summary Buscon schorlarship - Assumption University

advertisement

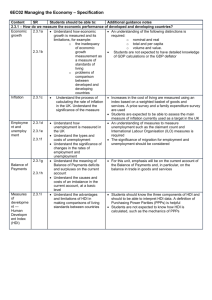

Chapter7: Economic growth, Business cycle, Unemployment, and Inflation 2 framework 1. Short run- a period of time in which the quantity of at least one input is fixed and the quantities of other inputs can be varies. 2. Long run- a period of time in which the quantities of all inputs can be varies. Growth – consider a long run framework which focuses on supply. Business cycle – consider a short run framework which focuses on demand. Inflation and Unemployment – fall within both framework. Growth The primary measurement of growth is changes in real GDP. *GDP- the market value of all final goods and services produced in an economy, stated in the prices of a given year. *GDP per capita = GDP/the total population. Business cycle There are 4 phases of the business cycle – Peak, Downturn, Trough, and Upturn. The business cycle changes over time. Unemployment The unemployment rate is the percentage of people who are willing and able to work but are not working. 1. Cyclical unemployment –results from fluctuations in economic activity. 2. Structural unemployment – caused by economic restructuring making some skills obsolete. *Full employment – an economic climate where nearly everyone who wants a job has one. Target rate of unemployment – the lowest sustainable rate of unemployment achievable under existing conditions. The changed of unemployment rate due to changing of; demographic, social and institutional structures, and unemployment insurance and welfare. Unemployment rate = (number of umemployed/labor force)x100 Inflation Inflation – a continual rise in the price level. Inflation is measured with changes in price indexes. *Price index – a number that summarizes what happens to a weighted composite of prices of a selection of goods over time. *Deflation – a continual fall in the price level. *Real World Price Indexes – GDP deflator, CPI, PCE,PPI >>> Nominal output – the total amount of goods and services measured at current prices >>>Real output- the total amount of goods and services produced, adjusted for price level changes. Real output = (Nominal output/price index)x100 Chapter 8: Measuring the Aggregate Economy National Income Accounting National Income Accounting – is a set of rules and definitions for measuring economic activity in the aggregate economy. 1. Gross Domestic Product (GDP) - the market value of all final goods and services produced in an economy, stated in the prices of a given year. >> one way to measure National Income Accounting. GDP = Consumption + Investment +Government spending + (Export-Import) GDP does not measure total transactions in the economy. It counts final output, but not intermediate goods. Counting the sale of both final output and intermediate goods would result in double counting. 2. Net Domestic Product (NDP) – is GDP adjusted for depreciation- the amount of capital used up in producing the year’s GDP. >> measure output available for purchase. NDP = Consumption + Investment +Government spending +(Export-Import)– Depreciation 3. Gross National Product (GNP) – is the aggregate final output of citizens and businesses of an economy in one year. *GDP is output produced within a country’s borders. But GNP is output produced by a country’s citizens. GNP = Consumption + Investment +Government spending + (Export-Import) + Net foreign factor income Aggregate Income = Aggregate Production Aggregate income – is the total income earned by citizens and businesses in a country in a year, consist of; employee compensation, rent, interest, profit. Chapter 9: Growth, Productivity, and The Wealth of Nation General Observations about Growth 1. Growth and Potential Output Growth is an increase in potential output. - Potential output – the maximum output an economy can produce from the existing production function and existing resources. The long-run growth focus is on how to increase potential output. - Say’s Law – supply creates its own demand – applies to the long run. The short-run focus is on how to get the economy operating at its potential. 2. Growth for Living Standard Growth improves average living standards because of compounding, long-term growth rates can make huge differences. Rule of 72 – # years to double= 72/ growth rate. Eg. If China’s per capita income of $2000 grows 9% per year and the U.S. per capita income of $40,000 grows 1% per year. 3. Markets, Specialization, and Growth - Markets may seem to be unfair because of the effect that they have on the distribution of income. - Specialization the concentration of individuals on certain aspects of production. - Division of labor the splitting up of a task to allow for specialization of production. 