Ch 8 Terms, Notes and Questions Terms Adjusting entries

advertisement

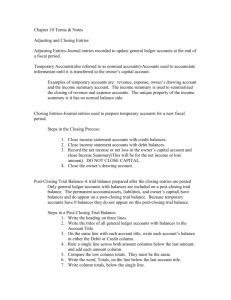

Ch 8 Terms, Notes and Questions Terms Adjusting entries- Permanent accounts- Temporary accounts- Closing Entries- Post-closing trial balance- Accounting cycle- 8-1 Recording Adjusting Entries You do not have to decide the debit and credit parts of the entry. The analysis was done when the work sheet was completed. Doc. No column is left blank when adjusting entries. Entry must be posted to the general ledger accounts before the account balance changes. Once the entry is posted, the supplies account balance will reflect the amoutn of supplies on hand at the end of the period. Steps for adjusting entry for supplies 1. 2. 3. 4. The entry must be posted to teh general ledger accoutns before teh account balance actually changes. Steps for adjusting entry for prepaid insurance 1. 2. 3. 8-2 Recording Closing Entries The four closing entries are taken from the income statement and balance sheet columns of the work sheet. One part of a closing entry makes the balance in every temporary account zero. Closing entry must have equal debits and credits. Therefore, another account must also be used in a closing entry. The other account used for closing revenue and expense accounts is titled income summary. The income summary account does not have a normal balance. Its balance depends on the amount of revenue and expenses the business had for the period. The first closing entry closes all income statement account with credit balances. Closing entries is centered on the Journal line. Steps for closing entry for an income statement account with a credit balance. 1. 2. 3. 4. Steps for closing entry to record net income or loss and close the income summary account. 1. 2. 3. Summary for closing entry for the owner’s drawing account 1. 2. 3. 8-3 Preparing a Post-Closing Trial Balance When posting, if an account has a zero balance, lines are drawn in both the balance debit and balance credit columns to assure the reader that a balance has not been omitted. Steps for preparing a post-closing trial balance 1. 2. 3. 4. 5. 6. 7. 8. Steps in an accounting cycle 1. 2. 3. 4. 5. 6. 7. 8. 9. Questions page 205 Audit your understanding 1. 2. 3. Questions page 212 Audit your understanding 1. 2. 3. Questions page 219 Audit your understanding 1. 2. 3.