Attachment

advertisement

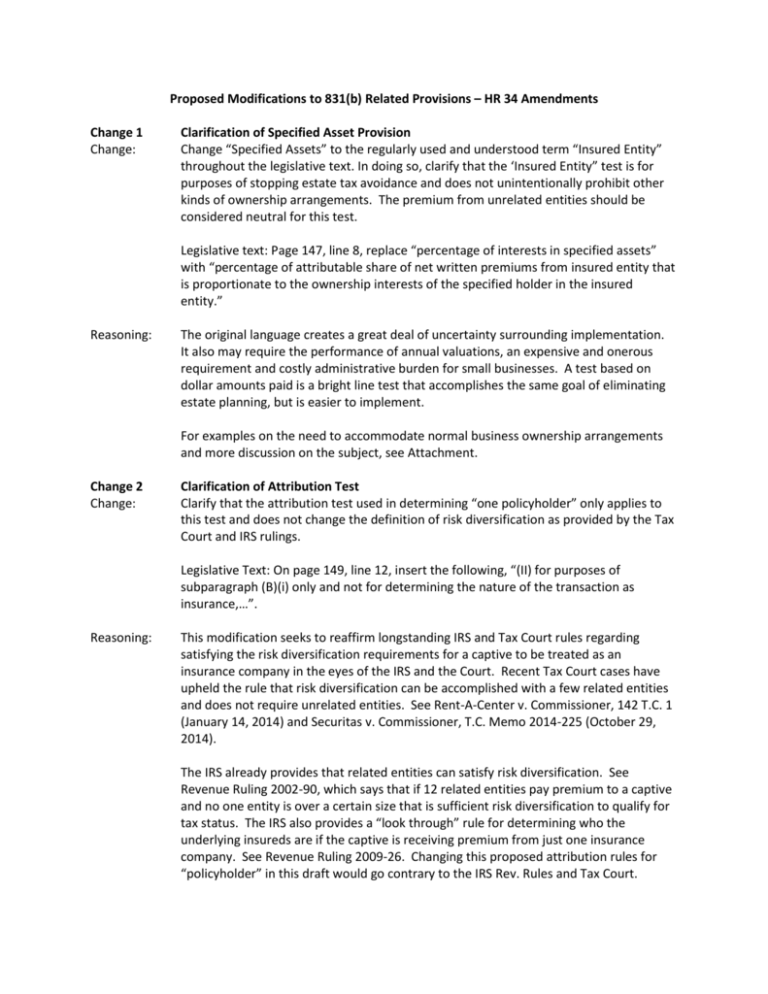

Proposed Modifications to 831(b) Related Provisions – HR 34 Amendments Change 1 Change: Clarification of Specified Asset Provision Change “Specified Assets” to the regularly used and understood term “Insured Entity” throughout the legislative text. In doing so, clarify that the ‘Insured Entity” test is for purposes of stopping estate tax avoidance and does not unintentionally prohibit other kinds of ownership arrangements. The premium from unrelated entities should be considered neutral for this test. Legislative text: Page 147, line 8, replace “percentage of interests in specified assets” with “percentage of attributable share of net written premiums from insured entity that is proportionate to the ownership interests of the specified holder in the insured entity.” Reasoning: The original language creates a great deal of uncertainty surrounding implementation. It also may require the performance of annual valuations, an expensive and onerous requirement and costly administrative burden for small businesses. A test based on dollar amounts paid is a bright line test that accomplishes the same goal of eliminating estate planning, but is easier to implement. For examples on the need to accommodate normal business ownership arrangements and more discussion on the subject, see Attachment. Change 2 Change: Clarification of Attribution Test Clarify that the attribution test used in determining “one policyholder” only applies to this test and does not change the definition of risk diversification as provided by the Tax Court and IRS rulings. Legislative Text: On page 149, line 12, insert the following, “(II) for purposes of subparagraph (B)(i) only and not for determining the nature of the transaction as insurance,…”. Reasoning: This modification seeks to reaffirm longstanding IRS and Tax Court rules regarding satisfying the risk diversification requirements for a captive to be treated as an insurance company in the eyes of the IRS and the Court. Recent Tax Court cases have upheld the rule that risk diversification can be accomplished with a few related entities and does not require unrelated entities. See Rent-A-Center v. Commissioner, 142 T.C. 1 (January 14, 2014) and Securitas v. Commissioner, T.C. Memo 2014-225 (October 29, 2014). The IRS already provides that related entities can satisfy risk diversification. See Revenue Ruling 2002-90, which says that if 12 related entities pay premium to a captive and no one entity is over a certain size that is sufficient risk diversification to qualify for tax status. The IRS also provides a “look through” rule for determining who the underlying insureds are if the captive is receiving premium from just one insurance company. See Revenue Ruling 2009-26. Changing this proposed attribution rules for “policyholder” in this draft would go contrary to the IRS Rev. Rules and Tax Court. Change 3 Change: Increase of De-Minimis Standard Modify the de-minimis standard to 5% and request that the IRS write rules for greater amounts based on needs to avoid inadvertent slipups. On page 148, line 13, delete the current de-minimis rule and provide the following: “At least 5 percentage points shall be treated as de-minimis and the Secretary shall increase the de-minimis amount by regulations or other guidance to allow for an insurance company to maintain the election for inadvertent deviations in excess of the standard de-minimis percentage.” Legislative Tex: Page 150, line 5, after (b)(2)(A)(ii) add the following “…where the taxpayer is meeting the alternative diversification requirement and the specified holder and/or his spouse or lineal descendant (including by adoption) of the individual hold more than a 50% interest in such insurance company or insured entity.” Reasoning: The purpose of this change is to not impose an onerous information gathering or reporting when there is no need. A 2 percent standard is not sufficient to avoid unintended consequences due to minor ownership differences in the policyholders and would