Financial Markets - Superior University Gujranwala Campus

advertisement

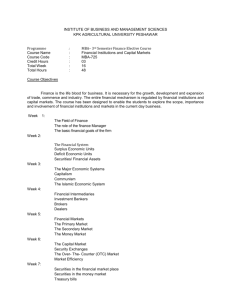

Lecture # 1 1 Superior College University Campus Chapter 1 To To To To To To develop concepts of financial markets understand some important facts market know components of financial market learn six parts of financial system seek out five parts of money be familiar with history and elements of money Financial market is the place where lenders and borrowers are allow to buy and sell financial securities In general financial markets deals in 1. Securities 2. Commodities Stock exchange ◦ Three stock exchanges (KSE, LSE, ISE, 1948, 1974, 1997, 84%, 14%, 1% 167 companies listed) ◦ 2006-7 GDP of Pak US $ 143 billion, 49% capitalization from stock markets. ◦ 1997 dropped due to nuclear issue ◦ 2002 declared best market in world. ◦ Small market but attractive ◦ Central Depository company (CDC) Source: Iqbal, J (2008). “Stock Market in Pakistan: An Overview” Money market Capital market Money market is the market where short term credit instruments are traded. Money market in Pakistan Call loans Trading in credit ceiling Treasury bills (TBs) REPOs (Repurchase Agreements) Central bank Commercial banks Government Non bank financial intermediaries (NBFI). ◦ ◦ ◦ ◦ ◦ Insurance Micro financial institutes Pension funds Thrift institutions Discount house etc. Other participants Capital market is the market for long term debts .when funds are lent for a period of more than one year. The capital markets funds are used to finance long term investments. Security market (stocks & bonds) Further divided into two categories ◦ Primary market ◦ Secondary market Non security market (Development Finance Institutes) E.g. PICIC IDBP, ICP, SBFC, ADBP, HBFC,NIT Debt instrument ◦ ◦ ◦ ◦ Bonds Government securities Mortgages Mutual funds Issue of shares Primary Secondary Money Financial instruments Financial markets Financial institutions Government regulatory agencies Central bank 1. 2. 3. 4. 5. Time (has value) Risk (requires compensation) Information (basis for decision) Markets (Markets Determine Prices and Allocate Resources) Stability (improves welfare) MONEY 15 The word money is derived form the Latin word MONETA which was the surname of the Roman Goddess of Juno in whose temple money was coined Money Latin Word Moneta 16 “Anything that is generally acceptable as a medium of exchange & at the same time acts as a measure and store of value is called money”. 17 Medium of Exchange Measures Value MONEY Standard of deferred payments Govt Approval FUNCTIONS OF MONEY Primary Function Secondary Function Contingent Function Superior College University Campus Resource Person : Muhammad Rafiq 19 Functions Of Money Primary Function Medium of exchange Standard of Value Store of wealth Standard of deferred payments Secondary Function Money as liquid assets Money as guarantee of solvency Medium of Govt payments Transfer of wealth Contingent Function Basis of bank credit Distribution of national Income Distribution of joint product Maintenance of accounting record 20 Why Study Financial Markets?: ◦ the three primary markets (bond, stock, and foreign exchange) were briefly introduced. Why Study Financial Institutions?: ◦ the market, institutions, and key changes affecting these were outlined. What is money and its characteristics. What are element of money. ◦ Medium of exchange ◦ Measures value ◦ Standard of deferred payment ◦ Government approval ◦ Money definitions and elements ◦ Functions of money