727 = $0.7945/SFr S (1 h ) St (1 f ) 1.053 0.75 1.033 $0.7945 / SFr 28 RPPP : Implication • Suppose U.S. price level is $15,000 and U.K.’s is £10,000; Actual FX rate, S=$1.40/£ – $15,000/£10,000 = $1.50/£ (PPP rate ≠ actual forex rate) – £ needs to strengthen by 7.14% ($1.50/£ / $1.40/£) • Now suppose U.S.=3% and U.K.=10%. U.S. price level goes to $15,450 and U.K. price level goes to £11,000 – New implied PPP rate is $15,450/£11,000 or $1.4045/£ – This means it actually needs to weaken relative to the $ for relative PPP to be satisfied • If it devalues by 7.14% we have ($1.4045/£)/1.0714 = $1.3109/£ – The actual forex rate changes by only ($1.3109/£)/ ($1.40/£) = 0.9364 = 1-0.0636 or 6.36% – This is also the ratio of (1+ U.S.)/(1+ U.K.) – Using the formula, New S = $1.40 *(1.03 / 1.10) = $1.3109 /£ 29 Testing PPP and Evidence • Empirical testing of PPP and the law of one price has been done, but has not proved PPP to be accurate in predicting future exchange rates. • Two general conclusions can be made from these tests: – PPP holds up well over the very long run but poorly for shorter time periods; and, – the theory holds better for countries with relatively high rates of inflation and underdeveloped capital markets. 30 Testing PPP and Evidence (contd) • Why violations of the law of one price occur? • PPP probably doesn’t hold precisely in the real world for a variety of reasons. – Shipping costs - would you go to Italy to get a haircut? – Haircuts cost 10 times as much in the developed world as in the developing world. – Film, on the other hand, is a highly standardized commodity that is actively traded across borders. – Tariffs and quotas, can lead to deviations from PPP. (Before 2003, Malaysia tariff up to 300%!) – Japanese eat more sushi, while Americans eat more steak. – Lack of substitutes for traded goods. – Confounding effects: Exchange rates are also affected by differentials in interest rates, income levels, and risk, as well as government controls. 31 32 PPP and Actual Exchange Rates USD/GBP CAD/USD USD/EUR JPY/USD MXN/USD 33 Bottom Lining PPP • Purchasing Power Parity arises because of the opportunity to trade goods and services between countries. • Poor forecasting tool for developed countries in the short run. – Capital movements tend to overwhelm trade flows in determining the exchange rate between currencies of developed countries. – General price indices not necessarily the price indices of traded goods. • May give an indication of pressure on currencies in the very long run. • For countries that have high inflation rates and controlled or underdeveloped financial markets, PPP a useful guide. 34 Nominal versus Real Exchange Rate • Nominal exchange rate – The actual exchange rate you observe from the market today – The rate without adjusting for relative purchasing power of each currency – Of little significance in determining the true effects of currency changes • Real exchange rate – The rate that represent changes in the competiveness of a currency. – The rate that adjusted for changes in the relative purchasing powers of each currency 35 Real Exchange Rate • The definition of the real exchange rate – the exchange rate adjusted for inflation Streal ,$ / euro Stnominal ,$ / euro P (t , euro) P(t ,$) • Suppose that the U.S. price level is initially $15,000/U.S. consumption bundle and the price level in Europe is initially €12,000/European consumption bundle. With the nominal exchange rate equal to $1.30/€, the real exchange rate equals S real t ,$/ euro S nominal t ,$/ euro P(t , euro) 12, 000 1.30 1.04 P(t ,$) 15, 000 36 Real Exchange Rate (contd) • Suppose the over the next year there is 4% inflation in the Us, there is 8% inflation in Europe, and the nominal exchange rates changes so that relative PPP is satisfied. Using RPPP formula, the new nominal exchange rate is StPPP 1,$/ euro $ (1 ) 1.04 nominal St ,$/ euro 1.30 $1.2519 / euro euro (1 ) 1.08 • Suppose the actual rate turns out to be $1.2519 at year t+1, which is the predicted rate by PPP. The euro weaken by 3.7%. With 4% U.S. inflation, the new U.S. price level is $15,600 = $15,000 x 1.04, and with 8% European inflation, the new European price level is €12,960 = €12,000 x 1.08, the real exchange rate equals S real t 1,$/ euro S nominal t 1,$/ euro P(t 1, euro) 12,960 1.2519 1.04 P(t 1,$) 15, 600 37 Real Exchange Rate • The RPPP predicts a 3.7% depreciation of euro ($1.2519/€). PPP t 1,$/ euro e (1 $ ) 1.04 1 1 .963 1 3.7% euro (1 ) 1.08 • Confirming 3.7% depreciation, 1.2519/1.3000 -1 = -3.7% • Alternatively, suppose the actual rate turns out to be $1.2740/€ (instead of 1.2519) at year t+1. This represents only 2% (= 1.2740/1.3000 – 1) depreciation of euro, instead of 3.7%. • The new real exchange rate now equal, S real t 1,$ / euro S nominal t 1,$ / euro P(t 1, euro) 12,960 1.2740 1.0584 P(t 1,$) 15, 600 38 Real Exchange Rates - Summary • The old real exchange rate was 1.04. • There is a real appreciation of the euro, and there is a real depreciation of the dollar, even though the dollar appreciated (2%) relative to the euro in nominal terms. • The nominal dollar value of the euro just did not fall enough when compared to the respective inflation differentials between two countries. • Because the euro only weakened by 2% instead of the 3.7% that was warranted by the inflation differential, the euro actually strengthened in real terms by 1.7%. (=1.0584/1.04-1). 