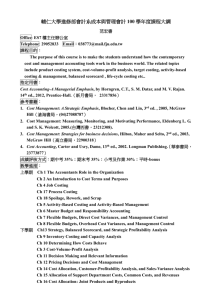

Chapter 5 Activity-Based Costing and Management

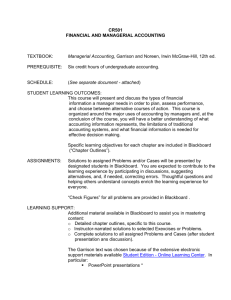

advertisement

IES 342 2/2004 Chapter 5 Activity-Based Costing and Management Practice Problem Partial Solution 5-25 Activity-Based Costing Hakara Company (pg 168) Cost Pools Machine setup Materials handling Electric power Activity Costs $360,000 $100,000 $40,000 Direct materials Direct labor Factory overhead: Machine setup $120 x 200 = Materials handling $4 x 1,000= Electric power $1 x 2,000 = Total product costs Production units COST PER UNIT Cost Drivers 3,000 setup hours 25,000 pounds 40,000 kilowatt hours Overhead Rate $120 $4 $1 A $40,000 24,000 24,000 4,000 2,000 $94,000 4,000 $23.50 B $50,000 40,000 $120 x 240 = $4 x 3,000 = $1 x 4,000 = 28,800 12,000 4,000 $134,800 20,000 $6.74 5-27 Product Selection (pg 169) Before deciding on which of the two products the firm should focus, the company should review its costing system. It is likely that Johans’ product costing system is providing misleading cost information. The company is probably using a volumebased product costing system, which tends to overcost the high-volume product (Desktop Computer) and undercost the low-volume product (Tablet Computer). When competitors can sell a product at a price ($380) much lower than our cost ($660), it is likely that Johan’s costing system fails to determine product costs properly or that applied manufacturing process is very inefficient. The company should install an activity-based product costing system. If the reported product cost indicates that the price of the high-volume desktops is too high compared to the competitor’s price, then the company should adjust the price accordingly. 1