Accounting I - Campbellsport Public Schools

advertisement

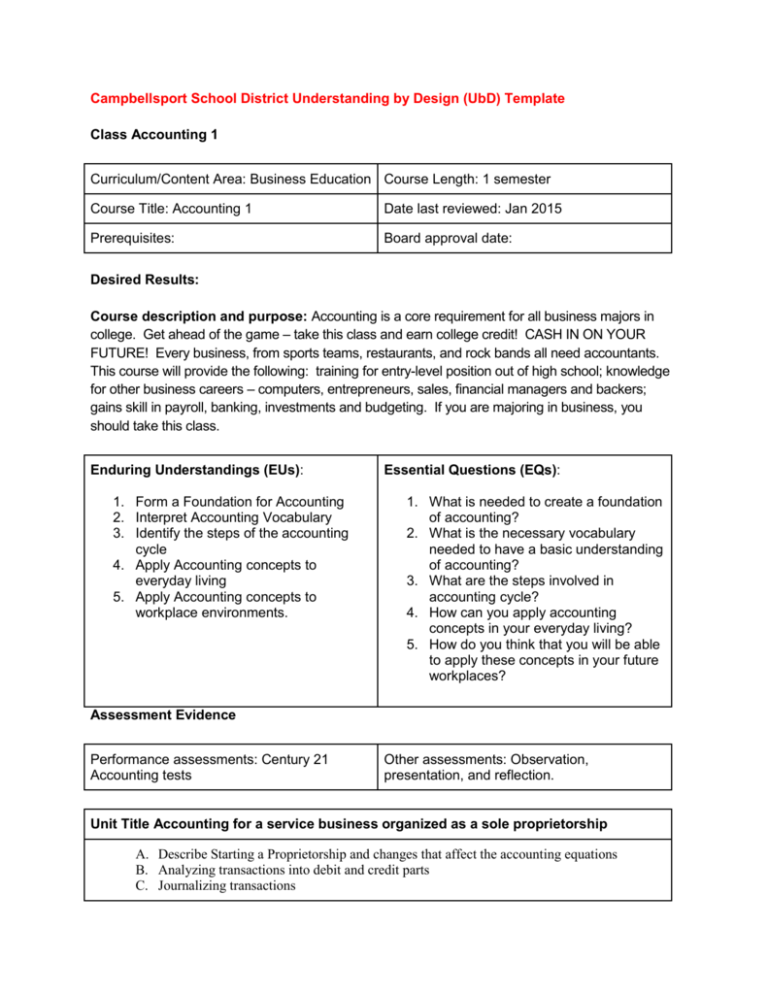

Campbellsport School District Understanding by Design (UbD) Template Class Accounting 1 Curriculum/Content Area: Business Education Course Length: 1 semester Course Title: Accounting 1 Date last reviewed: Jan 2015 Prerequisites: Board approval date: Desired Results: Course description and purpose: Accounting is a core requirement for all business majors in college. Get ahead of the game – take this class and earn college credit! CASH IN ON YOUR FUTURE! Every business, from sports teams, restaurants, and rock bands all need accountants. This course will provide the following: training for entry-level position out of high school; knowledge for other business careers – computers, entrepreneurs, sales, financial managers and backers; gains skill in payroll, banking, investments and budgeting. If you are majoring in business, you should take this class. Enduring Understandings (EUs): 1. Form a Foundation for Accounting 2. Interpret Accounting Vocabulary 3. Identify the steps of the accounting cycle 4. Apply Accounting concepts to everyday living 5. Apply Accounting concepts to workplace environments. Essential Questions (EQs): 1. What is needed to create a foundation of accounting? 2. What is the necessary vocabulary needed to have a basic understanding of accounting? 3. What are the steps involved in accounting cycle? 4. How can you apply accounting concepts in your everyday living? 5. How do you think that you will be able to apply these concepts in your future workplaces? Assessment Evidence Performance assessments: Century 21 Accounting tests Other assessments: Observation, presentation, and reflection. Unit Title Accounting for a service business organized as a sole proprietorship A. Describe Starting a Proprietorship and changes that affect the accounting equations B. Analyzing transactions into debit and credit parts C. Journalizing transactions D. E. F. G. Posting to the general ledger Identify cash control systems Creating a work sheet for a service business Create Financial systems for a Proprietorship H. Record adjusting and closing entries for a service business I. Research current news items relating to business and the student Standards (National Business Education Standards) I. The Accounting Profession Achievement Standard: Understand the role that accountants play in business and society. Achievement Standard: Describe career opportunities in the accounting profession. Achievement Standard: Demonstrate the skills and competencies required to be successful in the accounting profession and/or in an accounting-related career. II. Financial Reports Achievement Standard: Develop an understanding and working knowledge of an annual report and financial statements. III. Financial Analysis Achievement Standard: Assess the financial condition and operating results of a company and analyze and interpret financial statements and information to make informed business decisions. IV. Accounting Applications Achievement Standard: Identify and describe generally accepted accounting principles (GAAP), explain how the application of GAAP impacts the recording of financial transactions, and the preparation of financial statements. V. Accounting Process Achievement Standard: Complete the steps in the accounting cycle in order to prepare the financial statements. VI. Interpretation and Use of Data Achievement Standard: Use planning and control principles to evaluate the performance of an