Payment

advertisement

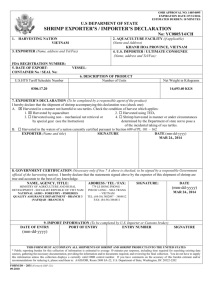

Academy of Economic Studies Faculty of International Business and Economics “International Finance and Payments” Lecture VII “International Payments” Lect. Cristian PĂUN Email: cpaun@ase.ro URL: http://www.finint.ase.ro International FX Markets - review • FX Markets is the place where we can buy or sell different currencies; • FX Rates; • Convertibility of a currency; • FX Regimes; • Depreciation vs Appreciation of a currency; • Direct Quote vs Indirect Quote • FX Rate Determinants; • Fisher Relationships; • FX Transactions: Spot Transactions vs Forward Transactions Lecture 6: International FX Markets 2 International payments • Commercial banks play a fundamental role; • More complex than local payments; • Higher risks require specific money transfer procedures; • In international payments are used: • Non – cash payments (barter, compensation, clearing, buy – back) • Cash payments • Payment instruments • Payment techniques. Lecture 6: International FX Markets 3 International Payments Methods I. Cash in advance II. Consignment III. Open Account Payments IV. Bank Drafts: V. - bill of exchange (sight and time drafts) - checks - money orders - promissory note Letter of Credit VI. Documentary collection • Documents against payments • Documents against acceptance Lecture 6: International FX Markets 4 I. Cash in advance Goods Exporter • The goods will not be shipped until the buyer has paid the seller. • Time of payment : Before shipment • Goods available to buyers : After payment • Risk to exporter : None (maximum security for the seller) • Risk to importer : Relies completely on exporter to ship goods as ordered • Lecture 6: International FX Markets one-time sales Used for: small amounts, new customers, 5 II. Consignment Delivering of goods (1) Exporter (consigner) Payment of Import at a specific date (4) Importer (consignee) Payment in the local currency (3) Selling of goods (2) Clients (third part) • The exporter retains actual title to the goods that are shipped to the importer. • Time of payment : At time of sale to third party • Goods available to buyers : Before payment • Risk to exporter : Allows importer to sell inventory before paying exporter • Risk to importer : None Lecture 6: International FX Markets 6 III. Open Account Payments Delivery of goods (1) Exporter Importer Payment on the agreed time (2) 1. In an open account trade arrangement, the goods are shipped to a buyer without guarantee of payment. 2. The credit terms are arranged between the importer and the exporter. 3. These are usually afforded to longstanding partners, or to foreign affiliates where payment is reasonably assumed 4. Quite often, the buyer does not pay on the agreed time. 3. Unless the buyer's integrity is unquestionable, this trade arrangement is risky to the seller. 4. Time of payment : As agreed upon 5. Goods available to buyers : Before payment 6. Risk to exporter : Relies completely on buyer to pay account as agreed upon 7. Risk to importer : None Lecture 6: International FX Markets 7 IV. Bank Drafts: Check Check = an order given to a bank in order to pay a specific amount to a person from the company current account. Delivery (3) Exporter Importer Payment (4) Payment (7) Presenting the cheque for payment (5) Cheque remittance (2) Cash deposit (1) Exporter bank Importer bank Money transfer (6) Risk vs Simplicity Lecture 6: International FX Markets 8 Problems with the payments by checks Risk of non-payment for lack of funds (the cheque is uncovered); Banks usually place a hold on funds for 3-4 weeks from deposit date May be post-dated Must ensure cheque is properly filled out Used for: small payments or well-known clients. Lecture 6: International FX Markets 9 Check - example Check This check is to be Paid to the Order of Value Issuing Date at Issuing Place Exporter Euros € Value by the: Importer Bank Importer Bank Address ____Importer Signature____ Lecture 6: International FX Markets 10 Bank Drafts: Money Orders Money Order = is an order given by a person to its bank in order to pay a specific amount directly in the beneficiary’s account. Importer Delivery (1) Exporter) Presenting the documents (4) Importer Bank Money transfer (3) Payment (5) Exporter Bank beneficiary stipulates the account to