Cash Budgets - St Kevins College

advertisement

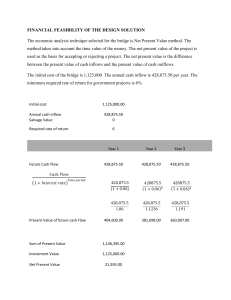

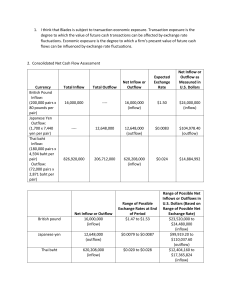

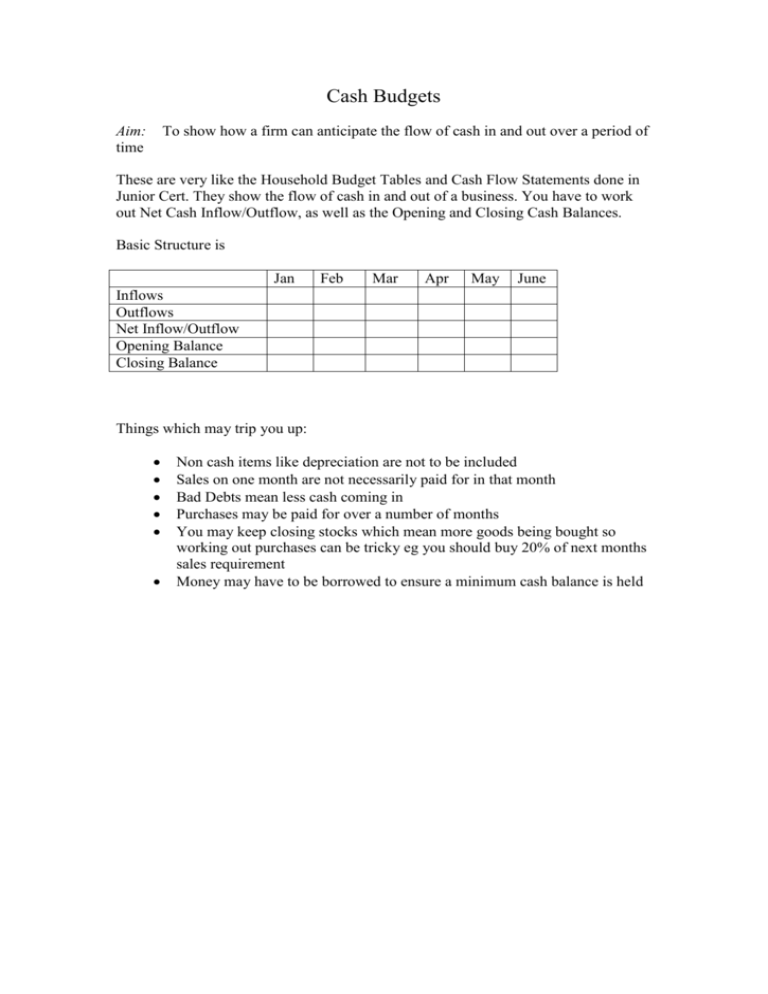

Cash Budgets Aim: time To show how a firm can anticipate the flow of cash in and out over a period of These are very like the Household Budget Tables and Cash Flow Statements done in Junior Cert. They show the flow of cash in and out of a business. You have to work out Net Cash Inflow/Outflow, as well as the Opening and Closing Cash Balances. Basic Structure is Jan Feb Mar Apr May June Inflows Outflows Net Inflow/Outflow Opening Balance Closing Balance Things which may trip you up: Non cash items like depreciation are not to be included Sales on one month are not necessarily paid for in that month Bad Debts mean less cash coming in Purchases may be paid for over a number of months You may keep closing stocks which mean more goods being bought so working out purchases can be tricky eg you should buy 20% of next months sales requirement Money may have to be borrowed to ensure a minimum cash balance is held