The World’s Largest, Privately-Held Insurance Brokerage Firm

Alternative Insurance Structures

Presented by Greg Cushard

Lockton Insurance Brokers, LLC

L

O

C

K

T

O

N

I

N

S

U

R

A

N

C

E

B

R

O

K

E

R

S

,

L

L

C

Gregory Cushard

Partner – Global Petroleum and Convenience Store Group

Professional Profile

Current Positions

Expertise:

Environmental

Petroleum

Convenience Stores

Rail

Terminals

Transportation

Refineries

Private Equity

Lockton Insurance Brokers, LLC—

Partner and Vice President

Education

University of Southern California,

Bachelor of Science—Entrepreneurship

Professional Affiliations

Society of Independent Gasoline Marketers

of America, Committee Member

Turnaround Management Association,

Committee Member

Property and Casualty Insurance

PMAA

Employee Benefits

NACS

Captive Consulting

ILTA

IPAA

gcushard@lockton.com | O: 415.568.4115 | M: 916.730.4849

1

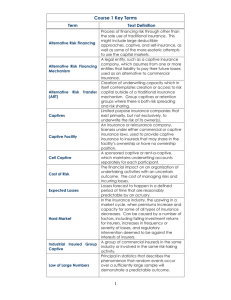

Table of Contents

1. Insurance Overview

2. Fronted Programs

3. Corridor Deductible

4. Integrated Risk Program

5. Traditional Aggregate Stop Loss

6. Captives

a) Group Captive

b) Private Insurance (831b)

2

Insurance Overview

Insurance Overview

Small

Deductible

with

Aggregate

Risk Transfer

Large

Deductible

with

Aggregate

Retro

with Low

Maximum

Small

Deductible

without

Aggregate

Retro

with

High

Maximum

Group

Captive

SingleParent

Captive

Large

Deductible

without

Aggregate

Segregated

Cell Captive

Qualified

Self Insured

UNINSURED

GUARANTEED

COST

Risk Finance Spectrum

Pure Self-Insurance

High Premium

Low Premium

Low Volatility

High Volatility

4

Fronted Programs

Fronted Programs

“Fronts” are programs where a carrier issues a policy to meet insurance

requirements for contractual or statutory requirements, but the client retains most,

if not all, of the risk on the back end. There are many ways to structure a fronted

program to allow for:

a) Maximum use to meet insurance objective

b) Minimize cost (fronting fees)

c) Minimize collateral.

Example:

A company is interested in self-insuring their storage tank liability and replacing their current UST

policy covering 650 tanks. The company pays the insurer 20% of their current policy premium and in

return the insurer agrees to put up a new insurance policy to satisfy Federal Financial Responsibility

Laws. All claims become 100% the responsibility of the insured.

6

Corridor Deductible

Corridor Deductible

In addition to the retained losses within a deductible, the client can also retain

a limited portion of the excess losses in its primary excess layer. Excess

coverage will attach above the retained layer only after the client’s corridor

deductible aggregate is exhausted. Premiums for the excess layer are,

therefore, reduced by this risk-sharing approach by the client.

Example:

As an example, ABC Corp had annual Auto losses equal to $125k at a $100K deductible. Loss history

included 2 large losses. ABC Corp subsequently took a 2nd deductible of $100k on their 2nd excess

layer and added a $200k aggregate limit on losses in the 2nd layer. This equaled substantial premium

reductions.

8

Integrated Risk Program

Integrated Risk Program

Integrated risk solutions can take many different forms. “Integrated” simply

means there is a single block of insurance spread across at least two lines of

business. An integrated program could be 100 percent risk transfer, or have

large components of risk retention. In some instances, we see clients’ captives

participate in this alternative risk program.

Example:

As an example, MNO Corp has several policies of excess coverage, covering their Property, D&O, Cyber,

Employment Practices Liability, and Workers’ Compensation. Each layer has attachment and limits that

vary from one another. Total combined insurance spend is in excess of $1M. By combining these

multiple towers into one policy/program, there can be a potential cost savings greater than 5% (this can

vary). In addition to the potential cost savings, integrated programs provide the flexibility to have a

longer policy term (i.e. 3 years), thus eliminating the annual renewal of each and every coverage.

