Accounting Systems for Manufacturing Businesses

advertisement

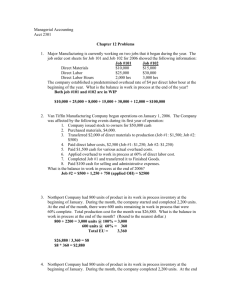

Accounting Systems for Manufacturing Businesses Chapter 10 Cost Classifications for Manufacturers Direct materials Cost of materials that become part of the finished product Direct labor Cost of labor that is directly involved with converting materials into finished products Cost Classifications for Manufacturers Overhead All other costs involved in converting materials into finished products Indirectly related to the product Indirect materials, indirect labor, utilities, depreciation, property taxes, plant manager’s salary, maintenance, etc. Conversion costs Direct labor plus overhead Cost Classifications for Manufacturers Product costs Direct materials, direct labor and overhead Closely related to the manufacturing of the product Asset (inventory) until the product is sold Period costs More closely related to time periods than to the product Expense when incurred Inventories in a Manufacturing environment Raw materials inventory Materials or components which have not yet been placed into production Work in process inventory Partially completed goods Includes material, labor and overhead cost Finished goods inventory Completed goods ready for sale Similar to the merchandise inventory of a retailer Types of Accounting Systems for Manufacturing Operations Job order system Costs are accumulated for each job Used for custom goods for specific customers or when a variety of goods are produced for stock Process cost system Costs are accumulated for each time period, then allocated to the units produced during the time period Used for continuous production process of identical goods The Flow of Goods and Costs Through a Manufacturing System Materials are purchased Raw materials inventory Materials placed in production Labor Overhead Work in process inventory Goods are completed Finished goods inventory Goods are sold Cost of goods sold (expense) The Flow of Goods and Costs Through a Manufacturing System Purchases of materials Raw material inventory is increased Materials are placed into production Raw materials inventory is decreased Work in process inventory is increased Labor and overhead costs are incurred Work in process inventory is increased The Flow of Goods and Costs Through a Manufacturing System Goods are completed Work in process inventory is decreased Finished goods inventory is increased Goods are sold Finished goods inventory is decreased Cost of goods sold is increased Cost of Goods Manufactured Statement Matches the flow of costs Determine the total manufacturing costs for the period (inputs) Cost of materials used in production Cost of labor Cost of overhead Determine the cost of goods manufactured (outputs) Beginning work in process + total manufacturing costs – ending work in process Cost of Goods Manufactured Statement Beginning raw materials inventory Purchases of raw materials Raw materials available for use Ending raw materials inventory Raw materials used in production $ $ $ Direct labor Overhead Total manufacturing costs for the period 48,000 116,000 $ Beginning work in process inventory $ Ending work in process inventory Cost of goods manufactured 10,000 182,000 192,000 15,000 177,000 $ 341,000 27,000 368,000 25,000 343,000 Applying Overhead to Production Overhead is an indirect cost and cannot be accurately related to individual jobs Overhead is applied to jobs using a predetermined overhead rate Total estimated overhead = rate per unit Total estimated activity of activity Amount of overhead applied is determined by the amount of activity consumed Applying Overhead to Production The amount applied is an estimate Any difference between the actual overhead cost and the amount applied is transferred to cost of goods sold If overhead is overapplied (too much was charged to jobs), reduce cost of goods sold If overhead is underapplied (not enough was charged to jobs), increase cost of goods sold Applications to Service Industries The same concepts apply to service industries except Probably no raw materials, although supplies may be used No finished goods inventory Services are performed on demand, and cannot be stored for later sale Costs move directly from work in process to cost of services provided (similar to cost of goods sold) Activity-Based Costing More refined method of applying overhead to production Uses multiple application rates for more accurate charging of costs to products based on the demand those products place on the company’s resources Products and services consume activities, and activities consume resources Activity-Based Costing Costs are accumulated in cost pools related to the major activities A separate application rate is determined for each cost pool For example, cost per hour of inspection time, cost per test performed, cost per pound of material moved, etc. Costs are charged to products based on how much of the activity the product consumes