Masiello, Ralph (Kema)—Breakout F

advertisement

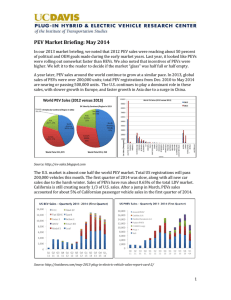

Charging Ahead Power Grid Perspectives on Plug-in Electric Vehicles 1 ISO/RTO Council (IRC) North America’s 10 independent system operators (ISOs) and regional transmission organizations (RTOs) serve two-thirds of electricity consumers in the United States and more than 50 percent of Canada's population. 2 IRC Electric Vehicle Study IRC report examines grid impacts of Plugin Electric Vehicles (PEVs). Among the study’s conclusions: • One million PEVs may be on U.S. roadways in a decade -- with concentrations of the vehicles in the major metropolitan areas of the West Coast and the Northeast. • Staggered charging of PEVs would reduce the potential negative impact on electric load. • Power companies will need new tools to manage growth in PEV use. 3 PEV Projections – ISO/RTO Of the 1,000,000 PEVs expected over the next 10 years, more than 684,000 may be served by U.S. ISO/RTOs CAISO 267,654 ISO-NE 61,074 NYISO 43,738 PJM 144,172 ERCOT 42,769 SPP 30,459 Midwest ISO 94,644 4 The Historical Data: The Pace of Prius Market Penetration United States Annual Prius New Registrations Methodology question – Why focus on the Prius? – Prius was (a) high mileage, (b) very new technology, (c) “green,” (d) relatively expensive Prius sales illustrate the introduction of a new vehicle technology – – Market introduction: first generation technology, limited production capacity, high prices Market development: second generation, improved technology, expanded capacity, growing consumer interest and acceptance 180,000 160,000 140,000 120,000 100,000 80,000 60,000 40,000 20,000 The Prius study period represents “early adopters” only – – Data focus on Prius concentrations, not “niches” or very small numbers NOT focused on distribution circuits – but could be! 0 2000 2001 2002 2003 2004 2005 2006 2007 United States Notes: • 2000-2002 represented Prius “Gen 2” • Prius “Gen 2” introduced in 2003 Note: All Prius data provided by R. L. Polk What have we learned about Prius early adopters? New Prius Registrations – Total Prius Sales, 2000-2007* Ranking by state 1 – 10 11 – 20 21 – 30 31 – 40 41 – 51 New Prius registrations for study period: 2007: 435,400 vehicles *2000 Prius–data provided by R. L. Polk Buyer Demographics: Locations of New Registrations Sales of the Prius were generally concentrated in states with the highest population – but… States With Highest Population, 2000-2007 Rank 1 2 3 4 5 6 7 8 9 10 State CA TX NY FL IL PA OH MI GA NC Population (Millions) 36.8 24.3 19.5 18.3 12.9 12.5 11.5 10.0 9.7 9.2 States With Highest Prius Sales Rank 1 2 3 4 5 6 7 8 9 10 State CA FL TX NY VA WA PA IL MA MD Total New Registrations 123,989 20,596 18,297 18,033 17,828 16,459 14,791 14,660 13,723 12,040 What have we learned about early Prius consumers? Prius Registrations – New Regi strations Per Capita, 2000-2007* Ranking by state Per capita data New Prius registrations for study period: 2000 – 2007: 435,400 vehicles * Prius data provided by R. L. Polk Rank Registrations per 1,000 1 – 10 2.0 – 3.4 11 – 20 1.3 – 1.9 21 – 30 1,0 – 1,3 31 – 40 0.7 – 1.0 41 – 51 0.3 – 0.7 Buyer Demographics: Urban Concentrations …but the demographics of the Prius customer has a strong “coastal” character - and was heavily concentrated in the largest urban areas, which account for 31.6% of total U.S. sales States Where Prius Was Most Popular Rank 1 2 3 4 5 6 7 8 9 10 State CA VT OR NH WA DC VA MD MA ME Registrations per 1000 Residents 3.37 3.21 3.04 2.54 2.51 2.46 2.29 2.14 2.11 2.03 Note: “Most popular” = highest per capita sales Metro Areas Where Prius Was Most Popular Rank 1 2 3 4 5 6 7 8 9 10 Metro Area New York Los Angeles Chicago Wash., DC San Francisco Philadelphia Boston Detroit Dallas Houston Total New Registrations 18,622 52,700 9,400 15,100 42,900 6,300 13,200 3,000 3,200 3,900 % of US 3.7% 10.4% 1.9% 8.4% 8.4% 1.2% 2.6% 0.6% 0.6% 0.8% The “Take-aways” From the Prius Review 1. Early adopters WERE NOT proportional to population size alone – – 2. 