39 Real Exchange Rates –Scenario Analysis Inflation price level t t+1 U.S. 4% $15,000 $15,600 $15,600 $15,600 Euro 8% €12,000 €12,960 €12,960 €12,960 U.K. 2% £10,000 £10,200 £10,200 £10,200 ppp rate $1.30/€ 1.2519(-3.7%) 1.2519(-3.7%) 1.2519(-3.7%) actual rate $1.30/€ 1.2519(-3.7%) 1.2740(-2.0%) 1.2400(-4.6%) real rate $1.04/€ 1.04(0.0%) ppp rate $1.50/£ 1.5294(2.0%) 1.5294(2.0%) 1.5294(2.0%) actual rate $1.50/£ 1.5294(2.0%) 1.5100(0.7%) 1.5500(3.3%) real rate $1.00/£ 1.0584(1.7%) 1.0302(-0.9%) 1.00(0.0%) 0.9873(-1.3%) 1.0135(1.4%) 40 Real Exchange Rate - Example • Between 1982 and 2006, – The ¥/$ rate moved from 249.05 to 116.34. ($ depr. by 53%, ¥ appr. by 114%) – Japan’s CPI rose from 80.75 to 97.72 (97.72/80.75=1.2102=1+∏¥) – U.S. CPI rose from 56.06 to 117.07 (117.07/56.06=2.0883=1+∏$) • Analysis – The PPP predicts that $ has to depreciate by 42% (1.2102/2.0883-1=.4205) or ¥ has to appreciate by 73% (2.0883/1.2102-1=.7256) – ¥ appreciated (or $ depreciated) more than was warranted by PPP. – The real exchange rate is ¥200.76/$ (=116.34(2.0883/1.2102)) – This means that in real exchange rate terms, ¥ has appreciated by 24% (=249.05/200.76-1) and $ depreciated 19% (=200.76/249.05-1). – This dramatic appreciation in the inflation-adjusted Japanese yen put enormous competitive pressure on Japanese exporters as the dollar prices of their goods rose far more than the U.S. rate of inflation would justify. 41 Real Exchange Rate Indexes • Because any single country trades with numerous partners, we need to track and evaluate its individual currency value against all other currency values in order to determine relative purchasing power. • The objective is to discover whether a nation’s exchange rate is “overvalued” or “undervalued” in terms of PPP. • This problem is often dealt with through the calculation of exchange rate indices such as the “trade-weighted real exchange rates” between the home country and its trading partners. • useful when looking at how forex changes will affect trade balance. • The numerator of a trade-weighted real exchange rate contains the sum of the nominal exchange rates for different currencies multiplied by the price levels of different countries weighted by the proportion of trade conducted with that country. 42 Real Exchange Rate Indexes (contd) • The nominal effective exchange rate index uses actual exchange rates to create an index. • However, it does not really indicate anything about the “true value” of the currency, or anything related to PPP. • The real effective exchange rate index indicates how the weighted average purchasing power of the currency has changed relative to some arbitrarily selected based period. • The real effective exchange rate index for the U.S. dollar, E$R, is founded by multiplying the nominal effective exchange rate index, by the ratio of U.S. dollar price level, over foreign currency price level. FC / $ FC / $ Ereal Enominal • PI FC PI $ Where price levels at time t, both indexed to 100 at time 0. By indexing these price levels to 100 as of the base period, their ratio reflects the change in the relative purchasing power of these currencies since time 0. 43 Real Exchange Rate Indexes (contd) • If changes in exchange rates just offset differential inflation rates-if purchasing power parity holds-all the real effective exchange rate indices would stay at 100. • If an exchange rate strengthened more than was justified differential inflation, its index would rise above 100, and the currency would be considered “overvalued” from a competitive perspective. – Overvalued currency means a deterioration of the currency’s competiveness, as their goods are over priced in foreign markets (e.g., Japanese yen). • If an exchange rate depreciated more than was warranted by PPP, its index would fall below 100, and the currency would be considered “undervalued” from a competitive perspective. – Undervalued currency means am improvement of the currency’s competiveness, as their goods are under priced in foreign markets. (e.g., Chinese yuan) 44 IMF’s Real Effective Exchange Rate Indexes for the U.S., Japan, and the Euro Area (2000 = 100) 45 Actual versus Implied PPP FX Rates 46 Pass-Through • Incomplete exchange rate pass-through is one reason that a country’s real effective exchange rate index can deviate • The degree to which the prices of imported and exported goods change as a result of exchange rate changes is termed pass-through. • Although PPP implies that all exchange rate changes are passed through by equivalent changes in prices to trading partners, empirical research in the 1980s questioned this long-held assumption. • For example, a car manufacturer may or may not adjust pricing of its cars sold in a foreign country if exchange rates alter the manufacturer’s cost structure in comparison to the foreign market. 