Summary Cost Manegement 33KB Oct 22 2012 10:33:49 PM

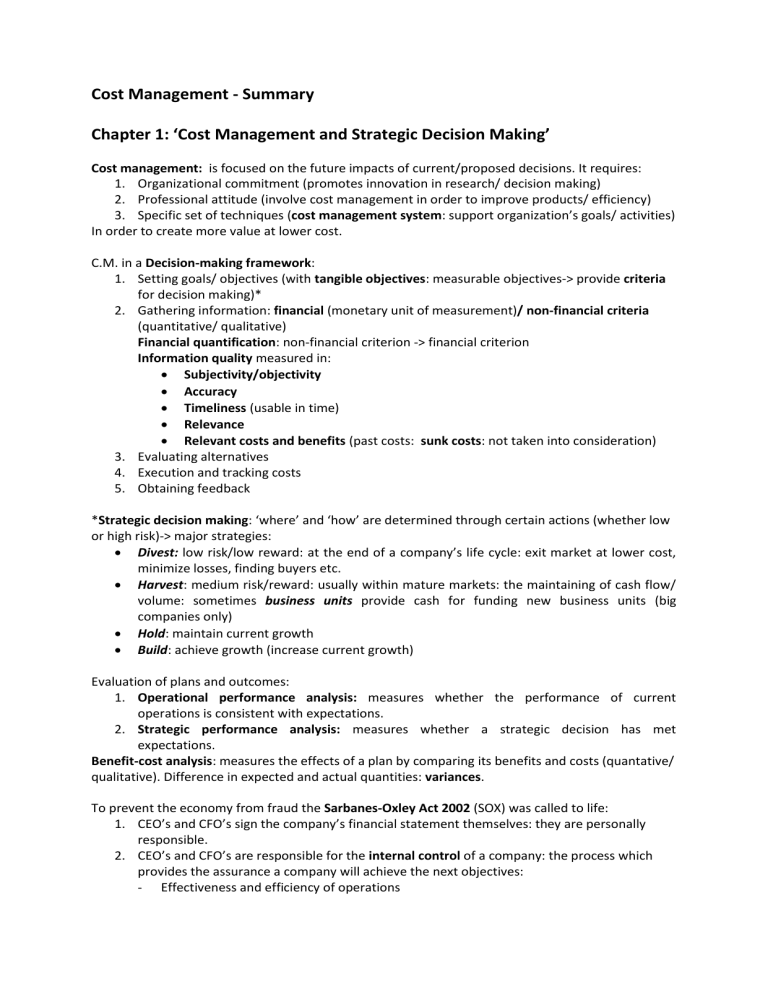

Cost Management - Summary

Chapter 1: ‘Cost Management and Strategic Decision Making’

Cost management: is focused on the future impacts of current/proposed decisions. It requires:

1.

Organizational commitment (promotes innovation in research/ decision making)

2.

Professional attitude (involve cost management in order to improve products/ efficiency)

3.

Specific set of techniques (cost management system: support organization’s goals/ activities)

In order to create more value at lower cost.

C.M. in a Decision-making framework:

1.

Setting goals/ objectives (with tangible objectives: measurable objectives-> provide criteria for decision making)*

2.

Gathering information: financial (monetary unit of measurement)/ non-financial criteria

(quantitative/ qualitative)

Financial quantification: non-financial criterion -> financial criterion

Information quality measured in:

Subjectivity/objectivity

Accuracy

Timeliness (usable in time)

Relevance

Relevant costs and benefits (past costs: sunk costs: not taken into consideration)

3.

Evaluating alternatives

4.

Execution and tracking costs

5.

Obtaining feedback

*Strategic decision making: ‘where’ and ‘how’ are determined through certain actions (whether low or high risk)-> major strategies:

Divest: low risk/low reward: at the end of a company’s life cycle: exit market at lower cost, minimize losses, finding buyers etc.

Harvest: medium risk/reward: usually within mature markets: the maintaining of cash flow/ volume: sometimes business units provide cash for funding new business units (big companies only)

Hold: maintain current growth

Build: achieve growth (increase current growth)

Evaluation of plans and outcomes:

1.

