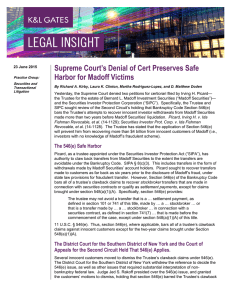

The Madoff Investment Scandal

advertisement

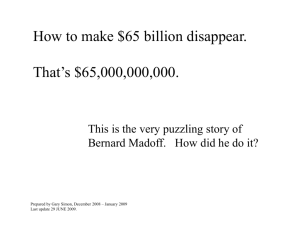

The Madoff Investment Scandal By Tarnbir Singh, Jonathan Mason, David Yong, Jennifer Nguyen, and Lucy Pham About Bernard Madoff • Born in Queens, NY • His father was a stockbroker • Received his BA in Political Science from Holstra University • Briefly attended Brooklyn Law School, but did not receive a degree. • Shortly after, founded his company: Bernard L. Madoff Investment Securities LLC in 1960. About Bernard L. Madoff Investment Securities LLC • In order to compete with firms that were members of the New York Stock Exchange trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes • At one point, Madoff Securities was the largest buying-and-selling "market maker" at the NASDAQ. Background • Federal investigators believe the fraud in the investment management division and advisory division may have begun in the 1970s. • By 2000, Madoff Securities, one of the top traders of US securities, held approximately $300 million in assets. Ponzi Scheme • Hallmarks of a Ponzi scheme: - Abnormally high returns - Abnormally consistent returns - Sometimes begins as a legitimate investment vehicle Ponzi Scheme Cont. • What ends a Ponzi scheme: - Government intervention - Promoter leaves with all the money - Stream of new investors slows - External economic factors cause investors to withdraw their funds Strategy Cont. • Methods Madoff used: - Madoff's Ponzi differed from others in that his was based on a real brokerage organization - Madoff never revealed much about his business, and kept his financial statements secret - By being so secretive, Madoff created an air of mystery around his company and methods. - People did not question Madoff, which is how he got away with this scheme for so long. - Split-strike conversion to cap the lose What happened? • 2008 (economic downturn): His scheme began to unravel as the market began to dwindle. • Investors wanted to withdraw their money. • However, even with his new investors, Bernie could not cover the amount needed to be withdrawn • December 2008: Bernie Madoff confessed to his sons stating “it was one big lie” and he was “finished” Effect on International Community • Forced the temporary closing of many charities • Examples: Robert I. Lappin Charitable Foundation, the Picower Foundation, and • the JEHT Foundation • Madoff’s Ponzi scheme also effected major banks around the globe. • Examples: HSBC Holdings PLC of Britain, Royal Bank of Scotland Group PLC • and Man Group PLC, Spain's Grupo Santander SA, France's BNP Paribas and Japan's • Nomura Holdings Effect on Health Industry • Also caused a large disruption in scientific and health communities. • It even affected diabetes research and palliative care. • Mortimer Zuckerman, a real-estate magnate, pledged to Memorial Sloan-Kettering • Cancer Center in 2006 an amount of $100 million. • 10% of this amount was invested in Madoff’s business. • Led to a loss of $30 million; many patients affected. • Carl Schapiro, the founder of Kay Windsor Inc., has been a generous donor to healthcare causes for many years. • Donated to hospitals affiliated with Harvard. • Lost $100 million in their foundations endowment. • Also made a personal loss of $400 million due to Madoffs scam. SEC Controls: Encouraging Greater Cooperation from Insiders • New incentives to give tips on illegal activity. • Recruiting new staff with specialized experience- bringing in staff to the SEC with wide skill sets to expand its knowledge and improve its ability to assess illegal operations. • Ex. Barry Minkow. SEC Controls: Enhancing Safeguards for Investors’ Assets • Surprise exams: random checks to ensure compliance with regulations. • Audit enhancements- broker dealer that maintains custody of customers assets will now have to go through a new compliance examination that includes an audit of the controls in place to protect customers investments. Aftermath • Bernie Madoff was sentenced to jail for 150 years in addition to his age. • Criminal charges against five directors will proceed against Swiss wealth manager Aurelia Finance, which lost an alleged $800 million of client money. The directors' assets have been frozen. • Elie Wiesel, holocaust survivor and nobel laureate, lost his life savings and his charity lost $15.2 million as a result of this scandal. Aftermath • One of the founders of Access International Advisors LLC was found dead in his company office on Madison Avenue in New York City. Although no suicide note was found at the scene, his brother in France received a note shortly after his death in which he expressed remorse and a feeling of responsibility. Aftermath • On February 10, 2009, highly-decorated British soldier William Foxton, OBE,65, shot himself in a park in Southampton, England, having lost all of his family's savings. He had invested in the Herald USA Fund and Herald Luxembourg Fund, feeder funds for Madoff from Bank Medici in Austria.