47 Pass-Through • Pass-through can also be partial as there are many mechanisms by which companies can compartmentalize or absorb the impact of exchange rate changes. • Price elasticity of demand is an important factor when determining pass-through levels. • The own price elasticity of demand for any good is the percentage change in quantity of the good demanded as a result of the percentage change in the goods own price. 48 Exchange Rate Pass-Through 49 FISHER EFFECT 50 Fisher Effect (FE) • The interest rate quoted in the financial press are nominal rates. • For example, 8% on money market deposit means that you anticipate receiving $1.08 in one year from the bank for $1 investment today. • What really matters most to you is increase in purchasing (or consumption) power of your investment return, which depends on how prices in the economy evolve over the year. • If prices increase by 3%, a real increase in purchasing power of your $1.08 then will be only 5% (=8% - 3%). • Nominal rate = 8% vs. Real rate = 5%, when inflation = 3% The Fisher Effect 51 Deriving the Fisher Effect • If you invest $1, you sacrifice $1/Pt real goods now. • But in 1 year, you get back $(1+i)/Pt+1 in real goods, where i is the nominal rate. • We calculate the real return by dividing the real amount you get back in the future by the real amount that you invest today. • Thus, if r is the real return and ∏ is inflation rate, we have 1 i 1 i p (1 i ) t 1 1 r 1 pt 1 (1 ) p p t t (1 i ) (1 r )(1 ) 52 Fisher Effect • The Fisher Effect states that nominal interest rates in each country are equal to the required real rate of return plus compensation for expected inflation. • This equation reduces to (in approximate form): i≈r+ where i = nominal interest rate, r = real interest rate and = expected inflation. 53 The Fisher Effect: Example • Example: Suppose we have $1,000, and Diet Coke costs $2.00 per six pack. We can buy 500 six packs now with $1,000. Now suppose the rate of inflation is 3%, so that the price rises to $2.06 in one year. We invest the $1,000 and it grows to $1,080 in one year. What’s our return in dollars? In six packs? A. Dollars. Our return is ($1080 - $1000)/$1000 = $80/$1000 = 8% Nominal Rate B. Six packs. We can buy $1080/$2.06 = 524.27 six packs, so our return is (524.27 - 500)/500 = 24.27/500 = 4.85% Real Rate • 8% ≈ 4.85% + 3% 54 The Exact Fisher Effect • For the U.S., the Fisher effect is written as: ( 1 + i ) = ( 1+ r ) ( 1 + ) • With the earlier example, we can re-write to find r as follows: 1.08 = (1+r)(1.03) r= 1.08/1.03 -1 =1.0485 – 1 = 4.85% 55 The Fisher Effect - Prediction • The FE says that “An increase (decrease) in the expected rate of inflation will cause a proportionate increase (decrease) in the interest rate in the country.” – Suppose the expected real interest rate is 2% per year in U.S. – Given this, the U.S. (nominal) interest rate will be entirely determined by the expected inflation in the U.S. – If, for instance, the expected inflation rate is 4% per year, the interest rate will then be set at 6%. – With a 6% interest rate, the lender will be fully compensated for the expected erosion of the purchasing power of money while still expecting to realize a 2% real return. – The Fisher Effect should hold in each country’s bond market as long as the bond market is efficient. – However, either the bon market is not efficient or other market frictions exist, the Fisher Effect does not consistently hold. 56 Fisher Effect (FE) - Implication • Relates inflation rates and interest rates in two countries. • Currencies with high inflation should bear higher interest rates than currencies with lower inflation. • The difference in forecasted interest rates in two countries equals the difference in forecasted inflation rates. • Put another way, the real rates of return are equal, in theory. • As real rates of return are not equal, generally does not hold. 57 Average Long-Term Government Bond Yields and Inflation Rates 58 The Fisher Effect: Reality • Real rates of interest should tend toward equality everywhere through arbitrage. • With no government interference nominal rates vary by inflation differential or countries with higher inflation rates have higher interest rates. • Due to capital market integration globally, interest rate differentials are eroding. • Empirical tests (using ex-post) on national inflation rates have shown the Fisher Effect usually exists for shortmaturity government securities (treasury bills and notes). 