organization and apply differential analysis and present-value concepts to make decision. VII. Compliance Achievement Standard: Develop a working knowledge of individual income tax procedures and requirements to comply with tax laws and regulations. Learning Targets Addressed [“I can” statements (focus on skill-based vs. contentbased)]: J. K. L. M. N. O. P. I can describe Starting a Proprietorship and changes that affect the accounting equations I can analyzing transactions into debit and credit parts I can journalizing transactions I can posting to the general ledger I can identify cash control systems I can creating a work sheet for a service business I can create Financial systems for a Proprietorship Q. I can record adjusting and closing entries for a service business R. I can research current news items relating to business and the student Unit Title: Accounting for a merchandising businesses organized as a corporation A. B. C. D. E. F. G. H. I. Describe the accounting for a merchandising business organized as a corporation Journalizing purchasing and cash payments Journalizing sales and cash receipts using special journals Posting to general and subsidiary ledgers Preparing payroll records Preparing payroll taxes, and reports Creating a worksheet for a merchandising business Preparing the financial statements for a corporation Record adjusting and closing entries for a corporation Standards (Wisconsin Common Career Technical Standards) I. The Accounting Profession Achievement Standard: Understand the role that accountants play in business and society. Achievement Standard: Describe career opportunities in the accounting profession. Achievement Standard: Demonstrate the skills and competencies required to be successful in the accounting profession and/or in an accounting-related career. II. Financial Reports Achievement Standard: Develop an understanding and working knowledge of an annual report and financial statements. III. Financial Analysis Achievement Standard: Assess the financial condition and operating results of a company and analyze and interpret financial statements and information to make informed business decisions. IV. Accounting Applications Achievement Standard: Identify and describe generally accepted accounting principles (GAAP), explain how the application of GAAP impacts the recording of financial transactions, and the preparation of financial statements. V. Accounting Process Achievement Standard: Complete the steps in the accounting cycle in order to prepare the financial statements. VI. Interpretation and Use of Data Achievement Standard: Use planning and control principles to evaluate the performance of an organization and apply differential analysis and present-value concepts to make decision. VII. Compliance Achievement Standard: Develop a working knowledge of individual income tax procedures and requirements to comply with tax laws and regulations. Learning Targets Addressed [“I can” statements (focus on skill-based vs. contentbased)]: 1. 2. 3. 4. 5. 6. I can describe the accounting for a merchandising business organized as a corporation I can journalizing purchasing and cash payments I can journalizing sales and cash receipts using special journals I can posting to general and subsidiary ledgers I can preparing payroll records I can preparing payroll taxes, and reports 7. I can creating a worksheet for a merchandising business 8. I can preparing the financial statements for a corporation 9. I can record adjusting and closing entries for a corporation