Operational performance analysis: measures whether the performance of current operations is consistent with expectations.

2.

Strategic performance analysis: measures whether a strategic decision has met expectations.

Benefit-cost analysis: measures the effects of a plan by comparing its benefits and costs (quantative/ qualitative). Difference in expected and actual quantities: variances.

To prevent the economy from fraud the Sarbanes-Oxley Act 2002 (SOX) was called to life:

1.

CEO’s and CFO’s sign the company’s financial statement themselves: they are personally responsible.

2.

CEO’s and CFO’s are responsible for the internal control of a company: the process which provides the assurance a company will achieve the next objectives:

Effectiveness and efficiency of operations

Reliability of financial reporting

Compliance with applicable laws and regulation

Chapter 2: ‘Product Costing Concepts and Systems’

There are two types of costs in the production chain:

Direct costs: materials/ labour*

Indirect costs/ overhead/ burden**

Total costs= direct costs + indirect costs

Cost: sacrifice made, measured by value of resources used, to achieve a particular purpose:

Cash cost/ out of pocket cost: incremental costs of short-term decisions (e.g. extra resources).

Accrual cost: recorded costs over a past period (long-term).

Opportunity cost: highest foregone value that could be obtained from the sacrifice of a resource.

To determine whether accrual costs are used correctly a cost accounting system is used:

Expenses: the measure of a cost incurred when a resource is consumed or sold for the purpose of generating value.

Product costs: costs assigned to goods which were purchased/ manufactured for resale.

Costs of sales: when products are sold, their costs are recognized as an expense.

Any costs that aren’t product costs are period costs: costs not associated with the manufacturing process.

Cost analysis:

Method to allow profitability comparisons:

Gross margin ratio: Gross margin/ sales turnover => (sales turnover – cost of sales)/ sales turnover

Operating income: gross margin – expenses

* direct materials: resources used in production: total cost of raw material used in production= direct material cost. Direct labour: cost of compensating employees for converting direct material into a finished product.

** Manufacturing overhead costs: includes costs for necessary resources, but cannot be traced back to specific units of product. Also overtime premium and idle time.

When total labour cost is a small percentage of the total manufacture costs, companies sometimes combine labour costs and overhead: conversion costs.

Non-manufacturing costs: selling costs, administrative costs, period costs

Stages of Production and the Flow of Costs:

Raw materials inventory -> work in progress (WIP) inventory -> finished goods inventory

Beginning balance + transfers in – transfers out= ending balance

Chapter 3: ‘Job and Order Costing’

Product costing system: accumulation of costs of a production process which is assigned to products/ services that constitute the organization’s output. Major types:

Job-order costing: treats each individual job as the unit of output and assigns costs to it when resources are used. Separate records are created and maintained for each job (occurs when: unit/ batch is distinguishable from other products, unit/ batch is of high value, units/ batches are priced differently, direct costs are feasibly traceable). Companies must be able to estimate future job-costs in order to be competitive and profitable.

Process costing: treats all units manufactured during a time period as the output to be costed and the products-costs are not recorded separately.

Operation costing: combination of job-order costing and process costing.

Job –cost record: records costs of all production-related resources used on the job. The sum of these costs is equal to the ‘transfer in’ in a cost-flow model.

A material requisition form: costs of raw material are traced as direct material on the WIP inventory account and to job-cost records of the specific job.

A relatively reliable estimate of actual indirect product costs (overhead) over the year can be made with the predetermined overhead rate (POR):

𝑬𝒔𝒕𝒊𝒎𝒂𝒕𝒆𝒅 𝒂𝒏𝒏𝒖𝒂𝒍 𝒎𝒂𝒏𝒖𝒇𝒂𝒄𝒕𝒖𝒓𝒊𝒏𝒈 𝒐𝒗𝒆𝒓𝒉𝒆𝒂𝒅 𝒄𝒐𝒔𝒕

𝑬𝒔𝒕𝒊𝒎𝒂𝒕𝒆𝒅 𝒂𝒏𝒏𝒖𝒂𝒍 𝒄𝒐𝒔𝒕 − 𝒅𝒓𝒊𝒗𝒆𝒓 𝒍𝒆𝒗𝒆𝒍

The POR normalizes the overhead applied to production jobs. Overhead costs assigned to jobs are obtained if the POR is multiplied by the amount of cost/driver activity. This is a normal costing

system, i.e. the POR is based on normal production capacity (average of previous periods).