59 INTERNATIONAL FISHER EFFECT 60 International Fisher Effect (IFE) • The difference in interest rates between two countries is related to the forecasted change in the exchange rate between their currencies. • The Fisher Effect can be expanded internationally into socalled, the International Fisher Effect (IFE). – – – • That is, IFE = PPP + FE A higher interest rate means a higher inflation rate, according to FE. A higher inflation rate means a currency depreciation, according to PPP. Therefore, the currency whose country has the higher interest rate will depreciate. • • It suggests that currencies with higher (lower) interest rates will depreciate (appreciate) because the higher (lower) rates reflect higher (lower) expected inflation and therefore, implying the lower (higher) real return. For example, if the interest rate is 5 percent per year in the U.S. and 7 percent in the U.K., the dollar is expected appreciate against the British pound by about 2 percent per year 61 IFE - Rationale • IFE suggests that the spot exchange rate adjusts to the interest rate differential between two countries. – Interest rate differentials are unbiased (while not necessarily accurate) predictors of the exchange rate. • Hence, investors hoping to capitalize on a higher foreign interest rate should earn a return no better than what they would have earned domestically. • If the same real return is required, differentials in interest rates may be due to differentials in expected inflation. • In the earlier example, the U.S. investors would earn about the same return on British deposits as they would on U.S. deposits. • This is because the expected inflation in U.S. is lower. 62 IFE equation • More formally: S1 – S 2 S2 = i$ - i¥ • Where i$ and i¥ are the respective national interest rates and S is the spot exchange rate using indirect quotes (¥/$). • “Fisher-open”, as it is termed, states that the spot exchange rate should change in an equal amount but in the opposite direction to the difference in interest rates between two countries. • Justification for the international Fisher effect is that investors must be rewarded or penalized to offset the expected change in exchange rates. 63 International Fisher Effect (IFE) Investors Residing in Attempt to Invest in ih Japan Japan U.S. Canada 5% 5% 0% 8 -3 5 13 -8 5 U.S. Japan U.S. Canada 8 8 8 5 8 13 Canada Japan U.S. Canada 13 13 13 5 8 13 if Sf Return in Home Currency Пh Real Return Earned 5% 5 5 3% 3 3 2% 2 2 3 0 -5 8 8 8 6 6 6 2 2 2 8 5 0 13 13 13 11 11 11 2 2 2 64 Graphic Analysis of IRP Interest Rate Differential (%) home interest rate – foreign interest rate 4 Lower returns from investing IFE line in foreign 2 deposits -3 -1 % D in the foreign Higher returns currency’s investing spot rate - 2 from in foreign deposits 1 -4 3 65 Tests of the IFE • If the actual points of interest rates and exchange rate changes are plotted over time on a graph, we can see whether the points are evenly scattered on both sides of the IFE line. • Empirical studies indicate that the IFE theory holds during some time frames. However, there is also evidence that it does not consistently hold. • Why the IFE does not occur? – Since the IFE is based on PPP, it will not hold when PPP does not hold. – For example, if there are factors other than inflation that affect exchange rates, the rates will not adjust in accordance with the inflation differential. 66 The Real Exchange Rate and the Real Interest Differential 67 Application of the IFE to the Asian Crisis • According to the IFE, the high interest rates in Southeast Asian countries before the Asian crisis should not attract foreign investment because of exchange rate expectations. • However, since some central banks were maintaining their currencies within narrow bands, some foreign investors were motivated. • Unfortunately for these investors, the efforts (to keep the values of their currencies) made by the central banks to stabilize the currencies were overwhelmed by market forces. • In essence, the depreciation in the Southeast Asian currencies wiped out the high level of interest earned. 68 What Causes a Currency Crisis? • Macroeconomic conditions – Government follows policies inconsistent with its currency peg – speculative attack is unavoidable – Government will exhaust reserves defending peg – Growing budget deficits – Fast money growth – Rising wages and prices – Currency overvaluation – Current account deficits (caused by budget deficits combined with currency overvaluation) • Self-fulfilling expectations – Group of investors begin speculative attack – Other investors see this and think that the currency will collapse so they convert out of currency • Contagion – If group successfully attacks one currency, they might as well try another – If one currency is attacked, other currencies will appreciate relative to that currency and their domestic firms suffer a loss of competitiveness – Other countries in similar position – obvious targets (e.g., Asian crisis) 69 INTEREST RATE PARITY (IRP) 70 International Arbitrage • Arbitrage can be loosely defined as capitalizing on a discrepancy in quoted prices. • Often, the funds invested are not tied up or any initial fund from investors is not necessary and therefore, no risk is involved. • In response to the imbalance in demand and supply resulting from arbitrage activity, prices will realign very quickly, such that no further risk-free profits can be made. 71 International Arbitrage • Locational arbitrage is possible when a bank’s buying price (bid price) is higher than another bank’s selling price (ask price) for the same currency. • Example: Bank C NZ$ Bid $.635 Ask $.640 Bank D Bid Ask NZ$ $.645 $.650 Buy NZ$ from Bank C @ $.640, and sell it to Bank D @ $.645. Profit = $.005/NZ$. 