3. Significant differences in per capita sales between states and regions Some strong preferences, some distinct disinterest TOTAL numbers WERE driven by overall population size The “Coastal” phenomenon for this class of vehicle among early adopters is very clear – in both the per capita numbers and in the overall sales numbers Conclusions 1. Early adopters have a clear demographic locational component • 2. The so-called “coastal effect” appears valid There are likely to be significant differences in PEV clustering among ISOs/RTOs • BUT – from an ISO/RTO perspective, where clusters of significant size are needed to provide a useful level of MWs of connected PEVs, POPULATION SIZE matters more than almost any other criteria III PEV Projections: Distribution Where are PEVs likely to be concentrated among the ISOs and RTOs? PEVs: Where will they land? • How do we apply the Prius experience to project the distribution of PEVs among the ISOs and RTOs? – Where are PEVs likely to be concentrated in significant numbers from an ISO/RTO perspective? • Key to an ISO/RTO perspective – MWs – concentrations of PEVs that provide significant MW demand response resources • One vehicle here and there doesn’t count • Where will PEVs wind up? – The consumer model: PHEVs and EREVs (and some BEVs) • The Prius analogy – applied to consumer behavior, not fleets – The “fleet” model: BEVs • An “urban center” model, driven largely by population size The “Top Twenty” Metropolitan Areas City Population City Population New York 16,400,000 Atlanta 4,100,000 Los Angeles 16,400,000 Miami 3,900,000 Chicago 9,200,000 Seattle-Tacoma 3,600,000 Washington, DC 7,600,000 Phoenix 3,300,000 San Francisco 7,000,000 Minneapolis 3,000,000 Philadelphia 6,200,000 Cleveland-Akron 3,000,000 Boston 5,800,000 San Diego 2,850,000 Detroit-Ann Arbor 5,500,000 St. Louis 2,600,000 Dallas-Fort Worth 5,200,000 Denver-Boulder 2,600,000 Houston 4,700,000 Tampa-St. Pete 2,400,000 Metro areas located within the ISO/RTO study area are in bold, other metro areas are in gray PEVs in the “Top Twenty” Metropolitan Areas – Slide 1 of 2 City New York Consumer PEVs Fleet PEVs Total PEVs 40,000 14,069 54,069 105,000 14,069 119,069 Chicago 20,000 7,892 27,892 Washington, DC 31,000 6,520 37,520 San Francisco 85,000 6,005 91,005 Philadelphia 13,000 5,319 18,319 Boston 27,000 4,976 31,976 Detroit-Ann Arbor 6,000 4,718 10,718 Dallas-Fort Worth 6,500 4,461 10,961 Houston 8,000 4,032 12,032 Los Angeles Metro areas located within the ISO/RTO study area are in bold, other metro areas are in gray PEVs in the “Top Twenty” Metropolitan Areas – Slide 2 of 2 City Consumer PEVs Fleet PEVs Total PEVs Atlanta 4,500 3,517 8,017 Miami 8,000 3,346 11,346 Seattle-Tacoma 23,000 3,088 26,088 Phoenix 13,000 2,831 15,831 Minneapolis 8,000 2,574 10,574 Cleveland-Akron 6,000 2,574 8,574 20,000 2,445 22,445 St. Louis 3,500 2,230 5,730 Denver-Boulder 9,000 2,230 11,230 Tampa-St. Pete 7,000 2,059 9,059 San Diego Metro areas located within the ISO/RTO study area are in bold, other metro areas are in gray IV Moving from PEVs to MWs Translating from numbers of PEVs to numbers of MW in ISO/RTO metro areas MW: Translating PEVs to Available MWs It’s not the size, it’s the miles driven – and the kWh used – that matter – PEVs come with different size batteries (e.g., 10 kW, 25 kW, 100 kW)) – PEVs come in different designs (e.g., PHEV, EREV, BEVs) – The PEV may be hooked up, but it may be already fully charged and not available for demand reduction Ultimately, MW available for demand reduction are a function of: – Number of PEVs of varying size available locally – Charging voltage (e.g., Level 1, 2, 3) – how long it takes to charge – Connection at load • Likelihood that a vehicle is in fact connected at a given moment in time • Likely depth of discharge at time of hook-up • BOTH are stochastic Calculating “Available” MW Implications – Our analysis estimates the number of PEVs in the SMSA clusters – We estimate a split between PHEVs, EREVs and BEVs, and locate the majority of BEVs in the larger urban