10

Traditional Aggregate

Stop Loss

Traditional Aggregate Stop Loss

Underwriter provides limited coverage in the retained frequency layer that

attaches at or above a chosen loss threshold for multiple lines of coverage.

This is also called a Basket Aggregate.

Example:

As an example, XYZ Corp has varying deductibles across multiple lines at $5,000, $25,000, and

$50,000. Carrier offers a single deductible across all lines at an acceptable reduction in premium.

Claims volatility would increase leaving the client uncomfortable. Carrier then offers an aggregate stop

loss attaching at $250,000, which is the clients maximum tolerance for loss.

12

Captives

Captives

Captives have become a very large part of the alternative risk market, with more than

6,000 captives worldwide and hundreds of billions in captive premiums written annually.

Types of Captives:

Private Insurance

Captive

Group

Captive

14

Captives: Group

A group captive is an insurance company that provides insurance to and is controlled by

its multiple owners. Participants join a group captive to pool premiums and share risk

amongst each other.

Captive premiums are actuarially based on your individual loss experience. This means

your past losses determine your premium not state rates, experience mods, or market

conditions

Lines of coverage in the captive include: Workers Compensation, General Liability, and

Auto Liability (Separate Property and Employee Benefits Captive are available).

15

Captives: Private Insurance

“Pure captive”

Closely held insurance company owned and controlled by its owner. Generally, a

captive works in conjunction with traditional insurance.

Direct Captive Program

A traditional captive arrangement is one in which a company (Parent) sets up its

own insurance company to insure the risk under its deductible policies or those

risks currently self- insuring. The captive issues a direct policy to the parent to

reimburse the parent for the risk under its deductibles/SIR.

16

Captives: Private Insurance

Potential Benefits

Program Design

a)

Funding for uninsured exposures

Financial Benefits

a)

b) Fund for cost-prohibitive coverage

c)

Manuscript coverage

insurance premiums

b) Creates up to $1.2m annually in

d) Offer subsidiaries a deductible

corporate tax deductions for C-Corp,

buy-down option

e)

Insure joint ventures or

development projects

Effective in lowering traditional

LLC, or S-Corp

c)

Investment strategy with pre tax dollars

versus post tax dollars

17

The World’s Largest, Privately-Held Insurance Brokerage Firm

Private Insurance Companies

Study Groups—December 8, 2015

L

O

C

K

T

O

N

I

N

S

U

R

A

N

C

E

B

R

O

K

E

R

S

,

L

L

C

Private Insurance Company Growth

A Captive Insurance Company provides insurance for its owner

With the continued awareness and recognition of opportunity, the captive insurance company concept is

now entering the middle market through the use of Private Insurance Companies.

Continued Growth of Captives

Enterprise Risk Strategies

ERS does not provide legal or tax advice

www.eriskstrategies.com

19

Private Insurance Company Benefits

Protect

Assets

Business

Expense

Protects

Assets

Investment

Income

Investment

Income

Reduces

Reduces Insurance

Insurance Cost

Costs

Versatility

Unmatched

Business

Expense

Risk

Financing

Risk

FinancingCustom

Coverage

Custom

Coverage

Dynamic

Program

Underwriting

Underwriting

Profit

Profit

Owner

Involvement

Owner

Involvement

Dynamic

Program

20

Who Should Consider a PIC?

Companies with significant uninsured risk

Private/closely held organizations

Companies with minimum gross revenue of $5 million

Companies that are consistently profitable

Entrepreneurs

Businesses with strong cash flow

21

Example Coverage Descriptions

Governmental Actions Protection

Reimbursement for costs/expenses paid by the Insured resulting from a Governmental Action, which

includes hearings, review boards, or appeals resulting in assessments, penalties, fines, sanctions or

any costs to ensure compliance with the rules, regulations and standards of any local, county, state or

federal government agency. In addition, reimbursement for costs/expenses paid by the Insured for

professional licenses mandated by any local, state or federal government as well as local, state or

Federal Department of Health or Health Care Finance Administration and Medicare are covered.