72 International Arbitrage • Triangular arbitrage is possible when a cross exchange rate quote differs from the rate calculated from spot rates. • When the exchange rates of the currencies are not in equilibrium, triangular arbitrage will force them back into equilibrium. • Example: British pound (£) in Bank A Malaysian ringgit (MYR) in Bank B £ in Bank C Bid $1.60 $.200 MYR8.1 Ask $1.61 $.202 MYR8.2 Buy £ @ $1.61, convert @ MYR8.1/£, then sell MYR @ $.200. Profit = $.01/£. (8.1.2=1.62) 73 International Arbitrage • Covered interest arbitrage is the process of capitalizing on the relationship between interest rate differentials of two countries and forward rate premium/discount, while covering for exchange rate risk. • Example: £ spot rate = 90-day forward rate = $1.60 U.S. 90-day interest rate = 3% U.K. 90-day interest rate = 4% Borrow $ at 3%, convert $ to £ at $1.60/£ and engage in a 90-day forward contract to sell (deliver) £ at $1.60/£ in 90 days. Lend £ at 4%. Perform arbitrages until new equilibrium in forward rates (or interest rates) is set in a way that they all consume profit opportunities. 74 Interest Rate Parity (IRP) • The theory of Interest Rate Parity (IRP) provides the linkage between the foreign exchange markets and the international money markets. • The spot and forward exchange rates are not constantly in the state of equilibrium described by interest rate parity. • When the market is not in equilibrium, the potential for “risk-less” or arbitrage profit exists. It’s riskless because it does not require initial capital (from the investor’s pocket) to start with. • IRP is a “no arbitrage” condition. If IRP did not hold, then it would be possible for an astute arbitrager to make unlimited amounts of money by exploiting the imbalance by investing in whichever currency offers the higher return on a covered basis. • This is known as covered interest arbitrage (CIA). • If covered interest arbitrage is no longer feasible, then the equilibrium state achieved, which is referred to as interest rate parity (IRP). 75 IRP: Strategy 1 • Suppose 1+id < (1+if)(forward rate)/spot rate. • This means that the domestic rate is low relative to the hedged foreign rate. • Hence, borrow domestic currency, convert it to foreign currency at the current spot rate, lend at the foreign currency interest rate, and simultaneously sell foreign currency units forward to hedge or lock in your foreign lending. • At the end of the period, liquidate your foreign lending and deliver the foreign currency proceeds against the forward contract to convert your foreign loan proceeds back into local currency units. • Repay your domestic loan, and reap your arbitrage profits in domestic currency. 76 IRP: Strategy 2 • 1+id > (1+if)(forward rate)/spot rate • This means that the domestic rate is high relative to the hedged foreign rate. • Hence, borrow foreign currency units, sell them for domestic currency units at the spot rate, lend these domestic currency units at the domestic interest rate, and simultaneously sell just enough domestic currency forward so that you can repay your foreign loan. • At the end of the period, collect the proceeds of your domestic lending, repay your foreign loan by buying foreign currency through the forward contract. You will be left with an arbitrage profit in foreign currency. 77 How is IRP Reached? • Market forces cause the forward rate to differ from the spot rate by an amount that is sufficient (or equal) to offset the interest rate differential between the two currencies. • As one currency is more demanded spot and sold forward – Inflow of fund depresses interest rates – Parity eventually reached – Higher interest rates on a currency are offset by forward discounts – Lower interest rates are offset by forward premiums 78 Covered Interest Arbitrage (CIA) • Given: iUK = 12%, iUS = 7%, S = $1.95/£, F = $1.88/£ • Analysis iUS - iUK = -5% (F – S)/S = ($1.88 - $1.95) / $1.95 = -3.6% = forward discount on pound iUS – iUK ≠ (F – S) / S A higher rate in U.K. is offset by forward discount on £ and a lower rate in U.S. is offset by forward premium on $. 