Madoff

advertisement

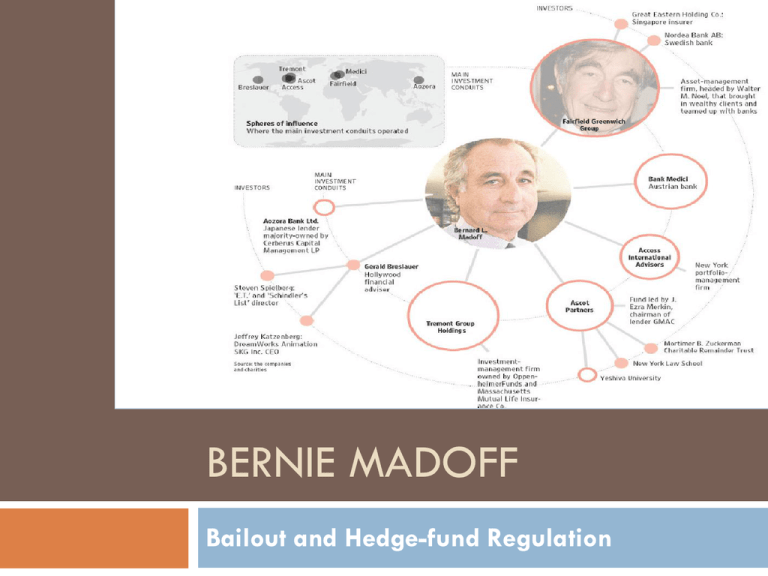

BERNIE MADOFF Bailout and Hedge-fund Regulation Outline Background Bailout? Regulation Moving Forward Conclusion & Ponzi Schemes Moving Forward Outline Background Bailout? Regulation Moving Forward Conclusion & Ponzi Schemes Moving Forward Gravity World’s Largest Ponzi Scheme The bankruptcy court released a 162-page list naming thousands of Madoff victims, including: ◊ ◊ ◊ ◊ ◊ ◊ ◊ New York University John Malkovich Steven Spielberg Kevin Bacon ◊ Aozora Bank (Japan) ◊ Nordea Bank (Sweden) ◊ Bank Medici (Austria) ◊ ◊ HSBC ◊ ◊ Fairfield Greenwich ◊ Begs the questions 1) How could this scheme go on for so long? 2) How could so many sophisticated individuals be taken in by a fund that provided no info on how it was able to achieve consistent returns of 8-13% for many years, during both good and bad times? 20+ Years of trickery SEC did a bad job regulating. They too were caught up with the hype surrounding investors. Split-Strike Strategy – complex with many moving parts. Begs the questions 1) How could this scheme go on for so long? 2) How could so many sophisticated individuals be taken in by a fund that provided no info on how it was able to achieve consistent returns of 8-13% for many years, during both good and bad times? Information Cascades Each successive investor assumed that the previous investor did their due diligence “Information cascades” – kind of like playing telephone. Perhaps “sophisticated” financial institutions are NOT immune from hypes Bernard L. Madoff Professional Accomplishments: Founder of Bernard L .Madoff Investment Securities (BMIS) Chairman of the Board of NASDAQ Founding Member of the International Securities Clearing Corporation in London Board of Governors of National Association of Securities Dealers Exclusive Circle: Club Madoff Bernie Madoff Ruth Madoff’s Friends International Banks; College Endowments Exclusive Circle Feeder Funds Mutual Funds Outline Background Bailout? Regulation Moving Forward Conclusion & Ponzi Schemes Moving Forward Yes Bailout . . . . Millions were affected Not only wealthy white-collar individuals, but also blue-collar individuals with retirement funds managed by one of the feeder funds. Hedge Fund Bailout It’s been done before with success, i.e. LTCM. LTCM v. Madoff Long Term Capital Management Bernard Madoff Investment Securities “Tail” risk(s) that triggered the downfall: Asian Financial Crisis of 1997 & Russian Default of 1998 Current Financial Crisis Counterparties: Wall Street Banks Feeder Funds Prominent Management attracted investments: John Meriwether Myron Scholes Robert Merton Bernard Madoff Millions of Innocent parties affected: Approximately $4.6 Billion loss Approximately $50 Billion loss LTCM v. Madoff Long Term Capital Management Bernard Madoff Investment Securities Hedge Fund Secret: “Secret sauce” (= profitable arbitrage and pairs trade) Split-Strike Strategy (but in fact Ponzi Scheme) Investment Strategy was Legitimate? Yes No Investor Money was … Spread out to purchase US, Japanese, and European government bonds Concentrated in Madoff’s pocket Economic or legal remedy available? No Yes No Bailout Legal Remedy Available People are already bringing lawsuits against Madoff and feeder funds. Bailout will encourage Ponzi Schemes If government bails out Ponzi scheme participants, then taxpayers stand to lose more money than Ponzi players. This incentivizes a rational person to partake in the next Ponzi game rather than avoid it. Outline Background Bailout? Regulation Moving Forward Conclusion & Ponzi Schemes Moving Forward What is a Hedge Fund? Unregistered, privately-managed pools of capital Equity investments Leverage and short selling Absolute return Why regulate? Long-term incentive alignment Retailization Systemic risk Securities Act of 1933 Section 4. Exempted Transactions Regulation D, Rule 501 “Accredited Investor” Calculating purchasers Regulation D, Rule 506 No more than 35 purchasers Sophisticated purchasers Securities Exchange Act of 1934 “Dealer” vs. “Trader” In the business of buying and selling securities Registration under 15(b) Section 12. Registration Requirements for Securities More than 500 holders of record, and Assets in excess of $10M Investment Companies Act of 1940 Section 3(c). Further exemptions 3(c)(1) –type hedge fund Up to 100 investors No public offerings 3(c)(7) – type hedge fund Up to 500 qualified purchasers No public offerings “Qualified Purchaser” Investment Advisors Act of 1940 Section 203(b). Registration of Investment Advisors Fewer than 15 clients in past 12 months, and Doesn’t hold self out as an investment advisor Other Commodity Exchange Act FINRA ERISA Department of Treasury Fraud Madoff: Repeated Investigations 1999: SEC send examiners to review trading practices 2000: SEC sends examiners to review trading practices 2004: SEC investigates front running allegations 2005: NASD reviews Madoff 2005: SEC investigates front running allegations 2006: SEC investigates Ponzi Scheme allegations Madoff Skeptics Harry Markopolos Mark Occrant Erin Arvedlund SEC: Organizational Problems Understaffed Lawyers not financial experts Political influences Little deterrent effect GAO study – 92% of hedge funds in study were not in compliance. Any Lessons Learned from LTCM? “Unique characteristics and unlikely events” Amount of leverage is rarely seen today Private parties were willing to buy LTCM Counterparties could have absorbed losses from a default Outline Background Bailout? Regulation Moving Forward Conclusion & Ponzi Schemes Moving Forward In the end… No Bailout for Madoff victims Regulation laws seem fine. The problem is the people running the organization. How to Succeed in a Ponzi Scheme Don’t expand too fast. Show bad numbers once in a while. Run while you’re ahead.