COURSE TITLE

advertisement

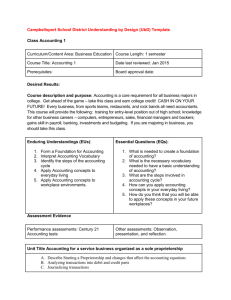

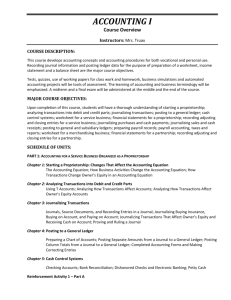

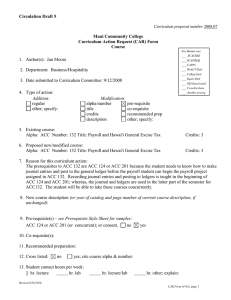

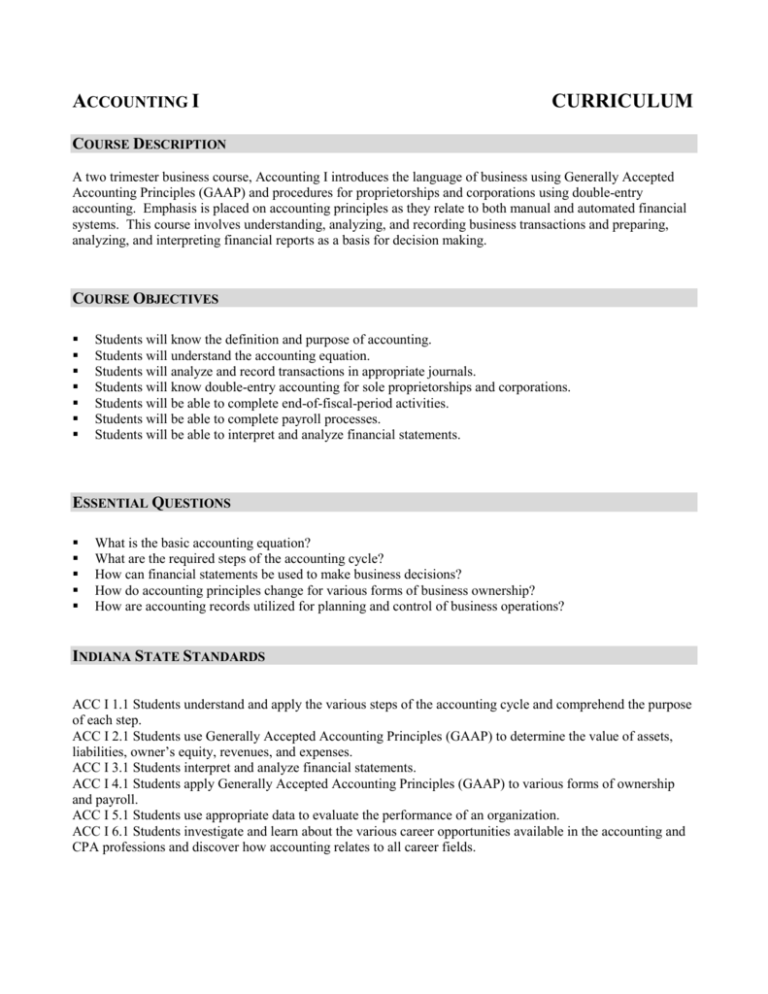

ACCOUNTING I CURRICULUM COURSE DESCRIPTION A two trimester business course, Accounting I introduces the language of business using Generally Accepted Accounting Principles (GAAP) and procedures for proprietorships and corporations using double-entry accounting. Emphasis is placed on accounting principles as they relate to both manual and automated financial systems. This course involves understanding, analyzing, and recording business transactions and preparing, analyzing, and interpreting financial reports as a basis for decision making. COURSE OBJECTIVES Students will know the definition and purpose of accounting. Students will understand the accounting equation. Students will analyze and record transactions in appropriate journals. Students will know double-entry accounting for sole proprietorships and corporations. Students will be able to complete end-of-fiscal-period activities. Students will be able to complete payroll processes. Students will be able to interpret and analyze financial statements. ESSENTIAL QUESTIONS What is the basic accounting equation? What are the required steps of the accounting cycle? How can financial statements be used to make business decisions? How do accounting principles change for various forms of business ownership? How are accounting records utilized for planning and control of business operations? INDIANA STATE STANDARDS ACC I 1.1 Students understand and apply the various steps of the accounting cycle and comprehend the purpose of each step. ACC I 2.1 Students use Generally Accepted Accounting Principles (GAAP) to determine the value of assets, liabilities, owner’s equity, revenues, and expenses. ACC I 3.1 Students interpret and analyze financial statements. ACC I 4.1 Students apply Generally Accepted Accounting Principles (GAAP) to various forms of ownership and payroll. ACC I 5.1 Students use appropriate data to evaluate the performance of an organization. ACC I 6.1 Students investigate and learn about the various career opportunities available in the accounting and CPA professions and discover how accounting relates to all career fields. UNITS OF INSTRUCTION Unit 1: Accounting for a Service Business Organized as a Proprietorship Unit 2: Accounting for a Merchandising Business Organized as a Corporation COURSE ASSESSMENTS STUDENT PRODUCTS FOR ASSESSMENT Instructional methods will include the use of lectures, demonstrations, computers, projects, simulations, and business experiences requiring the application of accounting theories and principles. Typically, a test will be given at the end of each