1+ iUS = 1.07, (1+ iUK)F / S = 1.12 * 1.88 / 1.95 = 1.0798, profit=1.0798 - 1.07 = $.0098, Since 1.07 < 1.0798, borrow $ and lend £ 79 CIA (contd) • Arbitrage profit – Borrow $1 in U.S., convert it to pound at S (1/1.95=£.5128), – lend at U.K rate (£.5128*1.12=£.5744), – convert proceeds back to dollars at F (£.5744*1.88=$1.0798), – and then pay back $1.07. – Profit=$.0098 per dollar. • Results – Funds will flow from U.S. to U.K. to exploit profit opportunity (CIA). – As pounds are bought spot and sold forward, S will increase and F will decrease, increasing the forward discount. – As funds flow from U.S. to U.K., iUS will increase and iUK will decrease. – CIA will continue until IRP is achieved. 80 Arbitrage Profit is Disappearing! U.K. int. rate 12.00% 12.00% 11.50% 12.00% 11.70% 12.00% U.S. int. rate 7.00% 7.00% 7.50% 7.00% 7.40% 7.00% F in $ 1.8800 1.8800 1.8800 1.8715 1.8760 1.8629 S in $ 1.9500 1.9500 1.9500 1.9590 1.9510 1.9500 Implied IRP Forward Rate 1.8629 US rate- UK rate -5.00% -5.00% -4.00% -5.00% -4.30% -5.00% Forward premium -0.0359 -0.0359 -0.0359 -0.0447 -0.0384 -0.0446 1 1000000 1000000 1000000 1000000 1000000 1.07 1070000 1075000 1070000 1074000 1070000 convert into pound at S 0.512820513 512820.51 512820.5 510464.5 512557.7 512820.5 invest in U.K. 0.574358974 574358.97 571794.9 571720.3 572526.9 Convert back to $ at F 1.079794872 1079794.9 1074974 1069974 1074060 Profit 0.009794872 9794.8718 -25.641 -25.5232 60.4818 borrow $ pay back in one year 574359 1070000 0 81 Forward Premium / Discount and Interest Rate Differential ih – if Parity Line Arbitrage inflow to UK 5 4 3 1 -5 -4 -3 -2 -1 -1 -2 -3 E -4 2. Funds will flow from the U.S. to the U.K.: Arbitrage outflow from UK* 2 F–S 1 2 3 4 5 1. ih - if = -5% and forward discount = -3.6%. S – Increasing S; Decreasing F and – Increasing iUS and decreasing iUK 3. CIA continues until IRP is achieved at the point E in parity line. -5 *Points below the parity line represent points at which the forward premium would negate the favorable UK interest rate differential. 82 Deriving IRP • IRP draws on the principle that in equilibrium, two investments exposed to the same risks must have the same returns. • Suppose an investor puts $1 in a US$ security. At the end of one period, wealth = $1 (1 + i$) • Alternatively, the investor can put the $1 in a UK£ security and cover his or her exposure to UK £ exchange rate changes. At the end of one period, wealth = 1.0 $1 1 i£ F S • Driven by covered interest arbitrage, the two investments should produce identical ending wealth. So, 1.0 $1 1 i£ F $1 1 i$ S 1 i$ F S 1 i£ 83 Alternative 2: Send your $ on a round trip to Britain IRP $1,000 S$/£ Step 2: Invest those pounds at i£ Future Value = $1,000 $1,000 IRP Alternative 1: Invest $1,000 at i$ $1,000×(1 + i$) = Step 3: Repatriate future value to the U.S.A. $1,000 S$/£ S$/£ (1+ i£) (1+ i£) × F$/£ Since both of these investments have the same risk, they must have the 84 same future value—otherwise an arbitrage would exist. A Slightly Different Form of IRP F 1 i$ S 1 i£ 1 i$ F 1 i$ F 1 1 S S 1 i£ 1 i£ i$ i£ F S S 1 i£ Approximation : F S i$ i£ S % forward premium = % interest differential A higher rate in U.K. is offset by forward discount on £ and a lower rate in U.S. is offset by forward premium on $. 85 Implied Forward Rates: More General Form • Implied Forward Rate is the equilibrium forward rate that eliminates the covered interest rate arbitrage opportunity and thus it makes IRP hold. • If the foreign currency is quoted directly against $, F$/f= = S$/f(1+i$ (T/360))/(1+if (T/360)). • If the foreign currency is quoted indirectly against $, Ff/$= Sf/$ (1+if (T/360))/(1+i$(T/360)). 86 Interest Rate Parity - Example Implied Forward Rate = 1.4800(1.01)/(1.02) = SF1.46549/$ Forward Rate Premium = [(1.48-1.4655)/1.4655]*4 =3.96% 87 Currency Yield Curves and Forward Premium 88 Covered Interest Arbitrage (CIA) Implied Forward Rate = 106.00(1.02)/(1.04) = ¥103.96/$ Forward Rate Premium = [(106.00-103.50)/103.50]*2 = 4.83% 89 Interest Rate Parity (IRP) and Equilibrium 90 Uncovered Interest Arbitrage (UIA): Currency Carry Trade • A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA). It is also called as “currency carry trade.” • In this case, investors borrow in countries and currencies exhibiting relatively low interest rates and convert the proceed into currencies that offer much higher interest rates. • The transaction is “uncovered” because the investor does not sell the higher yielding currency proceeds forward, choosing to remain uncovered (or unhedged) and accept the currency risk of exchanging the higher yield currency into the lower yielding currency at the end of the period. • The carry trade is profitable as long as the interest rate differential is greater than the appreciation of the funding currency against the investment currency. 