Actual overhead incurred is unlikely to equal the applied overhead (POR*actual cost driver volume); the difference is called overhead variance (material if its disposition will affect decisions made by a user of this information, immaterial is unlikely to affect decisions).

Different types of product-costing methods:

Absorption costing: includes direct material, direct labour, fixed and variable manufacturing overhead. A.C. inventories fixed overhead with other product costs until the time when products are sold.

Variable costing: includes direct material, direct labour and variable manufacturing overhead. This method treats fixed overhead costs immediately. It uses a contribution

margin, which is the sales revenue – variable cost of sales.

The periodic incomes can differ a lot, depending on which method is used.

Throughput costing: only assigns cash spending for direct costs as the cost of products/ services.

Chapter 4 –‘Activity-based Management’

Activity Based Costing (ABC: ABC full-costing): a costing method which accurately assigns product/ service costs with resources to al products/ services accordingly the actual consumption by each.*

Five different categories:

Unit-level cost: cost of resources dedicated to an activity performed for every product-unit.

Batch-level cost: cost of resources dedicated to an activity performed for every batch/ multiple identical units.

Product-level cost: cost of resources dedicated to an activity performed for every product line of produced units.

Customer-level cost: cost of resources dedicated to an activity performed for every unique customer.

Facility-level cost: cost of resources dedicated to an activity performed for a production facility.

ABC’s advantage: this approach determines different activities performed to make/ manufacture different products and assigns costs accordingly (the method is accurate).

Traditional cost system: indirect costs are allocated to the products according a volume measure. Its advantage is its simplicity and ready access of needed data. Used if indirect costs are relatively low, the product diversity is low or the cost information accuracy is not critical.

For this method a cost pool (only for indirect costs) is useful: individual costs with similar functions are grouped together. Then cost allocation is implemented: systematic process of assigning indirect costs to products/ organizational units:

1.

Select a cost allocation base: measure which reflects the indirect costs to be allocated (from the cost pools).

2.

Indirect cost amount / cost allocation base: cost allocation rate.

3.

Cost allocation rate x cost allocation base: the indirect costs allocated.

*ABC: first traces costs to activities (act as activity-cost pools), then assigns these costs to goods/ services based on how much the goods/ services use the activity.

Activity-based analysis: measures the costs of goods and services (4 steps):

1.

All activities related to the company’s products are identified (in an activity dictionary).

2.

The costs of each activity are estimated.

3.

A cost-driver rate for each activity cost pool is calculated. **

4.

Activity costs are assigned to products.

Two ways to generate the activity dictionary:

1.

Top-down approach: team of top-level managers set up an activity dictionary: quickly and inexpensively.

2.

Interview/ participative approach: operating employees are included or interviewed during the process: more accurate analysis.

** Cost-driver rates should:

Have a plausible relationship with an activity and its costs.

Be measurable

Predict/ explain the activity’s use of resources with reasonable accuracy.

Be bases on the resource’s practical capacity: the most a resource can be used for normal operations.

Normal production capacity: practical capacity – reserve capacity. NPC is important because it obscures over-investments in resources that are chronically under-used.

ABC unit-level costing: alternative costing method, which only assigns the cost of unit-level resources to products.

Time-driven ABC: the time to complete an activity is used as main cost driver.

Chapter 5 – ‘Customer Profitability and Activity-based Management (ABM)’

Customer value: reflects the of customers’ satisfaction about products/ services compared to its price.

Important in ABM are customer-level costs, which are incurred to serve specific customers.

Customer profitability analysis: identifies costs and benefits of serving specific customers or customer types. Its goal is to improve the overall profitability.

Why serve unprofitable customers?

Status of being supplier to a leading company.

Potential of becoming profitable

The unprofitable customer is used to enter a new profitable market.

Knowledge (e.g. about product application)

Analyzing (un)profitable customers:

Calculate target costs: maximum amount of product costs for which the company still makes a profit.