Products & Services Reimbursement

Reimbursement for covered costs and expenses the Insured has paid resulting from loss of use,

withdrawal, recall, inspection, repair, replacement, adjustment, removal or disposal due to the Insured’s

product or the Insured’s work.

Supply Chain Interruption

Reimbursement for covered costs and expenses the Insured has paid and / or loss of business income

resulting from the loss the Insured sustained due to the loss of a Critical Customer, Critical Employee,

Critical Contract and/or Critical Supplier. The Insured will have the option under Supply Chain Interruption

to take any or all of the Critical Coverages.

Health Care Employers Deductible Reimbursement

Reimbursement to the Insured for the employer health care retention or deductible of the medical costs

associated with work related employer sponsored health care plans.

22

Real Estate Developer

Prefunding Losses within a Large Deductible

Client Concern/Issue:

A midsized, privately held real estate developer, is required to carry both an environmental liability policy

and a condemnation policy in order to enter into certain contractual agreements with local governmental

bodies and general contractors. Each coverage contains a $250,000 deductible. The insured is concerned

about the potential negative impact of a $250,000 expenditure to their operating income should they

incur a loss under either policy.

ERS Solution:

ERS created a captive insurance company exclusively owned by the partners of the developer to issue a

deductible reimbursement policy for expected losses. The captive provides a mechanism to prefund for

potential deductible obligations for any insurance policies which contain deductibles.

Results/Benefits:

The partners now own a captive insurance company and any underwriting profit generated in their

insurance program. Even though the captive is in its first year of operation, the developer has successfully

transferred the risk from their balance sheet to a captive

23

Construction Industry

Financing Difficult to Place Risks

Client Concern/Issue:

A concrete construction contractor owns and operates several batch plants in the region. The concrete is

manufactured to customer specifications at the batch plants and must be delivered within a specified

time frame. The insured approached his insurance broker to obtain quotes for a boiler and machinery

policy to provide coverage in the event of a mechanical breakdown of their manufacturing equipment.

The coverage provided by the traditional insurance market was restrictive and expensive.

ERS Solution:

ERS worked with the contractor to form a captive and provide coverage for mechanical breakdown, and

also their exposure to Governmental Action ,Loss of a Key Supplier and Loss of a Key Customer.

Results/Benefits:

The two owners of the concrete construction company each own 50% of the shares of the captive. ERS

Insurance, a Utah based insurance company, issues the three policies that are filed in the state of Utah

and the insured’s captive reinsures ERSI. The captive is in its third year of operation and is generating

an underwriting profit. The insured has used a risk financing strategy to turn a necessary business

expense into a potential profit center.

24

Oil and Gas

International Business Contractual Exposure

Client Concern/Issue:

A U.S. manufacturer builds trucks specially fitted with oil riggs that are sold to oil and gas companies to drill

for oil. Not only does the insured enter into a number of contracts with international customers, their

business is subject to the oil and gas cyclical economy. The loss of one or more of their international

contracts would be detrimental to the financial strength of the manufacturer.

ERS Solution:

ERS worked with the manufacturer to create a captive to insure their Contractual exposure, Loss of a Key

Customer, Mechanical Breakdown and Governmental Action coverage. Given the manufacturer’s focus on

minimizing expenses and capital, the customer utilizes ERS’ Utah cell facility instead of forming a pure

captive. This solution provides the same risk financing benefits but at a lower cost to the owners.

Results/Benefits:

The manufacturer has financed risk successfully each year for four years and has generated an

underwriting profit. In the current year the insured is anticipating a significant decrease in operating

income due to the downturn in the oil and gas market. The risk associated with their manufacturing

operation has decreased along with the decrease in production.

Consequently the insured has decided not to buy coverages through their captive and has placed the

captive in dormancy. This is an effective strategy to keep the captive operating and available for use in

the future without dissolving the captive.

25

Multiple Subsidiaries

Crop Hail Coverage for Farming Operations

Client Concern/Issue:

A doctor on the west coast owns 15 separate farming operations, each producing different crops each

year. The traditional approach for insuring damage to crops is through the Federal Crop Hail Program.

