Captive Insurance Presentation

advertisement

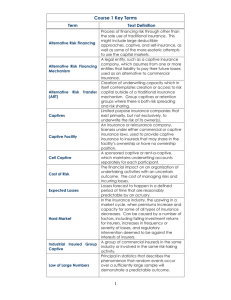

An Introduction to Captive Insurance Lucy A. Steitz, CFP ® CoreStates Capital Advisors, LLC (267) 759-5000 What is a Captive? A privately-owned limited purpose insurance company It is licensed in a U.S. state or foreign jurisdiction. IRC 831 (b). A captive’s purpose is to insure the risks of the operating company which has an above-average risk profile. Financial Planning Magazine’s November 2009 calls forming captives “one of the best risk management and wealth planning tools available to business owners... Captives are one of the best – if not the very best- asset protection tools available to business owners.” Which Companies Are More Likely to Benefit From a Captive? Doctors (specialists) and other professionals Manufacturers Exporters and Importers Dry Cleaning Construction Related Professions ◦ Contractors ◦ HVAC ◦ Plumbing Oil and Gas Hotels, Motels, Restaurants and Inns Transportation Companies Which Companies Should Consider Forming a Captive? Companies with an above-average risk profile (one which has substantial uninsured or under-insured risks). Companies which have a good combination of income and risk. Ideally, a company should have $3 million in gross revenue. Some companies with $1 - $3 million may have enough risk to warrant forming a captive. Captive Benefits: Insurance needs MUST be present! Think custom Insurance Policies. Direct Access to Reinsurance Program Control Program Stability Tax Savings Operating Cost Savings Cash Flow and Capital Program Flexibility Wealth Transfer Asset Protection Sample Coverages Written by Captives: Directors & Officers Liability Errors & Omissions Employment Practices Copyright, Trademark, Patent Infringement Loss of Franchise, Vendor or Customer Machinery Breakdown Antitrust & Unfair Competition Credit Default/Accounts Receivable Business Interruption Loss of Key Employee Environmental/Pollution Product Liability Employee Benefits Workers Comp Cyber-risk General Liability Professional Liability What Are the Benefits to Forming a Captive, con’t.? Underneath the insurance and risk management purposes of a captive insurance company is a great tax arbitrage opportunity. In the current year, the insured lowers his taxable income through the payment of insurance premiums. In forming the captive, the insured is most likely insuring a large amount of risk which was previously “self-insured,” meaning the insured paid for losses out of current earnings and savings. The premiums are placed into a tax-advantaged vehicle – captives under IRC 831(b) are taxed on their current portfolio income rather than their current earnings. When the insured sells his/her captive shares, the transaction is taxed as a capital gains transaction rather than as an ordinary income transaction. An Example of the benefits: A group of Ob/Gyn physicians form and own a captive to insure against medical malpractice risks. The captive allows them to again perform high risk procedures. Power of the pen to write their own policies. Control of Claims process. If claims are well-managed during life of captive, insurance reserves within the captive may be paid to doctors on retirement or sooner. Assets in the captive are protected from creditors, divorce, bankruptcy, lawsuits, etc. No deep pockets. Wealth transfer vehicle – captive established as C Corp. Can be owned by multiple entities (LLCs, FLPs, Trusts, Owners). Compare to traditional ins.: Commercial Insurance priced at 50% loss ratio. The “other 50%” is for overhead and profit. Captive may allow owners to retain a portion of their premiums. For Example, a group of physicians form a captive under 831 (b) with $1 Million in annual premiums With average claims, owners keep extra $500k/yr in captive Grows to $5 Million in 10 years Investment income taxed annually at ordinary income Use reinsurance to limit excess exposure per claim What Are the Steps to Forming a Captive? After a company decides to form a captive, the next step is to perform a feasibility study, which has three objectives: Frist, it provides a blueprint for the entire captive program. Second, it aids in compliance. Third, the study illustrates captive benefits to key decision-makers within the organization regarding the plan. What Are the Steps to Forming a Captive? The jurisdiction where the captive is being formed must determine if forming the captive is in the jurisdiction’s best interest. To do that, they will consider ◦ (i) The character, reputation, financial standing and purposes of the incorporators; ◦ (ii) The character, reputation, financial responsibility, insurance experience and business qualifications of the officers and directors; and ◦ (iii) Such other aspects as the insurance commissioner shall deem advisable. What Are the Steps in Forming a Captive, con’t. Next, the applicant must make a formal application to open an insurance company. The application must typically contain the following information (A) The amount and description of its assets relative to the risks to be assumed; (B) The adequacy of the expertise, experience, and character of the person or persons who will manage it; (C) The overall soundness of its plan of operation; (D) The adequacy of the loss-prevention programs of its parent, member organizations, or industrial insureds, as applicable; and (E) Other factors considered relevant by the commissioner in ascertaining whether the proposed captive insurance company will be able to meet its policy obligations Finally, there is the issue of original capital and surplus. Running the Captive Domicile manager Captive manager Legal counsel Audit Actuarial Services Investment manager Shutting Down the Captive In most states, one of the following seven reasons will allow a state regulator to shut down a captive: ◦ 1. Insolvency or impairment of capital and surplus. ◦ 2. Refusal or failure to submit an annual report … or any other report or statement required by law or by lawful order of the director. ◦ 3. Failure to comply with the provisions of its own articles of incorporation, bylaws or other organizational document. ◦ 4. Failure to submit to an examination or any legal obligation related to the examination. ◦ 5. Refusal or failure to pay the cost of an examination. ◦ 6. Use of methods that, although not otherwise specifically prohibited by law, render its operation hazardous or its condition unsound with respect to the public or to its policyholders. ◦ 7. Failure otherwise to comply with the captive statute. The IRS Fought Captive Insurance For Nearly 30 Years They used three arguments The Economic Family Nexus of Contracts Assignment of Income No Court Accepted Any of the IRS’ arguments Safe Harbor Guidance, Part I Under Harper v. Commissioner, a captive must comply with a three prong test: (1) whether the arrangement involves the existence of “insurance risk”; (2) whether there was both risk shifting and risk distribution; and (3) whether the arrangement was for “insurance” in its commonly accepted sense. The duck test – does the company “walk and talk” like an insurance company? Safe Harbor Guidance, Part II The IRS has issued several Revenue Rulings that provide further safe harbor guidance A captive must derive at least 50% of its insurance revenue from a non-parent. ◦ Harper lowers this amount to 30% ◦ This is accomplished through reinsurance Or, a captive must have at least 12 subsidiaries in order to have sufficient risk distribution. Private Letter Rulings, or, the Ultimate Safe Harbor A Private Letter Ruling (or PLR) is "issued for a fee upon a taxpayer's request and describes how the IRS will treat a proposed transaction for tax purposes." Private Letter Rulings create certainty – we know how the IRS will view a specific transaction IRS Revenue Rulings: Revenue Ruling 2001-31 IRS Gives Up on "Economic Family Theory" Revenue Procedure 2002-75 - Private Letter Rulings on Insurance Co. Issues Revenue Ruling 2002-89 - 50 Third Party Insurance Risk Revenue Ruling 2002-90 - 12 Brother / Sister Subsidiary Requirement Revenue Ruling 2002-91 - Spreading of Risk in Captive Group Presentation sourced from F. Hale Stewart, Esq., Author of U.S. Captive Insurance Law, and Stewart Feldman, Esq. with permission. QUESTIONS?