which funds will be paid cannot place conditions on payment, so cannot require proof of delivery of goods therefore, must exist high level of trust between the parties to use this method Lecture 6: International FX Markets 11 Bank Drafts: Bill of Exchange Bill of Exchange = unconditional order in writing to pay a specified amount of money to a specified person or to the bearer, upon presentation of the bill or at a specified future date BE Acceptance (2) BE Bearer Debtor BE Remittance (1) BE Remittance (3) Presenting BE for payment (4) Payment at the BE’s maturity (5) Beneficiary may be endorsed and passed on to another, or just passed on if to the bearer Lecture 6: International FX Markets 12 Bill of Exchange - sight drafts (documents against payment) BE Acceptance (2) BE Bearer (Exporter) Importer BE Remittance (1) BE Remittance (3) Presenting BE for payment when exporter delivers the goods (4) Payment at the BE’s maturity (5) Beneficiary (Exporter) Sight drafts (documents against payment) : When the shipment has been made, the draft is presented to the buyer for payment. (THE DRAFT ACCEPTANCE IS BEFORE THE DELIVERY OF GOODS) Time of payment : On presentation of draft Goods available to buyers : After payment Risk to exporter : Disposal of unpaid goods Risk to importer : Relies on exporter to ship goods as described in documents Lecture 6: International FX Markets 13 Bill of Exchange - time drafts (documents against acceptance) BE Acceptance (2) BE Bearer (Exporter) Importer BE Remittance (1) BE Remittance (3) Presenting BE for payment at a specified maturity (4) Payment at the BE’s maturity (5) Beneficiary (Exporter) Time drafts (documents against acceptance) : When the shipment has been made, the buyer accepts (signs) the presented draft. (THE DRAFT ACCEPTANCE IS IN THE MOMENT OF THE DELIVERY OF GOODS.) Time of payment : On maturity of draft Goods available to buyers : Before payment Risk to exporter : Relies on buyer to pay Risk to importer : Relies on exporter to ship goods as described in documents Lecture 6: International FX Markets 14 Bill of Exchange - example BILL OF EXCHANGE Issuing Data US$: BE Value On Payment Data, for value received, pay against this only set of bill of exchange to the order of Exporter the sum of BE Value Dollars of the United States of America and BE Value cents, effective payment to be made in Dollars of United States of America only, without deduction for and free of any taxes, impost, levies or duties present or future of any nature under the laws of Importer’s Country or any political subdivision thereof or therein. This bill of exchange is payable at Importer’s Place Drawn on: Importer’s Name Exporter: Exporter’s Name Accepted: Importer’s Signature Per aval for account of Importer’s Name Aval Bank (Full name and Address Lecture 6: International FX Markets 15 Bank Drafts: Promissory Notes Promissory note is a written promise to pay a determinate sum of money made between two parties. • Maker: The issuer of a promissory note (the importer) • Payee: The person to whom the note is to be paid (the exporter) • Difference Between a Promissory Note and a Bill of Exchange: The maker of a note promises to personally pay the payee rather than ordering a third party to do so Lecture 6: International FX Markets 16 Promissory Notes - Example Nov. 2, 2004 $ 10,000 New York, New York Ninety days after the above date for value received, the under- signed jointly and severally promise(s) to pay to the order of: BANK OF THE RIVER, at 100 Hudson Ave., New York, New York 02167 Ten Thousand and oo/100 DOLLARS With interest from the date above at the rate of -11- percent per annum (computed on the basis of actual days and a year of 360 days) payable at maturity Officer: Jones No: Importer’s Signature 990-11-9999 Lecture 6: International FX Markets 17 V. Letter of Credit - definition A letter addressed to a beneficiary (exporter) by a bank (issuing bank) • wherein the bank undertakes, on behalf of an applicant (importer) • to effect payment to the beneficiary for merchandise shipped or services performed • provided that the beneficiary presents the required documents in compliance with the terms of the letter of credit - Letters of Credit (l/c) are the means by which the majority of international transactions occur. - This is