Accounting 203 – Management Accounting Chapter 2: Managerial

advertisement

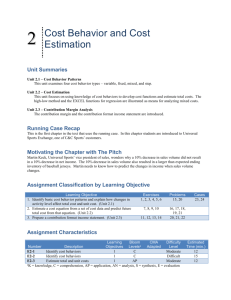

Accounting 203 – Management Accounting Chapter 2: Managerial Accounting & Cost Concepts Manufacturing Costs Define Direct Materials Example Direct Labor Manufacturing Overhead NON Manufacturing Costs Selling Costs Define Example Define Example Administrative costs PRODUCT COSTS PERIOD COSTS Prime Cost Conversion Cost Example: Nooksack Expeditions (rafting company, river tours): Cost Behavior Define Variable COST Example $30 Fixed COST $500 Committed Fixed Costs Discretionary fixed Costs Variable Costs Fixed Costs Example: Nooksack Expeditions (rafting : License fees: $25,000 per year PLUS $3 per rafting party Cost Behavior RELEVANT RANGE Define Variable COST Fixed COST MIXED COSTS Mixed Costs Scattergraph Independent Variable Dependent Variable High – Low Method FORMULA: Example High Low Method Practice: A hospital. Define: Patient-Days Maintenance Costs Maintenance Patient-Days Costs Incurred High Activity Low Activity Change Assignment: Using High-Low, develop a Cost formula where y = Total Maintenance Costs. Practice: Piedmont Wholesale Florists has maintained records of the number of orders and billing costs in each quarter over the past several years. Number of Orders Billing Costs Year 1—1st 1,500 $42,000 2nd 1,900 46,000 3rd 1,000 37,000 4th 1,300 43,000 Year 2—1st 2,800 54,000 2nd 1,700 47,000 3rd 2,100 51,000 4th 1,100 42,000 Year 3—1st 2,000 48,000 2nd 2,400 53,000 3rd 2,300 49,000 Create a line using High-Low based on the first Year of data. Line: Calculations High: Low: Y = ____x + ______ Difference: M = _______/_________ = $__________ Create a line using High-Low based on the all data. Line: Calculations High: Low: Y = ____x + ______ Difference: M = _______/_________ = $__________ What is total cost if volume is: 900? Or 2,900? Traditional and Contribution Format Income Statements: Traditional Formt: Cost of Goods Sold Sales Selling Administrative $6,000 12,000 3,100 1,900 Net Operating Income Contribution Margin Format Cost of Goods Sold $6,000 Sales 12,000 Variable Selling 600 Variable Administrative 400 Fixed Selling 2,500 Fixed Administrative 1,500 Variable Expenses: Contribution Margin Fixed Expenses: Net Operating Income Cost Objects Define Examples Define Examples Direct Costs Indirect Costs Cost Classifications for Decision Making DIFFERENTIAL COSTS – fixed or variable OPPORTUNITY COST SUNK COST Porter Company manufactures furniture, including tables. Required: Classify these costs according to the various cost terms used in the chapter. Product Costs Variable Wood used in a table 1 ($100/table) 2 3 4 5 6 7 8 9 Labor cots to assemble the table (40/table) Salary of the factory supervisor ($38,000/year) Cost of electricity to produce tables ($2/machine hour) Depreciation of machines used to produce tables ($10,000/year) Salary of the company president ($100,000/year) Advertising expense ($250,000/year) Commissions paid to salespersons ($30/table sold) Rental income forgone on factory space Fixed Period (S&A) DM DL MOH Sunk Opp.