MCIA Presentation - Gordon Fournaris & Mammarella

advertisement

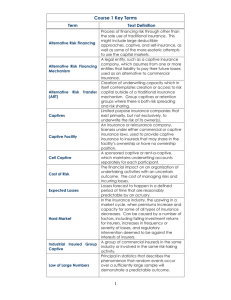

SERIES LLC CAPTIVES Jeffrey K. Simpson Gordon Fournaris & Mammarella, P.A. 1925 Lovering Avenue Wilmington, DE 19801 Tel: (302) 652-2900 Fax: (302) 652-4765 Email: jsimpson@gfmlaw.com www.gfmlaw.com 00596511 WHAT ARE SERIES LLC CAPTIVES? Check the “Series Captive” Law Surprise, There Isn’t One! No Express Provision Marriage of LLC Act and Captive Statute LLC Act must allow for Series Captive Statute must allow for LLCs Special Purpose Category really helps! 2 WHAT IS A SERIES? Cell with Superpowers! Separate Owners Statutory Separation of Assets and Liabilities Ability to contract in its own name Ability to have its own governance Now for an abstract legal distinction: Cells come from Insurance Law (Regulatory) Series come from Entity Law (Corporate) 3 EVOLUTION First Approved in 2010 Get Around your own law Dozens of Series LLCs and Hundreds of SBUs 4 Series LLC WHY SO POPULAR? Capital Access, Preservation and Growth Flexibility Customizability Regulatory intellectual capital and support 5 SPONSOR 1 SPONSOR SPONSOR 22 OWNER A OWNER C SERIES C C SERIES A XYZ LLC SERIES B OWNER B SERIES D OWNER D 6 CORE CAPITAL PROTECTED SERIES A MORE$ SERIES C MORE$ CORE CAPITAL EXPOSED SERIES A LESS$ $250,000 $250,000 SERIES B MORE$ SERIES C LESS$ SERIES D MORE$ SERIES B LESS$ SERIES D LESS$ THEORETICALLY, BUT NOT PRACTICALLY! 7 RISK IN NO RISK THE CORE IN THE CORE POLICY HOLDERS POLICY HOLDERS INSURANCE SERIES A REINSURANCE SERIES B INSURANCE SERIES C GENERAL ACCOUNT $250,000 REINSURANCE SERIES D SERIES A REINSURANCE SERIES C GENERAL ACCOUNT $250,000 SERIES B SERIES D ANOTHER WAY TO PROTECT CORE CAPITAL 8 PREMIUM TAX POLICY HOLDERS Not Subject To Premium Tax Subject To Premium Tax SERIES A SERIES C CORE SERIES B REINSURANCE SERIES D POLICY HOLDER NO MINIMUM TAX ON SBUs 9 USES OF SERIES LLC CAPTIVE Sponsored Enterprise Risk (831(b)) Vehicle - Captive Managers - Financial Advisors - Wealth Planners Multiple Owner Enterprises Multiple Classes of Insured 10 SUCCESSES - GENERAL Lower Initial Capital Reduced Operating Costs Customized Design Ease of Entry 11 CHALLENGES - GENERAL Evolving Regulatory Landscape Regulators and Participants Necessarily learning as they go Types of Risk First Party vs. Third Party Concern about authority to supervise single series Cost of Regulation Tax and Fee Structure not Sustainable Reporting Annual Report = Consolidated with Schedules Annual Audit = Consolidated with Schedules Actuarial Opinion = Migration Toward Individual Opinion Opening Accounts 12 Montana Specific Highlights Low Minimum Core Capital Flexibility for Special Purpose Captives Attractive to Sponsors Pool as Front is OK Reduces number of transactions Currently, No SBU Application Fee or Minimum Premium Tax Investments in Special Purpose Captive are same as Pure 13 Montana Specific Challenges Public filing of name and series agreement for every series May Facilitate account opening Likely to chill sponsors and participants seeking confidentiality Initial series capital at ratio of 4 to 1 May be too high an initial number SBU Application Fee or Minimum Premium Tax May have to Implement Pre-Approval of Secretary of State Filings Adds time and Frictional cost 14

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)