a letter written to the seller, signed by the buyer’s bank. Lecture 6: International FX Markets 18 Letter of Credit - Mechanism Lecture 6: International FX Markets 19 Letter of Credit - Terminology Documentary Requirement – L/C is required for most import/export transactions and is based on documents being independent from de import / export contract Clean L/C – presented without other documents, it is useful for overseas bank guarantees or security purchases Irrevocable L/C – cannot be revoked without the specific permission of all parties involved, including the exporter Confirmed L/C – is issued by on bank and confirmed by another, obligating both banks to honor drafts drawn in compliance Validity Period: maximum 21 working days from the opening moment (can be extended with an additional cost) Domiciliation of L / C: the place where the payment is realized (exporter country, importer country, other country) Lecture 6: International FX Markets 20 Documents Common to an Export L/C Commercial Invoice Packing List Bills of Lading Certificate of Origin Other Certificates: Quality, Inspection Beneficiary Statements A. Commercial documents B. Transport documents C. Insurance documents D. Other documents Lecture 6: International FX Markets 21 Benefits of Letters of Credit To the Exporter: Payment protection Reliance on issuing bank’s credit rather than buyer’s Rapid, local source of repayment, if payable at a local bank To the Importer: Documentary evidence that the ordered goods have been shipped on time Assurance that necessary clearance documents will be provided Payment deferred until goods are shipped and documents presented (use of funds) Lecture 6: International FX Markets 22 Problems of L/C Shipping schedule is not met Stipulations concerning freight cost are unacceptable Price is insufficient due to FX rate changes Unexpected quantity of product Description of product insufficient or too detailed Documents are impossible to obtain specified in L/C Lecture 6: International FX Markets 23 Special Letters of Credit The Transferable L/C – is where a beneficiary has the right to instruct the paying bank to make credit available to one or more secondary beneficiaries The Back to Back L/C – exists where the exporter, as beneficiary, offers its credit as security in order to finance the opening of a second credit The Revolving L/C – exists where the tenor or amount of the L/C is automatically renewed pursuant to terms and conditions. These can be cumulative or non-cumulative The Red-Clause L/C – used in case of an advance payment in favor for an exporter (a method of finance for the exporter). Banker’s Acceptance – On a time draft, the bank on whom the draft is drawn commits to pay the face amount at maturity by stamping “Accepted” across the draft . Stand-by L/C - are an irrevocable commitment issued by a bank for a stated time period to pay a beneficiary a stated amount of money upon presentation of specified documents stating that the applicant did not fulfill their contractual obligations. Banker’s Acceptance 1. Purchase Order Importer Exporter 5. Ship Goods 2. Apply for L/C 10. Sign Promissory Note to Pay 6. Shipping Documents & Time Draft 11. Shipping Documents 14. Pay Face Value of BA Importer’s Bank 12. BA 16. Pay Face Value of BA 8. Pay Discounted Value of BA 3. L/C 7. Shipping Documents & Time Draft Money Market Investor 13. Pay Discounted Value of BA 15. Present BA at Maturity 4. L/C Notification 9. Pay Discounted Value of BA Exporter’s Bank 1 - 7 : Prior to BA 8 - 13 : When BA is created 14 - 16 : When BA matures Standby Letter of Credit Export contract (1) Importer Exporter Delivery of goods (2) 3. Apply for Standby L/C 5. Standby L/C remittance Importer’s Bank 4. Standby L/C remittance Importer’s Bank It is used if Importer didn’t fulfill it’s obligations Lecture 6: International FX Markets 26 Transferable Letter of Credit Delivery (4) Exporter Transfer L of C (6) Importer Advising the transfer (3) Documents and payment (9) Order to open the L of C (1) Presenting the documents (5) Beneficiary Open L of C (2) Exporter’s Bank Payment (7) Importer’s Bank Documents and payment (8) Lecture 6: International FX Markets 27 “Back-to-back” Letter of Credit Delivery of goods (1) Beneficiary (real exporter) Importer Importer Exporter Delivery of