not highlight those returns where there was potential abuse. A 5 percent standard has precedent in the tax code in estate tax areas and in insurance premium areas. In addition, if there is no control of either the policyholder or the insurance company, there is no real need for gathering detailed shareholder information on all of the minority shareholders. For gift tax purposes, a 5% de-minimis standard is used for determining when a lapse of a general power of appointment creates a gift is under section 2515(e). A de-minimis standard of the lesser of 5 percent or $1,000,000 is used in an insurance premium context with sections 953 and 954. See § 954(b)(3)(A). While 5 percent is a minimum, we believe the IRS will see the need to provide additional guidance in the future to protect the election for accidental mistakes by taxpayers. For example, if someone unknowingly has a mismatch of ownership of business to ownership of captive, the IRS may grant them 90 days to bring it back into compliance. Another example if a Person A owned 100% of the captive and 100% of the business, but upon his death, the will passed the ownership of the business and captive to different children. The IRS could write rules to allow them a short period of time to fix the ownership before the election is failed. Congress should require the IRS to write such de-minimis exceptions. Change 4 Change: Two-Year Sunset Provision for Existing Captives Inclusion of a two-year sunset provision for existing 831(b) electing-captives. Legislative text: Page 151, line 7, change December 31, 2016 to December 31, 2017. Reasoning: This two-year sunset prevents unintended consequences from captives that already paid premiums to their captive prior to the change in law. For example, business paid premiums on December 1, 2015 for a policy that runs through November 30, 2016. Claims made during that policy period often take a year or more to resolve. Therefore, it will take at least until November 30, 2017 to settle all claims for an insurance policy that was purchased prior to the change of law. Attachment The following examples demonstrate normal ownership arrangements of small business owners and normal risk management situations faced by these owners. If these businesses need to form a captive for appropriate risk mitigation, it will be extremely challenging, if not impossible, to own a single parent captive making the 831(b) election because there will be no possible way to own the captive that will satisfy the Alternative Diversification tests. We understand the goal of these restrictors is to prevent abuse of estate planning techniques and not to put a chill on legitimate uses of captives that have no estate tax motivation. As you will see, under the current proposed definition of Specified Assets in the amendment, it creates a prohibitive standard that will unnecessarily prevent many business owners from using a captive for their intended and legitimate uses. The examples should demonstrate four important characteristics that should be part of the new Diversification test: 1) The formula for testing ownership percentages should be based on attributable premiums based on premiums paid times ownership percentage of such payor, and not on ownership interest in a business. Basing the test on “ownership interest” may require annual valuations of all businesses, which is something that small businesses normally don’t do and which will lead to disagreements between the IRS and taxpayer as to the valuation of a business. A test based on dollars paid is a bright line test that is easier to follow and accomplishes the same goal of eliminating estate tax planning. 