Chapter 4 Real Options and Project Analysis

advertisement

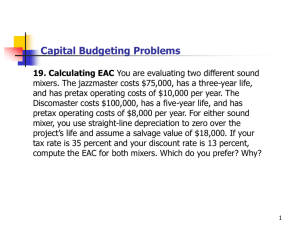

Chapter 4 Real Options and Project Analysis Capital Budgeting and Investment Analysis by Alan Shapiro Option valuation and Investment Decisions • The ability of companies to change course in response to changing circumstances create what often termed real or growth options • Many investments have very uncertain payoffs that are best valued with an options approach • The down payment agreement is a call option – Option price – Strike price – Stock price Option valuation and investment decisions cont. • A lease with an option to cancel can be viewed as a put option • The purchase of an insurance policy on property can be also thought of as a put option • Black-Scholes formula Option valuation and investment decisions cont. • The opportunities that a firm may have to increase the profitability of its existing lines and benefit from expanding into new products or markets may be thought of as growth options • Growth options are of great importance to new firms • Very high P/E Option valuation and investment decisions cont. • The owners of a gold mine may increase or decrease gold output depending on the current price • The mine can be shutdown and then reopened when production and market conditions are more favorable or it can be abandoned permanently Valuing a Gold Mine • • • • • • • Reopening a gold mine would cost $1 million 40,000 ounces of gold remaining Variable cost $390 per ounce Expected gold price $400 per ounce 15% yield required on such risky investment Do you think the NPV is negative?! DO NOT ignore the option not to produce gold if it is unprofitable to do so Valuing a Gold Mine cont. • Suppose two possibilities: • $300 per ounce and $500 per ounce each with probability of 0.5 • Mine gold if and only if the price of gold at year’s end is $500 per ounce • Incorporating the mine owner’s option NOT to mine gold when the price falls below the cost of extraction reveals a positive NPV of $913,043 • The current value of mine can be thought of as a call option on the value of the gold in the mine • The strike price equals the cost of reopening • The stock price equals the value of the gold that could subsequently be produced • Firms have 3 choice: – Continue to invest in a project – Abandon the project – Delay the project Evaluating R&D investments using an option valuation approach • The ability to alter decisions in response to new information may contribute significantly to the value of a project • An investment in R&D gives the investor the right to acquire the outcomes of the R&D at the cost of commercialization • Both investors in R&D and mine owner have put options, they can abandon their projects at an exercise price equal to the costs of shutdown Example • Product development cost $5 million a year from 2005 to 2007 • Build a plant which cost $100 million in beginning of 2008 • $13 million annual cash flow from yearend 2008 to 2017 • Terminal value at yearend 2017 is $105 million • Discount rate of 14% • Costs are assumed to occur at the start of the year and OCF at the end of the year • Option valuation allows for the decision NOT to build the plant and also values only those outcomes that will follow if the plant is built. • Clearly, if R&D investment does not pan out or if market conditions are unfavorable, the plant will not be built • Option valuation approach properly values ONLY positive NPV outcomes, whereas the traditional DCF analysis values ALL outcomes, negative as well as positive PV of CF items for new product development ($ millions) CF item PV as of Jan 1st 2005 PV as of Jan 1st 2008 R&D expense -13.2 0 Plant cost (2008, beginning of year) -67.5 -100 Post 2007 OCF (2008-2017) 45.8 67.8 Terminal value (2017) 16.8 28.3 NPV -18.2 -3.9 PV on Jan 1 2005 R&D expense 2008 Plant cost 2008 possible payoff 2005 project NPV DCF Analysis Assumes one outcome -13.2 -100 96.1 -18.2 I -13.2 -100 223.9 70.4 II -13.2 -100 118.1 -1 III -13.2 0 33.9 -13.2 IV -13.2 0 8.6 -13.2 Option Analysis Assumes many Possible outcomes and measures each one separately each with probability 0.25 Expected NPV of R&D investment in 2008 ($ millions) Scenario Decision Cost Payoff NPV Prob. Value I Build plant -100 223.9 123.9 0.25 31 II Build plant -100 118.1 18.1 0.25 4.5 III Don’t build 0 0 0 0.25 0 IV Don’t build 0 0 0 0.25 0 35.5 • The expected project NPV in 2008 valuing only favorable outcomes is $35.5 million • This yields PV in 2005 of $24 million • Subtract the $13.2 million PV of the R&D investment and the result is a $10.7 million NPV • Invest in new product development and exercise the option of proceeding forward in 2008 if the outcome looks favorable. Otherwise, the project should be abandoned at that point Strategic investments and growth options • Many strategically important investments such as investments in R&D, factory automation, a brand name, or distribution network, provide growth opportunities because they are often but the first link in a chain of subsequent investment decisions • Creating options on investment in other products, markets, or production processes are sometimes referred to as Growth option Strategic investments and growth options cont. • Valuing investments that embody discretionary follow up projects requires an expanded NPV rule hat considers the attendant options Valuing a growth option • According to option pricing theory, the discretion to invest or not in a project depends on: • 1. The length of time the project can be deferred • 2. The risk of the project • 3. The level of interest rates • 4. The proprietary nature of the option The length of time the project can be deferred • The ability to defer a project gives the firm more time to examine the course of future events and to avoid costly errors if unfavorable developments occur The risk of the project • Surprisingly, the riskier the investment is, the MORE valuable the option on it will be! • The reason is the asymmetry between gains and losses • Losses are limited by the option not to exercise when the project NPV is negative • The riskier the project is, the greater the odds will be of a large gain without a corresponding increase in the size of the potential loss The level of interest rate • The net effect is that high interest rates generally raise the value of projects that contain growth options The proprietary nature of the option • Consideration of competitive conditions is what separates growth options from stock options • Growth options are valuable because they allow the firm to delay investments to learn more about the value of the underlying growth opportunities Investment decisions and Real options • Value of Project = Project’s value using traditional DCF + Value of strategic options • VPROJ=VDCF + VSTRAT • The value of an option increases with uncertainty • An option represents a right but not an obligation to buy or sell an asset. There is no commitment to future investments unless conditions are favorable Investment decisions and real options cont. • A company can exploit a project’s upside potential without incurring significant downside risks • Decision to build a pilot plant to manufacture a new product. This mitigate losses if sales are disappointing • If sales take off, the firm can invest in a higher capacity plant that would be more efficient Investment decisions and real options cont. • The ability to abandon a project represents a put option for the firm • A project should be abandoned if the abandonment value exceeds the PV of subsequent CFs • Flexibility of a project represents a set of operating options • A power plant that burns only oil VS. a plant that is capable of burning both oil and coal • The firm can use different raw material mixes to produce the same final product, or the same inputs (e.g., crude oil) to produce a variety of outputs (e.g., gasoline, heating oil) • Other operating options: – Changing marketing (pricing/promotion) strategies – Temporarily closing a plant in response to a decline in demand – Reducing or increasing output in response to demand – Redesigning a product in response to changing demand or input costs Investment decisions and real options cont. • According to Graham and Harvey (2002), more than one-fourth of the companies claimed to be using real options evaluation techniques • NPV(project) + X = 0 • Management would have to decide whether they would be prepared to pay X dollars to acquire the strategic options associated with it.