Part 1

advertisement

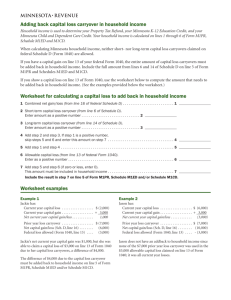

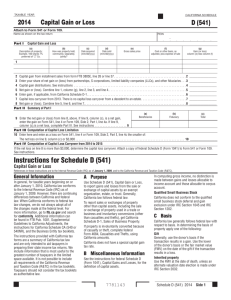

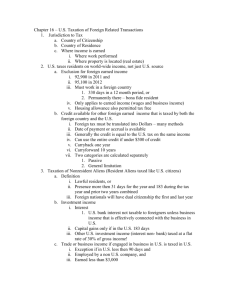

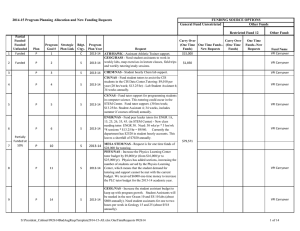

Part 1 Individuals 1 Two Cardinal Rules in Studying for the Enrolled Agents Exam Rule 1 – There are absolutely NO shortcuts in studying for the EA Exam Rule 2 – Refer to Rule 1 2 Pyramid Approach to Studying Final Review Cards PowerPoint Webinar Presentation NSA EA Exam Review Course IRS Publications 3 References Used in Slides Color Code Description of Topic - Based on analysis of last 10 publicly-available exams: Red [R] – Basic knowledge topic asked frequently Blue [B] – Complex topic asked fairly frequently Green [G] – Basic topic asked less frequently Yellow [Y] – Complex topic seldom tested * (asterisk) - Indicates at least 7 questions on the topic on last 10 publicly-available exams 4 Topic 30 Capital Gain & Loss Netting of Individuals 5 *30A Capital Gain and Loss Netting Process [R] 3-Step Process – (1) Net all S/Ts, (2) Net all L/Ts, (3) if same sign, add separately to income; if opposite signs, add net difference to income (Note: LT > 1yr) Final Result – 4 Basic Rules (for one transaction): S/T Capital Gain – Treat as ordinary income S/T Capital Loss - $3,000 offset against ordinary income L/T Capital Gain – 15% max. rate (0% if 10% or15% ordinary income bracket, 20% if 39.6% ordinary bracket) L/T Capital Loss - $3,000 offset against ordinary income Figure 1-8 Question 99 6 Figure 1-8 2010 2011 2012 2013 Transactionsrrent-Year Capital Transactions (Before c/o): ST Gain $16,000 $18,000 $ 3,000 $ 2,000 ST Loss (18,000) (26,000) ( 2,000) ( 6,000) LT Gain 24,000 2,000 8,000 4,000 LT Loss (12,000) ( 1,000) ( 2,000) ( 8,000) Net Result: Net ST ( 2,000) ( 8,000) ( 3,000) ( 4,000) Net LT 12,000 1,000 6,000 ( 4,000) Adjusted Gross Income: Salary $70,000 $70,000 $70,000 $70,000 Capital 10,000* ( 3,000) 3,000* ( 3,000) AGI $80,000 $67,000 $73,000 $67,000 Capital Loss Carryovers (c/o): ST Loss c/o 0 ( 4,000) 0 ( 1,000) LT Loss c/o 0 0 0 ( 4,000) * Qualifies for 15% maximum rate 2014 $ 9,000 ( 1,000) 8,000 ( 6,000) 7,000 ( 2,000) $70,000 5,000 $75,000 0 0 7 Question 99 During 2014, George sold the following shares of stock: Stock V Corp. Q Corp. A Corp. J Corp. Purchased 5/18/09 8/16/13 2/14/13 3/27/14 Basis $ 300 $3,000 $1,200 $2,000 Sold 9/3/14 1/6/14 1/9/14 9/2/14 Proceeds $1,000 $2,500 $ 600 $3,500 What is George’s net capital gain or loss for 2014? a. $(1,100) b. $(1,200) c. $1,100 d. $1,200 8 30B Preferential Tax Rates for Long-term Capital Gains [G] If Net L/T Gain – Determine appropriate rates 15% (or 0%) - Basic rate for most L/T capital gains 25% - For “unrecaptured Sec. 1250 gain” on realty 28% - For collectibles, Sec. 1202 stock gain, & all c/o Step Netting Process – Four columns for 4 rates: 1. 2. 3. 4. If 15% Nets to a Loss – Net against 28% result first If S/Ts Net to a Loss – Net against 28% result first If 28% Nets to a Loss – Net against 25% result first If 25% Nets to a Loss – Net against 15% result Figure 1-9 Question 100 9 Figure 1-10 All Short-Term (4,000) 9,000 (9,000) 28% 25% 15% Long-Term* Long-Term Long-Term (5,000) 14,000 (10,000) 4,000 6,000 12,000 1,000 (3,000) (4,000) 8,000 14,000 ** (3,000) | (3,000) <--------------------------v v--------- (4,000) 1,000 ** * Includes any long-term capital loss carryover ** Result - $1,000 taxed at a 28% rate, and $14,000 taxed at a 25% rate 10 Question100 In December, Emily sold an antique rug for $4,100. She bought the rug two years ago for $1,100. What is her taxable gain and at what maximum rate will it be taxed? a. $3,000 long-term capital gain, taxed at regular rate b. $3,000 long-term capital gain, taxed at 28% rate c. $1,500 long-term capital gain, taxed at regular rate d. $1,500 long-term capital gain, taxed at 28% rate 11 *30C Tax Treatment of Net Capital Losses [R] $3,000 – Maximum combined ordinary income offset for net S/T and net L/T losses each yr. (use S/T first) $1,500 – Married – filing separately limit If Taxable Income < Capital Loss – Full limit (up to $3,000) still assumed utilized in computing carryover Capital Loss Carryover – Indefinite (retain character) Decedent’s Return – No carryovers possible Question 101 and Question 102 12 Question 101 During the current year, Nancy had the following transactions: Short-term capital loss $(2,400) Short-term capital gain 2,000 Short-term capital loss carryover from 2013 (1,400) Long-term capital gain 3,800 Long-term capital loss (8,000) What is the amount of her capital loss deduction, and what is the amount and character of her capital loss carryover to the next year? Deduction Carryover a. $0 $6,000 long-term b. $3,000 $3,000 long-term c. $6,000 $-0d. $3,000 $3,000 short-term 13 Question 102 Bob sold securities in 2014. The sales resulted in a capital loss of $7,000. He had no other capital transactions. He and his wife Gloria decide to file separate returns for 2014. His taxable income was $26,000. What amount of capital loss can he deduct on his 2014 return and what amount can he carry over to 2015? a. $7,000 in 2014 and $0 carryover b. $3,000 in 2014 and $4,000 carryover c. $4,000 in 2014 and $3,000 carryover d. $1,500 in 2014 and $5,500 carry over 14