goods (2) L/C1 delivery (8) Documents shipment (8) Apply for L/C 2 (6) L/C1 delivery (5) Beneficiary’s Bank L/C 2 delivery (7) Exporter’s Bank Documents shipment (9) Funds (12) Apply for L/C 1 (3) L/C1 delivery (4) Importer’s Bank Documents shipment (10) Funds (11) Lecture 6: International FX Markets 28 Letter of credit - example 29 Documentary Collection Documents against Payment (D/P) the buyer may only receives the title and other documents after paying for the goods Documents against Acceptance (D/A) the buyer may receive the title and other documents after signing a time draft promising to pay at a later date. Acceptance Documents against Payment (Acceptance D/P) the buyer signs a time draft for payment at a later date. Goods remain in escrow until payment is made Lecture 6: International FX Markets 30 Documents against payment (D/P) flow Lecture 6: International FX Markets 31 Documents against acceptance (D/A) flow Lecture 6: International FX Markets 32 Documentary collection - example 33 Documentary collection – example (2) 34 International Methods of Payment: Advantages and Disadvantages Method cash in advance Risk L Sight draft M/L Letters of credit Irrevocable Revocable M M/H Time draft M/H Consignment sales M/H Open account H Chief Advantage No credit extension required Chief Disadvantage Can limit sales potential, disturb some potential customers. If customer does not or cannot accept goods, goods remain at port of entry and no payment is due If revocable, terms can change during contract work. Retains control and title; ensures payment before goods are delivered Banks accept responsibility pay; payment upon presentation of paper; costs go to buyer Lowers customer resistance Same as sight dragt, plus goods by allowing extanded payment delivered before payment is due after receipt of goods or received Facilitates delevery; lowers Capital tied up until sales; must customer resistance establish distributor's creditworthiness need political rish insurance in some countries; increased risk from currency controls Simplified procefure; no High risk; seller must finance customer resistance production; increased risk from currency controls Lecture 6: International FX Markets 35 Risk protection in case of international payments Buyer Min Max Confirmed Unconfirmed Sight Draft Max Time Draft Min Seller Cash in Advance Letter of Credit Documentary Collection Lecture 6: International FX Markets Open Account 36 Additional Topic Society for Worldwide Interbank Financial Telecommunications (SWIFT) Lecture 6: International FX Markets 37 Society for Worldwide Interbank Financial Telecommunications (SWIFT) •Secure, inexpensive international messaging system that exchanges financial data. •More than 7,500 financial institutions in 199 countries. •Helps members, sub-members, and participants reduce costs, improve automation, and manage risk. Lecture 6: International FX Markets 38 Society for Worldwide Interbank Financial Telecommunications (SWIFT) SWIFT can only be used between member banks for administrative messages such as: payment instructions; funds transfers for customers; funds transfers for the bank’s account; advices and foreign exchange transactions; confirmations and advices concerning loans and deposits; collection advices and payment acknowledgments; letters of credit; balance reports; and advices and confirmations of securities transactions. Lecture 6: International FX Markets 39 SWIFT - US Dollars US Importer Exporter’s Foreign Bank Exporter New York Bank SWIFT Network US$ US$ US$ US$ Funds Payment instructions USDO Bank in US (U.S. Disbursing Officers) Lecture 6: International FX Markets 40 SWIFT - Foreign Currency US Importer Exporter New York Bank Exporter’s Foreign Bank SWIFT Network US$ US$ USDO Bank overseas USDO Bank in US US$ Bank (or foreign exchange house) Lecture 6: International FX Markets 41 Society for Worldwide Interbank Financial Telecommunications (SWIFT) SWIFT BENEFITS Companies • • • Eliminates bank and check cashing fees. Eliminates lost or delayed mail Assures receipt of payment on payment due date Agency/Government • Facilitates the elimination of imprest funds. • Maintains funds in the Treasury Account until withdrawn. • Eliminates costs of processing checks Lecture 6: International FX Markets 42 SWIFT - Example 43