centers • 80% in the “top 20” – To arrive at MW estimates it is necessary to “rerate” the kW of the batteries to recognize: • Some batteries are larger than others (e.g., BEVs) • The likelihood that many batteries will be only partially discharged when first plugged in Our model – – – – Consumer BEVs average 100 miles in range vs. 40 miles for EREVs 80% of consumer BEVs are in the “top 20” metro areas The majority of fleet vehicles will be BEVs For this purpose, we only calculate fleet BEVs in the metro areas used throughout this analysis MW Load and Charging Projections Assumptions – – – – – Chargers – 20% level 1; 80% level 2 300 kWh per mile (includes travel, AC and accessories) Night time charging assumed; daytime charging not included Included both Consumer and Fleet projections Individual utility load profiles were not considered MW Load and Charging Projections Slide 1 of 2 City Metro Area New York Total PEVs MW Load if everyone charged at the same time MW Load if charging is staged over 8 hours MW Load if charging is staged over 12 hours 54,069 448 40 26 119,069 988 174 116 Chicago 27,892 231 41 27 Washington, DC 37,520 311 55 37 San Francisco 91,005 755 133 89 Philadelphia 18,319 152 27 18 Boston 31,976 265 47 31 Detroit-Ann Arbor 10,718 89 16 10 Dallas-Fort Worth 10,961 91 16 11 Houston 12,032 100 18 12 Los Angeles MW Load and Charging Projections Slide 2 of 2 City Metro Area Total PEVs MW Load if everyone charged at the same time MW Load if charging is staged over 8 hours MW Load if charging is staged over 12 hours Atlanta 8,017 67 12 8 Miami 11,346 94 17 11 Seattle-Tacoma 26,088 216 38 25 Phoenix 15,831 131 23 15 Minneapolis 10,574 88 15 10 8,574 71 13 8 22,445 186 33 22 5,730 48 8 6 Denver-Boulder 11,230 93 16 11 Tampa-St. Pete 9,059 75 13 9 Cleveland-Akron San Diego St. Louis Projected PEV Load Total PEVs Load if everyone charged at the same time (MW) Load if charging is staged over 8 hours (MW) Load if charging is staged over 12 hours (MW) ISO-NE 61,074 338 75 50 NYISO 43,738 242 27 18 PJM 144,172 797 178 119 Midwest ISO 94,644 523 117 78 SPP 30,459 168 38 25 ERCOT 42,769 237 53 35 CAISO 267,654 1,480 331 221 TOTAL 684,510 3,785 819 546 ISO/RTO 22 Impact of Charging Patterns PEV Load Impact - U.S. ISO & RTO Regions 4,000 Megawatts 3,500 3,785 3,000 2,500 2,000 1,500 1,000 819 500 546 0 Load if everyone charged at the same time Load if charging is Load if charging is staged over 8 hours staged over 12 hours 23 PEV Products & Services Emergency Load Curtailment (ELC)—PEVs are able to provide a quickresponse load-curtailment resource for emergency events, and may be aggregated for maximum effect. Dynamic Pricing (DP)—Dynamic pricing might be a way to accomplish charging of PEV batteries in off-peak hours. However, further research on consumer behavior is necessary to understand how a PEV owner will respond to retail price differentials. Enhanced Aggregation (EA)—The potential for high concentrations of PEV loads in the evening makes managing charging over the day a priority for the ISO/RTOs. This would be complementary to time-of-use programs and be potentially linked to a dynamic-pricing product. 24 Conclusions EV can be accommodated and managed within existing Ancillary Services Products Expanded use of electricity as primary fuel powering light-duty vehicles poses a challenges and opportunities to the electricity grid. Management of PEV charging — at a minimum — can limit the impact of new PEV loads and — at its best — provide new resources. In addition to testing and demonstrating new tools, grid operators will be able to leverage experience with smart grid technology and demand response to prepare for the unique changes predicted to arrive with PEVs. 25 For More Information A copy of the full report, Assessment of Plugin Electric Vehicle Integration with ISO/RTO Systems, is available at the IRC website, www.iso-rto.org. 26 ISO – New England 27 New York ISO 28 PJM Interconnection 29 Midwest ISO 30 Southwest Power Pool 31 Electric Reliability Council of Texas 32 California ISO 33