1) Acquisition Analysis -mergers and acquisitions Your company

advertisement

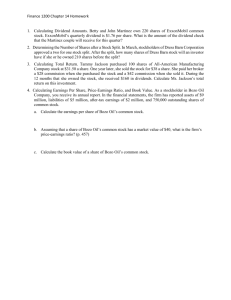

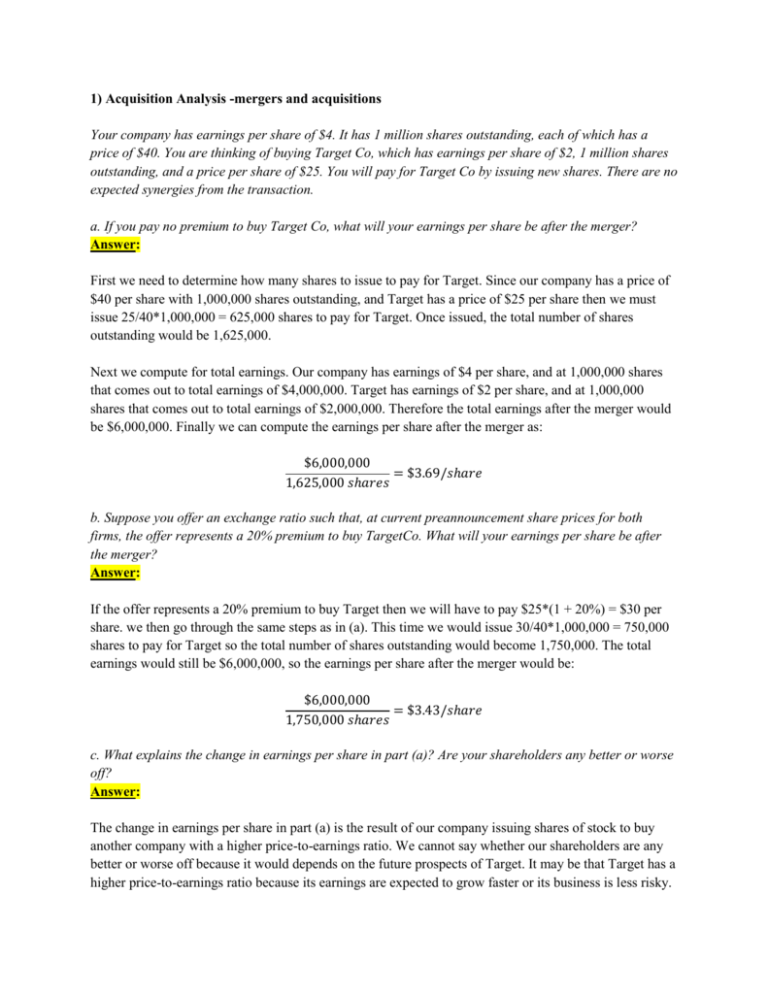

1) Acquisition Analysis -mergers and acquisitions Your company has earnings per share of $4. It has 1 million shares outstanding, each of which has a price of $40. You are thinking of buying Target Co, which has earnings per share of $2, 1 million shares outstanding, and a price per share of $25. You will pay for Target Co by issuing new shares. There are no expected synergies from the transaction. a. If you pay no premium to buy Target Co, what will your earnings per share be after the merger? Answer: First we need to determine how many shares to issue to pay for Target. Since our company has a price of $40 per share with 1,000,000 shares outstanding, and Target has a price of $25 per share then we must issue 25/40*1,000,000 = 625,000 shares to pay for Target. Once issued, the total number of shares outstanding would be 1,625,000. Next we compute for total earnings. Our company has earnings of $4 per share, and at 1,000,000 shares that comes out to total earnings of $4,000,000. Target has earnings of $2 per share, and at 1,000,000 shares that comes out to total earnings of $2,000,000. Therefore the total earnings after the merger would be $6,000,000. Finally we can compute the earnings per share after the merger as: $6,000,000 = $3.69/𝑠ℎ𝑎𝑟𝑒 1,625,000 𝑠ℎ𝑎𝑟𝑒𝑠 b. Suppose you offer an exchange ratio such that, at current preannouncement share prices for both firms, the offer represents a 20% premium to buy TargetCo. What will your earnings per share be after the merger? Answer: If the offer represents a 20% premium to buy Target then we will have to pay $25*(1 + 20%) = $30 per share. we then go through the same steps as in (a). This time we would issue 30/40*1,000,000 = 750,000 shares to pay for Target so the total number of shares outstanding would become 1,750,000. The total earnings would still be $6,000,000, so the earnings per share after the merger would be: $6,000,000 = $3.43/𝑠ℎ𝑎𝑟𝑒 1,750,000 𝑠ℎ𝑎𝑟𝑒𝑠 c. What explains the change in earnings per share in part (a)? Are your shareholders any better or worse off? Answer: The change in earnings per share in part (a) is the result of our company issuing shares of stock to buy another company with a higher price-to-earnings ratio. We cannot say whether our shareholders are any better or worse off because it would depends on the future prospects of Target. It may be that Target has a higher price-to-earnings ratio because its earnings are expected to grow faster or its business is less risky. d. What will your price-earnings ratio be after the merger (if you pay no premium)? How does this compare to your P/E ratio before the merger? How does this compare to Target Co’s premerger P/E ratio? Answer: The market capitalization of our company was $40*1,000,000 shares = $40,000,000 and total earnings was $4*1,000,000 = $4,000,000. Meanwhile the market capitalization for Target was $25*1,000,000 = $25,000,000 and its total earnings was $2*1,000,000 = $2,000,000. So before the merger, the price-toearnings ratio of our company was $40,000,000/$4,000,000 = 10 times. The price-to-earnings ratio for Target was $25,000,000/$2,000,000 = 12.5 times, and the price-to-earnings ratio of the merged firm is: $40,000,000 + $25,000,000 = 10.83 𝑡𝑖𝑚𝑒𝑠 $4,000,000 + $2,000,000 Therefore, the price-to-earnings ratio of the merged firm is higher than our company but lower than Target’s before the merger. 