4_MCQ_CapitalBudgeting

advertisement

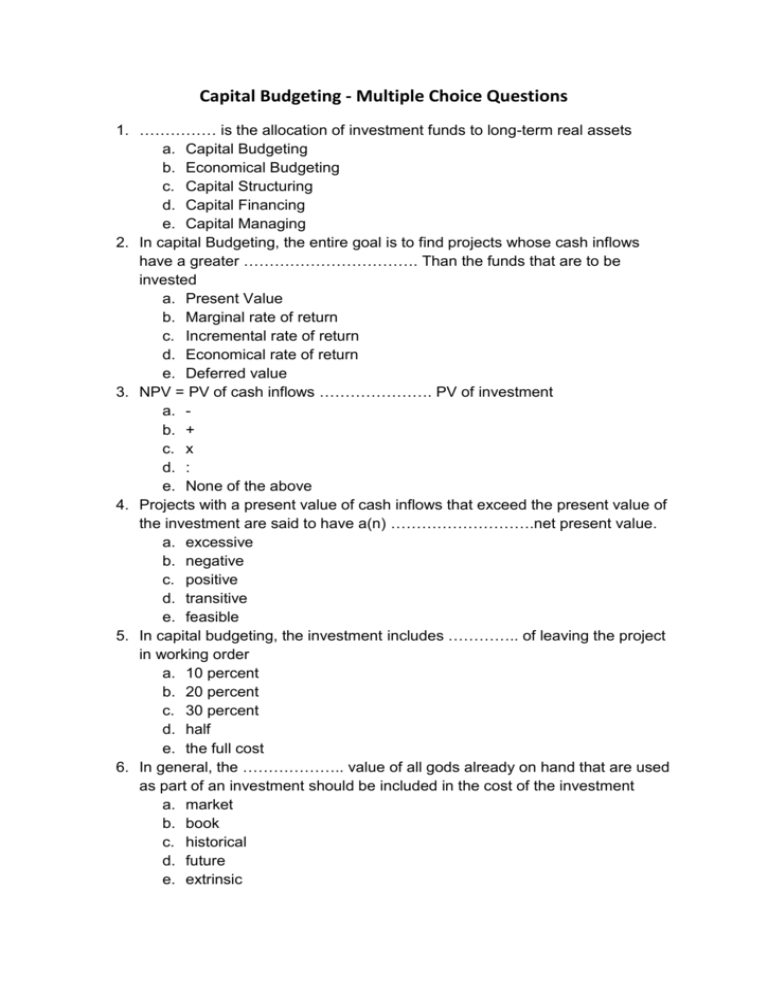

Capital Budgeting - Multiple Choice Questions 1. …………… is the allocation of investment funds to long-term real assets a. Capital Budgeting b. Economical Budgeting c. Capital Structuring d. Capital Financing e. Capital Managing 2. In capital Budgeting, the entire goal is to find projects whose cash inflows have a greater ……………………………. Than the funds that are to be invested a. Present Value b. Marginal rate of return c. Incremental rate of return d. Economical rate of return e. Deferred value 3. NPV = PV of cash inflows …………………. PV of investment a. b. + c. x d. : e. None of the above 4. Projects with a present value of cash inflows that exceed the present value of the investment are said to have a(n) ……………………….net present value. a. excessive b. negative c. positive d. transitive e. feasible 5. In capital budgeting, the investment includes ………….. of leaving the project in working order a. 10 percent b. 20 percent c. 30 percent d. half e. the full cost 6. In general, the ……………….. value of all gods already on hand that are used as part of an investment should be included in the cost of the investment a. market b. book c. historical d. future e. extrinsic 7. A cost that has been incurred previously that has no future value is known as a(n) ……………cost a. lost b. sunk c. past d. dead e. accrued 8. The capital budgeting analysis should consider only the ………………. Cash flows of an investment, those cash flows that differ if the investment is undertaken a. extraordinary b. accrued c. incremental d. intrinsic e. extrinsic 9. Typically, the most important incremental cash flow is the ………… operating cash flow generated by the project a. After-tax b. Before-tax c. Sunk d. Negative e. Positive 10. ………. is reduction in accounting earnings intended to reflect the reduction in value of an income-producing asset a. the investment tax credit b. depreciation c. the reduced rate of return d. appreciation 11. Depreciation tax shield = tax rate ……………………… deprecation expense a. + b. c. : d. x e. None of the above 12. The value of an investment depends on the …………………… value of all cash flows associated with the investment a. present b. future c. market d. net future e. economic 13. Which of the following statements about the internal rate of return is false a. The higher the IRR, the higher the return being earned on the investment funds b. If there are periods with negative cash flows, there may be more than one IRR c. In general, to find the IRR of a sequence of cash flows, we can use trial-and-error, a financial calculator, or a computer d. The discount rate that produces the highest NPV is, by definition, the IRR e. Following the IRR rule for normal projects gives the same accept or reject decision as the NPV rule 14. The best way to analyse a capital budgeting decision is to use the …………. a. NPV rule b. Profitability index c. Internal rate of return d. Payback period e. ARR (Return on investment) 15. The ………………… is usually calculated by dividing after-tax accounting profits by the investment a. NPV rule b. Profitability index c. Internal rate of return d. Payback period e. ARR (Return on investment) 16. The time it takes for the sum of the future cash flows from a project to equal the amount of the initial investment is called the .……………. Period. a. investment b. payback c. positive return d. constructive return e. positive operating 17. which of the following statement about payback period is false? a. The payback period is the time it takes for the sum of the future cash flows to equal the amount of the initial investment b. The payback period neglects the cash flows that occur after the payback period c. The payback criterion does not adequately consider the timing of the cash flows d. Payback has long been a very popular decision criterion for capital budgeting e. The payback rule is to prefer those projects with the longer payback period 18. The profitability index can be calculated by …………….. the PV of cash inflows …………… the PV of investment outlays a. Dividing; by b. Multiplying; by c. Adding; to d. Subtracting; from e. None of the above 19. A project requires an initial investment of £3,000 and has a discount rate of 15 percent. The cash flows of this project are as follows Year PV @ 15% 0 1 2 3 4 -£3,000 £1,200 £ 1,200 £880 £550 Calculate the projects NPV, and make a recommendation for acceptance or rejection a. b. c. d. e. £3,830; accept -£830; reject - £156; reject -£3,830; reject £5,750; accept 20. A project requires an initial investment of £15,000 and has a discount rate of 12 percent. The cash flows of this project are as follows: Year PV @ 12 % 0 £6,000 1 £5,000 2 £3,000 3 £1,500 4 £550 Calculate the NPV, and make a recommendation for acceptance or rejection a. b. c. d. e. £15,500; accept - £15,500; reject -£2,568; reject -£500; reject £ 30,500; accept 21. A project with only one sign change in its cash flow is called a …………………. project a. normal b. regular c. constant d. good e. steady 22. In general, the maximum possible number of positive IRRs for a project is equal to the …………… a. Maximum possible numbers of negative IRRs b. Number of signs changes in cash flows c. Number of years in the project’s life d. Discount rates minus the highest NPV e. Highest NPV minus the discount rate 23. We can find the IRR of a project by forcing NPV to equal ………………, then solving for the ……………….. a. Discount rate; cash flows b. Discount rate; IRR c. One; IRR d. Zero; discount rate e. The cash flows; discount rate 24. You find the IRR of your project to be 32.50. Which of the following sets of discount rates would allow you always to accept the project?: a. 20, 40, 30 b. 10, 15, 40 c. 30, 40, 50 d. 10, 20, 30 e. 15, 25, 35 25. The NPV ………………. Is a graphical representation of the NPV of a project for various discount rates. a. graph b. profile c. chart d. configuration e. analysis 26. the discount rate at which the NPV profile crosses the horizontal axis is exactly the ……………… of the project a. acceptance border b. discount rate c. IRR d. NPV e. Maximum cash flow 27. For every high discount rates, the NPV profile approaches ………….. a. Zero, because PVs of cash flows are increasing b. c. d. e. Its maximum point – I, because the PV of each future cash flow is increasing –I, because the PV of each future cash flow is diminishing Infinity 28. A project you are considering requires an investment of £2,000, and will pay out £200 a year forever. What is the project’s payback period? a. It doesn’t have one b. 1 year c. 1 month d. 10 years e. 10 months 29. A project you are considering requires an investment of £2,000, and will pay out £100 a year forever, what is the project’s IRR? a. 0.02 b. 0.05 c. 0.2 d. 0.5 e. 0.1 30. The payback period of an investment is 14 years and this investment’s cash flows constitute a perpetuity. Given this information, the IRR of this project is ………….. percent. a. 3.98 b. 2.22 c. 9.45 d. 8.12 e. 7.14 31. If the PI exceeds ………………….. when the cash flows are discounted at the appropriate rate, then the project should be …………………. a. 0; accepted b. 0; rejected c. 1; rejected d. 1; accepted e. 1.0; revaluated 32. Determine the total investment cost a firm should consider in a construction project in evaluating costs of; Land for project site (paid £150,000; market value £450,000; night security to protect vacate land before it was utilised (£45,000)l night security for construction site (£30,000); work crew to clear land for construction crew (£8,000); building materials (£150,000); construction permits (£10,000). a. £393,000 b. c. d. e. £383,000 £693,000 £648,000 £638,000 33. A nursery sells 10,000 plants a year at £5 a plant. Total costs are $4 per plant. The store pays income taxes at a rate of 30 percent. The store’s aftertax operating cash flows are £ …………… a. 10,000 b. 7,000 c. 3,000 d. 70,000 e. 0 34. The after-tax cash flows with and without the effect of depreciation differ by ………….. a. Tax rate times the cumulative cash flows b. Depreciation tax shield times depreciation c. Depreciation tax shield times cumulative csh flows d. Tax rate times the depreciation e. Depreciation times the cumulative cash flow 35. All of the following are components of working capital except …………….. a. Cash balances b. Inventory c. Accounts receivable d. Past-due accounts receivable e. Notes payable 36. A firm is selling £10,000 worth of a product per year and incurring £7,000 in costs to do so. The firm pays taxes at a 35 percent rate and shows depreciation expense of £350 a year. The firm’s depreciation tax shield is £ ………….. a. 87.50 b. 1,277.50 c. 750 d. 927.50 e. 662.50 37. A firm sells 250,000 units of a product each year for £10 a unit. It costs the firm £500,000, a quarter to manufacture the product. If the firm pays taxes t a rate of 20 percent, its annual after-tax operating cash flows are £ ………….. a. 500,000 b. 150,000 c. 350,000 d. 2,000,000 e. 300,000