Payroll Forms - University Of Wisconsin

advertisement

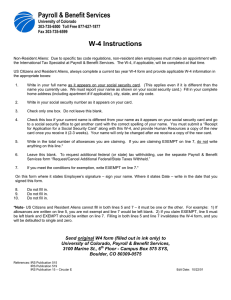

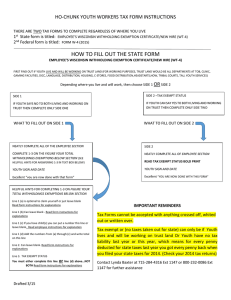

Human Resources Presents Supervisor Training Series Payroll Forms Friday, February 19, 2016 11:30 A.M. to 12:30 P.M. Student Center Oak Room Presenters: Amy Bobylak and Chris Heilgeist Human Resources Supervisor Training Series Training Date Completed FMLA/Workers Comp 10/8/2016 X Payroll Forms 2/19/2016 X Departure Process March 2016 Employee Onboarding TBD Developing Champions – Life Matters 2/24/2016 – See Email Effective Management Styles – Life Matters April 2016 Why Payroll Forms? • You’ve let us know that employees have many questions about these forms. • Student employees may need extra assistance with these forms. • Employees can make changes to Direct Deposit and W-4 forms as frequently as needed. Direct Deposit Authorization • Account Type must be correct, otherwise direct deposit record is inactivated • Routing Numbers are always 9 digits. • Forms without a signature are not valid and an entirely new form must be submitted. • Check with Payroll before closing bank account W-4 Form - Personal Information • If Social Security Number, Citizenship or Marital Status is missing, the form is NOT valid. An entirely new form must be submitted. • Marital status is a factor in determining how much money will come out of each check. • Less money is taken out of each pay check if Married is selected. • Address must be the employees permanent address, not their campus housing. W-4 Form - Withholding Information Exempt Wisconsin Resident • Exempt from taxes means the employee did not have a tax liability in the previous year and does not have a tax liability in the current year. • No taxes come out of their pay checks • Students often file this category. • Allowances must be LEFT BLANK when claiming EXEMPT. • Exempt from Federal/State Taxes? Yes = Exempt • Additional Withholding must also be left blank. • If allowances are provided along with the YES box checked, the form is NOT valid. An entirely new form would need to be submitted. W-4 Form - Withholding Information Non-Exempt Wisconsin Resident • Exempt from taxes means the employee did not have a tax liability in the previous year and does not have a tax liability in the current year. • Non-Exempt – Employee owes taxes and funds will come out of their pay checks 0 • • • • 0 • Exempt from Federal/State Taxes? No = Non-Exempt Allowances must be FILLED IN when claiming NON-EXEMPT. Number of Allowances is determined by each individual’s situation (e.g., number of dependents). The higher the number of allowances, the less amount of money will come out of each pay check If NO allowances are provided and the No box is checked, the form is NOT valid. An entirely new form would need to be submitted. • Additional Withholding is not required. This is if the individual would like to have a specific dollar amount taken out of their pay checks towards their taxes. W-4 Form - Withholding Information Non-Exempt Illinois Resident wanting Reciprocity • Federal information filled out as usual. See previous slides. 0 • Declaring Reciprocity means that NO State taxes will come out of the employee’s pay checks. The employee would be responsible for their own state tax payments. • Employees residing outside Wisconsin are not required to declare reciprocity. • To Declare Reciprocity: Chose YES for Exempt from WI State Taxes and check the box of the State in which the employee resides. • “Leave Above Fields BLANK for all other states outside of Wisconsin.” “If you have checked one of these boxes, do NOT enter any amounts in the Wisconsin State Tax blocks.“ • If these are NOT left BLANK, the form is NOT valid. An entirely new form would need to be submitted. W-4 Form - International Visitors and Signature • International employees must complete the International Visitors section, i.e., anyone who selects Neither for their Citizenship election. • Forms without a signature are not valid and an entirely new form must be submitted. QUESTIONS? Resources • Amy Bobylak - ext. 2253 - rank@uwp.edu • https://www.uwp.edu/explore/offices/humanresources/ • Important Forms • Academic Faculty & Staff • University Staff • Student Employment • W-4 https://uwservice.wisconsin.edu/docs/forms/pay-employeewithholding.pdf (Page 5 only) • Direct Deposit (ACH) Authorization https://www.uwp.edu/explore/offices/humanresources/upload/pay-directdeposit.pdf