Although this is a good alternative, the perils offered are limited, as there is usually a large deductible

and the coverage offered is restrictive.

ERS Solution:

ERS manuscripted a policy which not only offered better terms than the traditional Crop Hail Policy; but

the coverage offered was expanded to include other causes of loss such as damage due to pesticides.

Results/Benefits:

ERS worked with the owner of the farms to create a Crop Hail policy providing broader coverage than

provided in the traditional insurance market place while also giving the owner an opportunity to generate

underwriting profit within the captives. The risk is distributed amongst his own 15 farming operations.

26

Who Can Own the PIC?

Individuals

Trusts / FLPs

LLCs

Partnerships

Corporations

27

PIC Basic Concept

Business

Premiums may be a business expense

ERS Insurance

PIC

Premiums may not be taxable income for the PIC

PIC Owner

1. Surplus may build on tax deferred basis

2. Liquidation at long-term capital gains rate

28

Premium to Assets

This is what it looks like...

An example of a Private Insurance Company’s net financial performance with annual premiums of $1.2 million

PIC Structure

Distribution

Premium

$1,200,000

Claims:

Planned Distribution

Rate

Mean Claims Amount

$50,000

Start Date (first year of distribution, must be>2)

Standard Deviation

$10,000

Frequency (every N years)

Custom Claims Loss:

Year % of Premium

Years Inside PIC

Yes

5.0%

3

1

10

Custom Claims Loss 1

3

$250,000

Business Structure

LLC

Custom Claims Loss 2

7

$750,000

Planned Liquidation

Yes

Maximum Distribution Percentage

3.0%

$7,780,418PIC = Net Premiums + Investment Returns (after tax)

Using PIC

$8,066,462

NOT Using PIC

$6,365,845

Net Benefit

$1,700,617

Net Benefit of PIC

26.7%

ROI on Gross Premiums

14.2%

Actual setup fees will vary depending on domicile chosen

and whether captive type is a Pure, Sponsored Cell or

Delaware Series Business Unit.

29

To Qualify as an Insurance Contract:

Business Purpose (resemble insurance in its commonly accepted sense)

Insurance risk (fortuitous, not investment risk)

Risk Transfer

Risk Distribution

On December 30, 2002 the IRS issued three revenue rulings regarding the deductibility of

insurance premiums. The IRS provides safe harbor if a PIC’s operations fall under one of the

following three revenue rulings:

IRS “Safe Harbors” for Private Insurance Companies

Pool (2002-89)

Multiple Subsidiaries (2002-90)

Group Private Insurance Company (2002-91)

30

Disclaimer

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the U.S. Internal

Revenue Service, we inform you that any U.S. federal tax advice contained in this PowerPoint is not

intended or written to be used, and cannot be used, for the purpose of (a) avoiding penalties under the

U.S. Internal Revenue Code or (b) promoting, marketing or recommending to another party any

transaction or matter addressed herein.

The views and statements expressed in this presentation are for general information only. ERS, LLC is

not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or

other professional advice or services. This presentation provides general information about certain legal

and accounting issues and should not be regarded as rendering legal or accounting advice to any person

or entity. As such, the information is not privileged and does not create a client relationship with the

companies, or any of its employees. This presentation does not constitute an offer to represent you, and

you should not act, or refrain from acting, based upon any information so provided. In addition, the

information contained in this presentation is not specific to any particular case or situation and may not

reflect the most current developments.

31

Contact Us

Robert Nizzi, President

t: 913-220-0442

e: rnizzi@eriskstrategies.com

Dana Marino, Business Development/East Coast

t: 610-353-4820

e: dmarino@eriskstrategies.com

www.eriskstrategies.com

32

Our Mission

To be the worldwide value and service leader in insurance brokerage, employee benefits, and risk management

Our Goal

To be the best place to do business and to work

www.lockton.com

© 2015 Lockton, Inc. All rights reserved.

Images © 2015 Thinkstock. All rights reserved.

33