Tentative Outline

advertisement

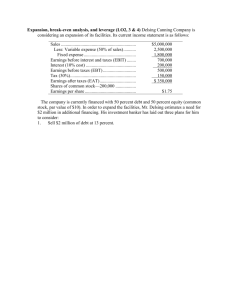

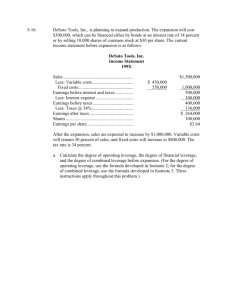

Capital structure 4. Degree of Operating Leverage The Island Paper Company has fixed operating costs of $380,000, variable operating costs per unit of $16, a selling price of $63.50 per unit. a. Calculate the operating breakeven point in units and sales dollars. b. Calculate the firm’s EBIT at 9,000, 10,000, and 11,000 units, respectively. c. Using 10,000 units as a base, what are the percentage changes in units sold and EBIT as sales move from the base to the other sales levels used in b. d. Use the percentages computed in c to determine the degree of operating leverage (DOL). Use the degree of operating leverage formula to determine the DOL at 10,000 units. 1 Capital structure Answer: QBE=8,000 units EBIT 9,000 47,500 Q 10,000 95,000 %CHANGE -50% BASE 11,000 142,500 50% DOL=5 2 Capital structure 7.Degree of Financial Leverage The Spring Water Company has EBIT of $67,500. Interest costs are $22,500 and the firm has $15,000 shares of common stock outstanding. Assume a 40 percent tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Assuming the firm also has 1,000 shares of preferred stock paying a $6.00 annual dividend per share, what is the DFL. Answer: a. DFL=1.5 DFL=1.93 3 Capital structure 10.Their fixed operating costs are $20,000, variable operating costs are $18 per unit, and the motors sell for $23 each. Johnson has $60,000 in 10 percent bonds and 20,000 shares of common stock outstanding. The firm is in the 40 percent tax bracket. a. What is Johnson’s operating breakeven point in units? b. What is Johnson’s financial breakeven point? c. What is Johnson’s total breakeven point? Answer: Q=4,000 units EBIT=$6,000 Q=5,200 units 4 Capital structure 12.Optimal capital structure and Hamada equation Aaron Athletics is trying to determine its optimal capital structure. The company’s capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: 5 Capital structure The company’s tax rate, T, is 40 percent. The company uses the CAPM to estimate its cost of common equity, ks. The risk-free rate is 5 percent and the market risk premium is 6 percent. Aaron estimates that if it had no debt its beta would be 1.0. (Its “unlevered beta,” bU, equals 1.0.) On the basis of this information, what is the company’s optimal capital structure, and what is the firm’s cost of capital at this optimal capital structure? Answer: the optimal capital structure is 40% debt and 60% equity. 6 Capital structure 41. Capital structure and stock price The following information applies to Lott Enterprises: Operating income (EBIT) $300,000 Debt $100,000 Interest expense $ 10,000 Tax rate 40% Shares outstanding 120,000 EPS $1.45 Stock price $17.40 The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company’s interest expense will be $50,000. Assume that the recapitalization has no effect on the company’s price earnings (P/E) ratio. What is the expected price of the company’s stock following the recapitalization? Answer: Price =$18.00. 7 Capital structure 43. Hamada equation and cost of equity Simon Software Co. is trying to estimate its optimal capital structure. Right now, Simon has a capital structure that consists of 20 percent debt and 80 percent equity. (Its D/E ratio is 0.25.) The risk-free rate is 6 percent and the market risk premium, kM – kRF, is 5 percent. Currently the company’s cost of equity, which is based on the CAPM, is 12 percent and its tax rate is 40 percent. What would be Simon’s estimated cost of equity if it were to change its capital structure to 50 percent debt and 50 percent equity? Answer: ks = 14.35%. 8