ch02_final

advertisement

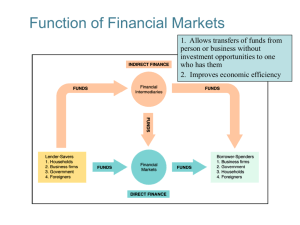

Chapter Two Overview of the Financial System Primary Function of Financial Markets Primary function: To facilitate the flow of funds from savers to borrowers Improves economic efficiency In the absence of borrowing, one can only “eat what they kill” Hard to accumulate wealth without saving Slide 2–3 Function of Financial Markets Slide 2–4 Six Functions of Financial Markets & Intermediaries 1. 2. 3. 4. 5. 6. To transfer economic resources through time, across borders & among industries To provide a mechanism for the pooling of resources & the subdividing of shares in enterprises To provide a mechanism to clear & settle payments To provide mechanisms for managing risk To provide price information to help coordinate decentralized decision making To provide ways of dealing with the incentive problems that arise due to asymmetric information Source: The Global Financial System: A functional perspective by Crane, Froot, Mason, Perold, Merton, Bodie, Sirri & Tufano Slide 2–5 Transfer economic resources The financial system facilitates the transfer of economic resources through time, across geographic regions, and across different industry sectors Facilitates the efficient allocations of household capital to the most productive use in the business sector Facilitates the efficient separation of ownership and management of money Facilitates specialization in production according to the principles of comparative advantage Slide 2–6 Mechanism for the pooling of resources Mechanism for the pooling of funds from small investors to undertake large scale indivisible investments in enterprises Mechanism for subdividing of investments in enterprises to facilitate diversification and distribution Can be done through financial intermediaries or the market mechanism Examples: Bank deposits & loans; mutual funds; common stocks; securitization Slide 2–7 Payments System Payments System: Set of institutions and arrangements that facilitate transfer of purchasing power from A to B Includes methods for clearing and settling cash and securities transactions Payments go through two steps: first they are cleared, then they are settled. Clearing is the daily process by which CPA members exchange deposited payment items and the net amounts owed to each other are then determined Settlement is the procedure by which CPA members use funds on deposit at the Bank of Canada to fulfil their net obligations to all other members. Slide 2–8 Canadian Payments System (CPA) Over eighteen million times a day, Canadians withdraw cash from banking machines, use cheques, debit cards and pre-authorized payments, or make other payments that result in one financial institution owing money to another. These transactions total more than $147 billion a day which, over the 2003 calendar year, amounted to more than 38 times Canada's GDP. Prior to 1980, the Canadian payments system was administered by the Canadian Bankers Association The CPA was created as a not-for-profit organization by an Act of Parliament in 1980 & assumed control of the Canadian payments system in 1983. The Association’s mandate, as amended through the Canadian Payments Act in 2001, is: (i) to establish and operate national systems for the clearing and settlement of payments and other arrangements for the making or exchange of payments, (ii) to facilitate the interaction of the CPA’s systems with others involved in the exchange, clearing and settlement of payments, and (iii) to facilitate the development of new payment methods and technologies. The Act also explicitly identifies public policy objectives for the CPA. It states that the Association will: Promote the efficiency, safety and soundness of the clearing and settlement systems Take into account the interest of users. Slide 2–9 Managing Risk Ways to manage uncertainty and control risk Risk-pooling versus risk-shifting Risk-pooling – Insurance - individual losses are spread over a large number of members in the pool, thereby reducing the impact on any one member Risk shifting – Derivatives - risk is assumed by those willing to absorb a loss in exchange for a higher expected return Basic ways of managing risk: Insurance Diversification Other hedging strategies Slide 2–10 Price Information Provision of price information to help coordinate decentralized decision-making in various sectors of the economy A primary function of markets is to allow the trading of assets A secondary function of markets is to provide price information that affects consumption-savings decisions and portfolio wealth allocation decisions Capital is analogous to water. Water will always flow downhill. Capital will always flow to the source of the highest, risk-adjusted returns. Market prices provide the information that investors require to make their portfolio