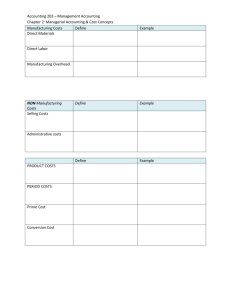

Managerial Accounting Chapter 4

advertisement

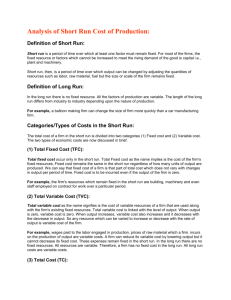

Chapter 5 Managerial Accounting Cost Estimation Prepared by Diane Tanner University of North Florida Cost Estimation Methods Used by managers to Enable the creation of a cost function so that costs can be predicted at various activity levels Useful when fixed and variable costs are grouped together Four common methods 1. Account analysis 2. Scattergraph 3. High-low 4. Linear regression 2 The Goal of Cost Estimation Goal is to create a total cost equation Total cost = Variable cost/unit * # of units + Total fixed cost TC = VCx + TFC Y = mx + b Both equations serve the same purpose Where: TC = Y = total costs TFC = b = total fixed costs = y-intercept VC = m = variable cost per unit = slope of function x = units produced/sold 3 4 Account Analysis Method Used to estimate fixed and variable costs Step 1: Classify costs as variable or fixed Separate the list of costs into two piles—fixed costs versus variable costs Requires professional judgment Step 2: Determine variable costs per unit Total Variable Costs Activity Level Achieved Step 3: Determine total fixed costs Add the costs in the fixed cost pile from step 1 Cost function (equation) = TC = VCx + TFC 5 Scattergraph Approach Used to estimate fixed and variable costs to determine how costs and activity levels change Step 1: Acquire cost information over activity levels Step 2: Graph the data points Step 3 : Eyeball a linear relationship and draw a ‘trend’ line through the data points Step 4: Determine where the line crosses the y-axis i.e., y-intercept = total fixed costs Step 5: Determine the slope (rise over run), i.e., variable cost per unit Step 6: Write the cost equation If you have forgotten how to graph data points, this will help. .http://www.studyzone.org/testprep/math4/d/linegraph4l.cfm Source www.studyzone.org Grade 4 Math Lessons 6 High-Low Method Used to estimate fixed and variable costs at various levels of activity Uses two data points, the high and low levels of activity and their related total costs Results: • Variable cost = Line slope • Total fixed costs = Y-intercept 7 High-Low Method Step 1: Select the high and low data activity points Step 2: Subtract the smallest from the largest cost and the smallest from the largest activity and use the changes in the following formula Change in Cost Change in Activity = Variable cost per unit Step 3: Pick one point—either the high or low: Plug the total cost and the activity of the point you selected in the cost equation: TC = VCx + TFC First select the high and low amounts from the activity column. Then use the costs related to those activity points. 8 High-Low Method Continued Step 4: Substitute the number of activity units for the data point chosen in step 3 for “x” Step 5: Solve for fixed costs “TFC” Step 6: Replace the VC with the variable cost per unit you calculated and the TFC with the fixed costs you calculated, into the following formula: TC= VC x + TFC Only two variables will be displayed in the formula: X and TC. The other components: VC and TFC, should be replaced by the respective amounts. The End 9