Calculate the current feasible costs: current total costs without improvement on efficiency of production etc.

Calculate the cost reduction target: current feasible costs – target costs

Activity-based management: evaluates the costs and values of process activities to identify whether efficiency has to be improved. Combined with value-added analysis to develop process improvements on customer value and wasted resources.

(Non) value-added activities: (don’t) increase the product’s/ service’s value in the opinion of the customer: customers are willing to pay to the outcome of value-added activities (customer (external) perceived value). NVA are eliminated, whereas VA are made more efficient.

Obstacles in measurement activity (whether NVA/VA): limited knowledge, responses involve biases.

Implementing ABM:

NVA-activities are eliminated by redesigning the certain processes. The resources those activities used can either be saved (less spending) or applied to VA-activities (increased

effectiveness).

When eliminating NVA-activities, the risk (exposure to loss) should be examined thoroughly.

Often a pilot model is used: a project on smaller scale intended to pilot-test the implementation of ABM.

Chapter 6 – ‘Managing Quality and Time to Create Value’

Approaches to improving product and service quality:

Total quality management (TQM): the view that improvements in quality always results in improved organizational performance, because improving quality improves efficiency. In this view, customer satisfaction and product/ service quality are the fundamental indicators of higher profits.

Return on quality (ROQ): the view that weighs costs and benefits of improving quality. The optimum quality level is below the maximum quality level.

Customer-focused quality: broad focus on meeting/ exceeding customer expectations rather than focus on single dimensions of quality.

Measuring quality:

Leading indicators of quality: measure the features that customers value while manufacturing the product/ before completion of a service.

Lagging indicators of quality: measure the features of products after exposure/ use by customers.

!!! Page 232 -> for different graphs and charts

Cause-and-effect analysis: formulating diagnostic signals that identify potential causes of product/ service defects. When the causes are identified, an organization develops and implements corrective measures.

Costs of quality (COQ): are costs of activities to control quality/ to correct a failure to control quality.

Two general activities to control quality:

Prevention activities: prevent defects in the products offered to customers (value added).

Appraisal activities: inspect inputs and attributes used for production, as well as inspect the products/ services to detect whether they conform to specifications or consumer expectations (non-value added).

Failing to control quality:

Internal failure activities are required to correct defects before products and services are delivered.

External failure activities are required to correct defects after products or services have been delivered.

Time-managing in a Competitive Environment

Competitive markets continuously demand:

Shorter new product (and service) development time: the period between the first consideration of a product and its first sale to the customer.

Shorter customer response time: timespan between the order/ request for a product/ service and its delivery to the customer.

Shorter (production) cycle time: the elapsed time between starting and finishing a production process.

Time-driven ABC: a method of ABC that uses time as the main cost driver.

Process efficiency: the ability to transform inputs into throughput 1 at the lowest cost.

1 amount of goods/ services produced and delivered during a period measured in physical measures.

Two types of processes: Production processes (result directly from producing goods/ services for external customers) and business processes (support production processes). Efficiency can be measured as:

Productivity: outcomes of a process/ amount of resources needed: o Total factor productivity: value of goods and services (sales revenue)/ total costs to provide these goods and services

Average cycle time: total processing time/ units (most useful when only the cycle time required to produce good products is calculated)

Throughput time ratio: value-added time/ total processing time

Process capacity: a measure of a process’ ability to transform resources into valued products and services (processing input (or generating outputs)/ time period). Capacity is measured by the following standards:

Theoretical capacity: maximum possible rate of transformation of inputs into outputs if the

process is fully used.

Practical capacity: theoretical capacity – planned downtime

Normal capacity: average level of usage (less than practical capacity).

Buffer capacity: amount of capacity intentionally reserved for unexpected demand.

Excess capacity: amount by which the practical capacity exceeds the demand + buffer capacity.

Different process management:

Just-in-time (JIT)/ lean processes (pull): the production of services/ products is only done when needed. JIT reduces inventory carrying costs largely. The capacity use is more efficient, which is observable in the overall equipment effectiveness (OEE): a summary measure of the use of process capacity to create good output.

Traditional manufacturing (push): forecasting and scheduling of activities are the two main functions in TM.