investment decisions. Slide 2–11 Dealing with the incentive problems : Adverse Selection and Moral Hazard Asymmetric information – problems arise when two parties to a transaction have access to different information Adverse Selection Before transaction occurs Potential borrowers most likely to produce adverse outcome are ones most likely to seek a loan and be selected Moral Hazard After the transaction has occurred The use of private information for personal gain Slide 2–12 Adverse Selection in Insurance Markets Adverse selection can be a problem when there is asymmetric information between the seller of insurance and the buyer; in particular, insurance will often not be profitable when buyers have better information about their risk of claiming than does the seller. Ideally, insurance premiums should be set according to the risk of a randomly selected person in the insured slice of the population (55-year-old male smokers, say). In practice, this means the average risk of that group. When there is adverse selection, people who know they have a higher risk of claiming than the average of the group will buy the insurance, whereas those who have a below-average risk may decide it is too expensive to be worth buying. In this case, premiums set according to the average risk will not be sufficient to cover the claims that eventually arise, because among the people who have bought the policy more will have above-average risk than below-average risk. Increasing the premium will not solve this problem, for as the premium rises the insurance policy will less attractive to more of the people who know they have a lower risk of claiming. One way to reduce adverse selection is to make the purchase of insurance compulsory, so that those for whom insurance priced for average risk is unattractive are not able to opt out. Slide 2–13 Moral Hazard in Insurance Markets Moral hazard means that people with insurance may take greater risks than they would do without it because they know they are protected, so the insurer may get more claims than it bargained for. Fire insurance increases the incentive to commit arson, especially if someone is operating a failing business and decides that they'd rather have the cash from the insurance proceeds on the buildings than the buildings themselves. (The value of a business often is based on profitability; after arson, the owner can claim the business was profitable.) In a worst case scenario (from the insurer's viewpoint), the building is over-insured or valuable contents are removed but claims are filed that they were destroyed in the fire. Many, perhaps most, police investigations of arson are the result of leads from suspicious insurance adjusters. More generally, having insurance discourages preventive measures, such as proper fire prevention. For example, the expectation of US federal government disaster aid seems to encourage the residents of Malibu, California to let bushes and trees grow near their houses, as part of their landscaping. This increased vegetation raises the risk of fire damage to their houses. Automobile insurance reduces the costs to insured people who have accidents, making people less cautious when driving (compared to how they would drive if they paid 100 percent of the damages they cause in an accident). http://insurancefraud.org/Hall_of_Shame_05/hallofshame_set.html Slide 2–14 Moral Hazard & Insurance: Examples You never know who might be listening. One fairly common type of fraud people commit is buying coverage after their car's been damaged. What's less common is when they buy it from the scene of the accident. Take the case of the motorcyclist who wiped out and, while lying on the side of the road with a ruptured spleen, had the presence of mind to call 1-800- PROGRESSIVE to buy coverage. What he didn't know was that a witness who saw the accident also heard him make the call. In another case, a couple's car caught on fire. While the husband was on the phone with Progressive buying a policy, his wife was overheard yelling in the background that the car was about to explode. Unintended consequences. Some people figure the easiest and quickest way to collect insurance money is to destroy their car by setting it on fire. Not necessarily. Consider the case of two brothers who were hired to set a car on fire. They doused it with gasoline, and to make sure the vehicle would be completely destroyed, they decided to throw in a pipe bomb. The bomb exploded, setting one of the men on fire. He was likely killed instantly from the explosion, but his brother, not realizing that, rushed to extinguish the flames and ended up catching on fire. He ran toward a nearby highway for help and flagged down a state trooper who had come to investigate the black cloud of smoke. The man told the trooper what he and his brother had done