2) The formula for testing attributable premiums needs to recognize that 3rd parties pay premiums to a captive and these premiums should not go against the ownership percentages test. 3) Many family business organizations have multiple businesses that often have differing ownership. Unless some flexibility is built into the rules, the current formula will prohibit many of these family businesses from doing a captive because it is impossible to own a captive in a way that would satisfy the Alternative Diversification test. 4) The IRS needs to write regulations on the de-minimis exceptions to accommodate situations much greater than 5% when it is clear that no estate tax minimization is the goal of the parties. EXAMPLE 1 Father owns 4% of bank A. Son owns 5% of bank B. Assume each bank has a captive owned in exact same percentage as the bank. The two banks participate in a risk pool with a number of other banks, including each other’s bank. Each captive receives more than 20% of its premium directly from the insured parent bank, thus they do not qualify for the 20% Diversification rule. Clearly this is not a situation where there was any estate planning intent. This situation would appear to fail the Alternative Diversification test as well, for two reasons. First, since Son owns 5% proportionally of bank B’s captive and 0% of bank A’s captive, this is a prohibited ownership arrangement since an amount of bank A’s premium will come to bank B’s captive through the risk pool. Second, assuming the de-minimis amount was raised to 5%, the term interest could be interpreted as valuation of the business or interpreted as the amount of premium paid. In a model situation, bank A was ten times the size of bank B and paid ten times the premium to the risk pool. This would force participates to perform annual valuations of the businesses participating and the captives to ensure that the ownership interest amounts stay within allowable limits. This is an onerous test and would require information gathering and reporting that would swamp the IRS with useless information with respect to identifying transactions with estate planning motivation. EXAMPLE 2 Father and Son each own 50% of ABC Property Managers. ABC manages the portfolio of properties for four really large apartment complex developers in the gulf coast states. ABC forms a captive to insure some of the risks of its clients. The captive is owned by Father and Son, 50% each and any profits earned by the captive would be rebated back to the developers by way of reducing premiums charged the next year. The four developers are independently owned from each other and independent of ABC, except that Father owns 10% ownership in one of the developers. Assume that the premium paid by each developer was $100,000 and the total annual premium from all was $400,000. Because the Father owns 10% of one of the developers, it is a Specified Asset. Because the son owns 50% of the captive, he is a Specified Holder. Because the son’s ownership percentage of the captive (50%) is higher than his ownership percentage of the developer for which his father has an ownership (son owns 0%, father owns 10%), the 831(b) election is prohibited. This is a strange result given that the captive and the business sponsoring the captive are owned in the exact same percentage, and given that the premium paid came from 3rd parties for which the Father has either zero or a minority interest. EXAMPLE 3 Senior Care LLC is a nursing home operator with operations in 4 states. Senior Care is owned 100% by Bill. The cost of professional liability insurance for nursing home operators has gone up significantly for all nursing home operators because of increased lawsuits. Senior Care LLC’s has never lost a large lawsuit, but because the insurance rates are going up for the entire industry, they are either forced to pay unreasonably high premiums, or find an alternative. Senior Care decides to form a captive to insure professional liability. Senior Care has a regional manager that heads up the operations in each of its 4 states. As a way to incentivize each of these regional managers to avoid malpractice claims, the 4 Regional Managers will own the captive, 25% each. One of the Regional Managers is Bill’s son Matthew. This captive is not allowed to make the 831(b) election because Matthew (the son) owns a higher percentage of the captive (25% of captive) than he does of the business (0% of Senior Care).