91 The Yen Carry Trade In the yen carry trade, the investor borrows Japanese yen at relatively low interest rates, converts the proceeds to another currency such as the U.S. dollar where the funds are invested at a higher interest rate for a term. At the end of the period, the investor exchanges the dollars back to yen to repay the loan, pocketing the difference as arbitrage profit. If the spot rate at the end of the period is roughly the same as at the start, or the yen has fallen in value against the dollar, the investor profits. If, however, the yen were to appreciate versus the dollar over the 92 period, the investment may result in significant loss. Currency Carry Trade Example • Suppose the 1-year borrowing rate in dollars is 1%. • The 1-year lending rate in pounds is 2½%. • The direct spot ask exchange rate is $1.60/£. • A trader who borrows $1m will owe $1,010,000 in one year. • Trading $1m for pounds today at the spot generates £625,000. • £625,000 invested for one year at 2½% yields £640,625. • The currency carry trade will be profitable if the spot bid rate prevailing in one year is high enough that his £640,625 will sell for at least $1,010,000 (enough to repay his debt). • No less expensive than: b S360($/£) $1,010,000 = £640,625 = $1.5766/ £ 93 Interpretation of IRP • When IRP exists, it does not mean that both local and foreign investors will earn the same returns. • What it means is that investors cannot use covered interest arbitrage to achieve higher returns than those achievable in their respective home countries. 94 Does IRP Hold? • Various empirical studies indicate that IRP generally holds. – One way to test whether IRP exists: Collect the actual interest rate differentials and forward premiums for various currencies. Pair up data that occur at the same point in time and plot the points on a graph. • While there are deviations from IRP, they are often not large enough to make covered interest arbitrage worthwhile. – This is due to the characteristics of foreign investments, including transaction costs, political risk, and differential tax laws. • Transaction cost: The interest rate available to an arbitrageur for borrowing, ib, may exceed the rate he can lend at, il. • Political Risk: A crisis in the foreign country could cause its government to restrict any exchange of the local currency for other currencies. (called “capital controls”) • Differential Tax Laws: If tax laws vary, after-tax returns should be considered instead of before-tax returns. 95 IRP Example – A Detail Analysis • • • • iUS = 90-day Interest Rate in U.S. = 4% per annum. iGB = 90-day Interest Rate in U.K. = 8% per annum. S = Spot rate = $2.0000/£. F = 90-day Forward Rate = $1.9900/£. • Is sterling at a premium or at a discount relative to the $? – Rates are quoted directly. Δ = (360/T) (Forward-Spot)/Spot = (360/90)(1.9900-2.0000)/2.0000 = 4 (-.01)/2.00 = -.04/2.00 = -2.00%. – 90 day forward sterling is at a 2.00% discount against the US dollar. 96 Covered Interest Arbitrage • An investor based in the US has two strategies for investing. – Invest in the United States – Engage in CIA by investing in Great Britain with the exchange risk eliminated. • Convert dollars to the foreign currency • Invest in that currency • On the day the investment is made, sell the proceeds (principal and interest) in the forward market to eliminate any uncertainty arising from movements in the exchange rate. 97 CIA - Investing in the US • We have $10,000,000 to invest. • We earn 4% per annum over 90 days. • Our investment proceeds are 10,000,000 (1+.04(90/360)) =10,000,000 (1.01) = $10,100,000 • We make $100,000. • We know exactly how many dollars we are going to make. 98 CIA - Investing in Great Britain 1 • We convert $10,000,000 at $2.00/£ in the spot market, and get £5,000,000. • We invest £5,000,000 for 90 days at 8% per annum. • In 90 days the proceeds of our investment will be 5,000,000 (1+.08(90/360)) = 5,000,000 (1.02) = £5,100,000 • So, today we sell £5,100,000 in the forward market at $1.99/£. • In 90 days we will have £5,100,000 – If the exchange rate stays at $2.00/£, we will have 5,100,000 * 1.99 = $10,149,000 – If the sterling appreciates to $2.20/£, we will have 5,100,000 * 1.99 = $10,149,000 – If the sterling depreciates to $1.80/£, we will have 5,100,000 * 1.99 = $10,149,000 99 CIA - Investing in Great Britain 2 Spot Rate Profit ($) Return 1.80 (depreciate) 149,000 5.96% 2.00 (stay) 149,000 5.96% 2.20 (appreciate) 149,000 5.96% Note: 5.96% = $149,000/$10,000,000*(360/90) 100 CIA (contd) • Covered Interest Arbitrage really is “arbitrage”. • It eliminates exchange risk by use of a forward contract. • Because the forward rate “locks in” our investment proceeds at 5.96%, the return from investing in sterling is always better than the 4% return from investing in dollars. • The Return from Covered Interest Arbitrage is equal to iGB + Δ + (Δ iGB)T/360 = .08 + (-.02) + (-.02*.08)(90/360) = .08 - .02 - .0004 = .0596 or 5.96%. • 5.96% is referred to as the covered yield on the investment. 