and then, like his brother, passed away from his injuries. Slide 2–15 Moral Hazard & Insurance: Examples What's wrong with this picture? A customer said some parts were stolen from his car, and to support his claim, he submitted what appeared to be phony invoices along with Polaroid photos. At first blush the photos looked pretty good, but something seemed a little odd about them. On closer inspection, investigators realized the guy had taken extreme close-ups of a toy car that was the same color and make of his actual car. The customer eventually admitted he took photos of the toy car in an attempt to get his claim paid. Miracle cure? A passenger riding in a customer's car was injured in a crash and needed chiropractic treatment. No problem. The customer's insurance covered it. However, sometime before completing the prescribed series of doctor visits, the passenger died of unrelated, natural causes. Now, you'd think that a person who is deceased would no longer benefit from a doctor's care, but evidently, the chiropractor thought otherwise. He continued to bill for treatment for a full month after the patient's death. That's gonna leave a mark. A woman decided to take her boyfriend's motorcycle for a ride. Unfortunately, she didn't know how to drive and crashed it. Luckily, she wasn't injured. The man, however – afraid his insurance wouldn't cover the damage to his motorcycle because his girlfriend wasn't listed as a driver on his policy – decided to pretend that he had crashed the motorcycle. He figured he needed some injuries to make his story credible, so he tied himself to the back of a truck and asked a friend to drag him around a little bit to produce the road rash he would have gotten from the wreck. Well, he got the injuries he wanted, but they didn't do him any good. His girlfriend told investigators that in fact it was she who crashed the motorcycle. Slide 2–16 Classifications of Financial Markets 1. Debt Markets Short-Term (maturity < 1 year) Money Market Long-Term (maturity > 1 year) Capital Market 2. Equity Markets Common Stock Forms part of the Capital Market Slide 2–17 Classifications of Financial Markets 1. Primary Market New security issues sold to initial buyers 2. Secondary Market Securities previously issued are bought and sold Slide 2–18 Classifications of Financial Markets 1. Securities are traded on an Exchange Trades conducted in central locations (e.g., Toronto Stock Exchange) 2. Securities are traded Over-the-Counter Dealers at different locations buy and sell Slide 2–19 Internationalization of Financial Markets International Bond Market Foreign bonds – any bond sold in a domestic market, denominated in the domestic currency, by a foreign issuer Eurobonds – sold in a foreign market by a non-resident issuer and denominated in a currency other than the currency of the country where the bond is issued Slide 2–20 Foreign Bonds Yankee bonds – A bond issued in the United States, denominated in U.S. dollars, by a foreign issuer Samurai Bonds – A bond issued in Japan, denominated in Yen, by a foreign issuer Bulldog Bonds - A bond issued in the UK, denominated in pounds sterling, by foreign issuer Matador bonds - A bond issued in Spain, denominated in pesetas, by a non-Spanish company Matilda bonds – A bond issued in the Australian market, denominated in Australian dollars, by a foreign entity Slide 2–21 Eurobonds - Characteristics Trading A Eurobond is a tradable instrument: it is intended to be bought and sold during the period up to it maturity. It is usually launched through a public offering and is listed on a stock exchange. Payments There is no central register where holders of the issue are named. Eurobonds are, in this sense, a bearer instrument - interest is paid upon presentation of detachable coupons, while the principal amount is repaid on presentation of the Eurobond itself. Listing Although Eurobonds are listed in several stock exchanges, the London and Luxemburg stock exchanges are those most frequently used. Taxation Eurobonds are not subject to tax and largely free from government regulation. Slide 2–22 International Stock Markets Slide 2–23 Financial Intermediaries Slide 2–24 Size of Financial Intermediaries Slide 2–25 Regulatory Agencies Slide 2–26 Regulation of Financial Markets Three Main Reasons for Regulation 1. Increase Information to Investors Decrease adverse selection and moral hazard problems Provincial securities commissions (such as the Ontario & Alberta Securities Commission) force corporations to disclose information 2. Ensure the Soundness of Financial Intermediaries Prevents financial panics Chartering, reporting requirements, restrictions on assets and activities, deposit insurance, and anti-competitive measures 3. Improve Monetary Control Reserve requirements Deposit insurance to prevent bank panics Slide 2–27