Chapter 11 – ‘Joint Product and Process Cost Systems

Joint production process: simultaneously converts a common input into several outputs (joint

products). The costs to operate such a process are joint costs*.

At the split-off point joint products appear in the production process:

Final product: ready for sale (without further significant processing).

Intermediate product: requires further processing. The costs incurred to do so, are called

further processing costs.

If a company has to decide whether it sells intermediate or final products, the net realizable value

(NRV) is important: a product’s contribution to profit after the split-off point, calculated by ‘Sales

revenue – Further processing costs’.

*Joint costs are allocated only to main products: a joint output that generates a significant part of the NRV (by-products carry relatively little costs, deemed to be immaterial). Two main allocation methods:

Net realizable value method: the allocation of joint costs is based on the NRV of each main product after the split-off point (calculated in proportion). If products are sold without further processing, their market value/ sales price at split-off are used.

Physical measures method: joint cost allocation based on an arbitrary relative measure

(volume, weight) that appears on the split-off point.

Process costing system: the output for costing are all units processed during a time period. Units are not separately recorded (to expensive). Steps to implement this system:

1.

Summarize flow of physical units (page 2)

2.

Apply concept of equivalent units: amount of work actually performed on products completed/ not yet completed, expressed as the work required to complete entire units.

3.

Accumulate the costs to be allocated

4.

Compute the cots per equivalent unit

5.

Allocate costs to goods completed/ goods not completed

Spoilage: effort that results in defective outcomes:

Normal spoilage: unsaleable products that are expected results, it is waste counted as usual costs of production (above 5%, it’s abnormal).

Abnormal spoilage: spoilage from unusual/ unexpected operations of a process.

Other methods based on economic values of joint outputs:

Relative sales value at split-off method: allocates joint costs based on the different relative sales values at their split-off point.

Constant gross margin percentage method: allocates joint cots so that the gross margin (as percentage of sales revenue) is the same for each joint product.

Chapter 14 – ‘Managing and Allocating Support Service Costs’

Organizations contain two types of subunits:

The production department

Support service department: provides services internally within an organization. Support

service costs* are allocated to the production department as indirect/ overhead costs.

Management approaches to support service costs:

No charges on support services for internal customers. Advantage: simple and inexpensive to operate (simple method carries less costs). Disadvantage: if free services are perceived as positive, then the demand increases without regards to the support service costs.

Support service costs are allocated to its internal customers. Advantage: support service is controlled. Disadvantages: the allocation is arbitrary, and it might take valuable time.

*Support service costs: costs of resources used by the support service department to provide its support service.

Cost allocation process:

1.

Support service costs are split up in cost pools. It is important to distinguish between resources supplied and resources used. Only used resources are allocated to user departments (i.e. users are not charged for unused capacity).

2.

For every cost pool a cost allocation base is set. Sometimes an indexed cost allocation base is used: multiple bases combined into a single index.

3.

Allocate the costs:

Direct method: allocation of support service costs directly to production department. It is based on the costs of each subunit of a department as a percentage of the total costs within that department. o Second-stage cost allocation: the reallocation of service department costs + direct costs to products.

Step method: allocates support service costs in ordered, sequential steps to production department. First the support service departments are ranked by proportion of their total

allocation basis. Then sequentially the costs from the general support service department are allocated to the production department, then this process is repeated with less general departments until the least general costs are allocated (! This process is in one direction).

This process recognizes that some support services also support other support service departments.

Reciprocal method: recognizes and allocates the costs of all services provided by any support service department, including those provided to other support service departments. The total departmental costs are calculated as follows:

𝑇𝑜𝑡𝑎𝑙 𝑑𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡𝑎𝑙 𝑐𝑜𝑠𝑡𝑠 = 𝑑𝑖𝑟𝑒𝑐𝑡 𝑐𝑜𝑠𝑡𝑠 𝑜𝑓 𝑡ℎ𝑒 𝑎𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 + 𝑠𝑒𝑟𝑣𝑖𝑐𝑒 𝑐𝑜𝑠𝑡 𝑡𝑜 𝑏𝑒 𝑎𝑙𝑙𝑜𝑐𝑎𝑡𝑒𝑑