2) Managerial Decision based on Financial Distress, Managerial Incentives and Information As in Problem 1, Gladstone Corporation is about to launch a new product. Depending on the success of the new product, Gladstone may have one of four values next year: $150 million, $135 million, $95 million, or $80 million. These outcomes are all equally likely, and this risk is diversifiable. Suppose the risk-free interest rate is 5% and that, in the event of default, 25% of the value of Gladstone’s assets will be lost to bankruptcy costs. (Ignore all other market imperfections, such as taxes.) a. What is the initial value of Gladstone’s equity without leverage? Answer: 0.25 ∗ 150 + 135 + 95 + 80 = $109.52 𝑚𝑖𝑙𝑙𝑖𝑜𝑛 1.05 Now suppose Gladstone has zero-coupon debt with a $100 million face value due next year. b. What is the initial value of Gladstone’s debt? Answer: 0.25 ∗ 100 + 100 + 95 ∗ 0.75 + 80 ∗ 0.75 = $78.87 𝑚𝑖𝑙𝑙𝑖𝑜𝑛 1.05 c. What is the yield-to-maturity of the debt? What is its expected return? Answer: 𝑌𝑇𝑀 = 100 − 1 = 26.79% 78.87 d. What is the initial value of Gladstone’s equity? What is Gladstone’s total value with leverage? Answer: 0.25 ∗ 150 + 135 + 95 ∗ 0.75 + 80 ∗ 0.75 = $99.11 𝑚𝑖𝑙𝑙𝑖𝑜𝑛 1.05 Suppose Gladstone has 10 million shares outstanding and no debt at the start of the year. e. If Gladstone does not issue debt, what is its share price? Answer: 109.52 = $10.95/𝑠ℎ𝑎𝑟𝑒 10 f. If Gladstone issues debt of $100 million due next year and uses the proceeds to repurchase shares, what will its share price be? Why does your answer differ from that in part (e)? Answer: 99.11 = $9.91/𝑠ℎ𝑎𝑟𝑒 10 The answer differs from that of part (e) because of bankruptcy costs which reduce the price of the stock. 3) Financial Distress, Managerial Incentives, and Information Kohwe Corporation plans to issue equity to raise $50 million to finance a new investment. After making the investment, Kohwe expects to earn free cash flows of $10 million each year. Kohwe currently has 5 million shares outstanding, and it has no other assets or opportunities. Suppose the appropriate discount rate for Kohwe’s future free cash flows is 8%, and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Kohwe’s investment? Answer: 10 − 50 = $75,000,000 0.08 b. What is Kohwe’s share price today? Answer: 75 = $15/𝑠ℎ𝑎𝑟𝑒 5 Suppose Kohwe borrows the $50 million instead. The firm will pay interest only on this loan each year, and it will maintain an outstanding balance of $50 million on the loan. Suppose that Kohwe’s corporate tax rate is 40%, and expected free cash flows are still $10 million each year. c. What is Kohwe’s share price today if the investment is financed with debt? Answer: 75 + 0.4 ∗ 0.50 = $19/𝑠ℎ𝑎𝑟𝑒 5 Now suppose that with leverage, Kohwe’s expected free cash flows will decline to $9 million per year due to reduced sales and other financial distress costs. Assume that the appropriate discount rate for Kohwe’s future free cash flows is still 8%. d. What is Kohwe’s share price today given the financial distress costs of leverage? Answer: 9 0.08 − 50 + 0.4 ∗ 50 = $16/𝑠ℎ𝑎𝑟𝑒 5