chapter. In addition, at least one homework assignment per week will be graded. Grades are calculated using a points system. For example, if a student earns 240 points out of a possible 305, the points earned will be divided by the points possible and converted to a percentage grade (240/305 = .787 = 79% = C+). Grades will be assigned using the grading scale found on page 17 of the student handbook. If an assignment/test is missed due to absence, students are expected to make-up this work in a timely manner. Timely will be defined by the length of the student’s absence. It is the student’s responsibility to meet with me to determine the deadline for making up work. Failure to do so will result in a zero for missed assignments/tests. TIMELINE Week 1 – Chapter 1 – Accounting Equation & Changes Affecting the Equation (1.1.1, 1.1.2, 1.1.3, 2.1.1, 2.1.6, 2.1.9) Week 2 – Chapter 2 – Analyzing Transactions Into Debit & Credit Parts (1.1.6, 1.1.7, 2.1.1, 2.1.6, 2.1.9) Week 3 – Chapter 3 – Recording Transactions in a General Journal (1.1.5, 1.1.6, 1.1.7) Week 4 – Chapter 4 – Posting from a General Journal to a General Ledger (1.1.9, 1.1.10) Week 5 – Chapter 5 – Cash Control Systems (2.1.2) Week 6 – Reinforcement Activity I – Part A (problem using knowledge gained in chapters 1-5) Week 7-8 – Chapter 6 - Work Sheet for a Service Business (1.1.11) Week 8-9 – Chapter 7 – Financial Statement for a Proprietorship(1.1.13) Week 9-10 – Chapter 8 – Recording Adjusting & Closing Entries (1.1.12, 1.1.14) Week 11 – Reinforcement Activity I – Part B (continuation of Part A using knowledge gained in chapter 68) Week 12 – Review and preparation for comprehensive trimester exam Week 13 – Chapter 9 – Journalizing Purchases & Cash Payments (1.1.8) Week 14 – Chapter 10 – Journalizing Sales & Cash Receipts Using Special Journals (1.1.8) Week 15 – Chapter 11 – Posting to General & Subsidiary Ledgers (1.1.9) Week 16 - 17 – Chapter 12 – Preparing Payroll Records (4.1.2, 4.1.3, 4.1.4, 4.1.5) Week 17-18 – Chapter 13 – Payroll Accounting, Taxes, & Reports (4.1.2, 4.1.3, 4.1.4, 4.1.5) Week 19-20 – Chapter 14 – Distributing Dividends & Preparing a Work Sheet for a Merchandising Business (1.1.11, 1.1.12) Week 20-21 – Chapter 15 – Financial Statements for a Corporation (1.1.13) Week 21-22 – Chapter 16 – Recording Adjusting & Closing Entries for a Corporation (1.1.14) Week 22-24 – Simulation Problem – Zenith Global Imports (This serves as a culminating project for the course. Students will be tested from their work on this project.) COURSE MATERIALS: MAJOR TEXTS, PRINCIPAL MATERIALS AND FILMS Southwestern Century 21 Accounting, General Journal, 8th edition, South-Western Educational Publishing Working Papers for the above textbook Zenith Global Imports Simulation Activity