101 CIA Example: Summary • How would financial markets react if investors could make an additional 1.96% on investment in Great Britain? – Money would begin to flow into the UK until the covered yield differential is erased. – The primary impact would be on the least liquid of the markets, the market for 90-day forward £. • At what forward exchange rate would an investment in $ and an investment in £ have the same rate of return? – We know investment in sterling will be worth £ 5,100,000. – We know investment in dollars will be worth $10,100,000 • The “breakeven exchange rate” is 10,100,000/5,100,000 = $1.9804/£ (The lower rate than $1.99/£ because more forwards to sell £ flows into the forward market.) The forward exchange rate where an investor would be indifferent between investing in the domestic money market and investing in the money market of the other currency is the interest rate parity forward rate. Alternatively, it is equal to 2.00*(1.01)/(1.02)=1.9804 102 IRP Forward Rate in Equilibrium • If the spot rate is $2.0000/£ and the 90-day forward rate is $1.9804/£, • The annualized premium for the 90-day British pound has changed against the dollar is Δ = (360/T) (Forward-Spot)/Spot x 100 = (360/90)(1.9804-2.0000)/2.0000 = -.0784/2.0000 = -0.0392 or -3.92% • The difference in interest rates is 4%-8% = -4%. • The exact form of interest rate parity is that the annualized forward premium for a forward contract maturing in T days is i i£ F S $ S 1 i£ Approximation : F S S (iUS – iGB) / (1 + iGB(T/360)) = (.04-.08) / (1+.08/4) -0.04 / 1.02 =-.0392 or -3.92% i$ i= £ 103 In Equilibrium, • The Return from Covered Interest Arbitrage is equal to iGB + Δ + (iGB Δ )T/360 =.08 + (-.0392) + (-.02*.0392)(90/360) =.08 - .0392 - .0008 = .0400 or 4.00%. • The covered yield on the investment is the same as the yield on a domestic investment. 104 IRP and CIA: An Equilibrium Example • If IRP failed to hold, an arbitrage would exist. It’s easiest to see this in the form of an example. • Consider the following set of foreign and domestic interest rates and spot and forward exchange rates. Spot exchange rate 360-day forward rate S($/£) = $2.0000/£ F360($/£) = $2.0100/£ U.S. discount rate i$ = 3.00% British discount rate i£ = 2.49% 105 IRP & Exchange Rate Determination • According to IRP only one 360-day forward rate F360($/£) can exist. It must be the case that F360($/£) = $2.01/£ • Why? • If F360($/£) $2.01/£, an astute trader could make money with one of the following strategies. • Proof: Implied Forward Rate = 2*1.03/1.0249=2.01 106 Other Choice: Buy £500 at $2/£. £1 £500 = $1,000× $2.00 $1,000 One Choice: Invest $1,000 at 3%. FV = $1,030 £500 Step 2: Invest £500 at i£ = 2.49%. £512.45 In one year £500 will be worth Step 3: £512.45 = Repatriate to the £500 (1+ i£) U.S. at F360($/£) = $2.01/£ $1,030 F£(360) $1,030 = £512.45 × £1 107 Arbitrage I Step 2: Buy pounds £1 £500 = $1,000× $2.00 $1,000 Step 1: Borrow $1,000. Step 5: Repay your dollar loan with $1,030. £500 Step 3: Invest £500 at i£ = 2.49%. £512.45 In one year £500 will be worth £512.45 = £500 (1+ i£) Step 4: Repatriate to the U.S. More than $1,030 F£(360) $1,030 < £512.45 × £1 If F£(360) > $2.01/£, £512.45 will be more than enough to repay your dollar obligation of $1,030. The excess is your profit. 108 Step 2: Buy dollars $2.00 $1,000 = £500× £1 Arbitrage II £500 Step 1: Borrow £500. $1,000 Step 5: Repay More Step 3: your pound loan than Invest $1,000 with £512.45. £512.45 at i$ = 3%. Step 4: Repatriate to the U.K. In one year $1,000 F£(360) will be worth $1,030 > £512.45 × $1,030 £1 If F£(360) < $2.01/£, $1,030 will be more than enough to repay your 109 pound obligation of £512.45. Keep the rest as profit. FORWARD RATE AS AN UNBIASED PREDICTOR OF FUTURE SPOT RATE 110 Forward Rate and Future Exchange Rate • States that, if the forward rate is unbiased, then it should reflect the expected future spot rate. • Some forecasters believe that forward exchange rates are unbiased predictors of future spot exchange rates. • Intuitively this means that the distribution of possible actual spot rates in the future is centered on the forward rate. • Unbiased prediction simply means that the forward rate will, on average, overestimate and underestimate the actual future spot rate in equal frequency and degree. 111 Graphic Evaluation of Forecast Performance Using the Forward Rate as a Forecast for the British Pound Perfect Forecast Line Realized Spot Rate $2.50 $2.00 $1.50 $1.00 $1.00 $1.50 $2.00 $2.50 Forecast (Forward Rate) 112 Graphic Evaluation of Forecast Performance Realized Value z Region of downward bias (underestimating) Perfect forecast line Region of upward bias (overestimating) x x Predicted Value z 113 Forecast Bias Using the Forward Rate as a Forecast for the British Pound $2.60 Forward Rate $2.40 $2.20 $2.00 $1.80 $1.60 $1.40 $1.20 $1.00 1975 Realized Spot Rate 1980 1985 1990 1995 2000 114 Forward Rate as an Unbiased Predictor for Future Spot Rate 115 International Parity Conditions in Equilibrium (Approximate Form) 116 International Parity Conditions • These theories do not always work out to be “true” when compared to what students and practitioners observe in the real world, but they are central to any understanding of how multinational business is conducted and funded in the world today. • The mistake is often not with the theory itself, but with the interpretation and application of said theories. 117