4. Economic Growth, Distribution, and Market 5. Per Capita Growth - Per capita output is total output divided by total population. - Per capita growth means producing more goods and services per person. Per capita growth = % Δ in output - %Δ in population Some suggest that median income is a better measure because it takes into account how income is distributed. Sources of growth 1. Growth Compatible Institution Markets and private ownership of property foster economic growth.> When individuals get much of the gains of growth themselves, they work harder. > Corporations are a growth-compatible institution because of limited liability, which gives stockholders an incentive to invest their savings in large enterprises. 2. Investment and Accumulated Capital Although capital is a key element in growth, capital accumulation does not necessarily lead to growth. Capital may become obsolete. Capital is much more than machines. Human capital – skills that workers gain from experience, education, and on-the-job training. Social capital – the habitual way of doing things that guides people in how they approach production. 3. Available Resources - The growth in the U.S. in the 20th century was due in part to its large supply of natural resources. - New technology can overcome a lack of resources. - Greater participation in the market may increase the labor force participation rate. 4. Technological Development - Technology - changes in the way we make goods and supply services, and in the goods and services we buy. - Advances in technology shift the production possibilities curve outward by making workers more productive. 5. Entrepreneurship is the ability to get things done using creativity, vision, and a talent for translating vision into reality. Eg. Thomas Edison – generation and use of electricity, Henry Ford – automobile production. Production Function Production function shows the relationship between inputs and outputs. Growth is shown by a shift in the production function. Output = A●f(labor, capital, land) Scale Economy - describe what will happens to output if all inputs increase by the same percentage Law of Diminishing Marginal Productivity - Increase in one input, keeping all others constant, will lead to smaller and smaller gain in outputs Classical Growth Model According to the Classical growth model, the more capital an economy has, the faster it will grow. Classical economists focused their analysis and their policy advice on how to increase investment: Saving > Investment > Increase in capital > Growth New Growth Theory Unlike Classical growth theory, which left technology outside of economic analysis, new growth theory emphasizes the role of technology rather than capital in the growth process. Technology > Investment > Further Tech Development > Growth Growth Theories and Policies Chapter 11: The Multiplier Model AS/AD Model when Price are Fixed The multiplier model was designed to explain how an initial shift in expenditures changes equilibrium output when the price level is fixed Aggregate Production The total amount of goods and services produced in an economy. Production creates an equal amount of income, so the 45° line represents production=income. Aggregate Expenditures - the total amount of spending on final goods and services 2-Type of Expenditures 1. Autonomous Expenditures expenditures that do not systematically vary with income. 2. Induced Expenditures expenditures that change as income changes. Aggregate Expenditure Curve Marginal Propensity to Expend is the ratio of the change in aggregate expenditures to a change in income. The relationship between aggregate expenditures and income can be expressed mathematically as: AE = AE0 + mpeY Autonomous Induced AE0 = C0 + I0 + G0 + (X0 – M0) Equilibrium Aggregate Income The Multiplier Equation The multiplier equation can be used to find equilibrium income. The expenditures multiplier reveals how much income will change in response to a change in autonomous expenditures. YE = multiplier x autonomous expenditures multiplier 1 1 - mpe The Multiplier Process Circular Flow and Multiplier Process Chapter 13: The Financial Sector and the Economy Financial Market and Macro The financial sector channels savings back into the circular flow. For every financial asset, there is a corresponding financial liability. Financial assets – assets such as stocks or bonds, whose benefit to the owner depend on the issuer of the asset meeting certain obligations. Financial liabilities - obligations by the issuer of the financial asset. Financial Sector as a Conduit for Savings Role of Interest Rates in the Financial Sector The interest rate is the price paid for use of a financial asset - The long-term interest rate is the price paid for financial assets with long maturities, called loanable funds The short-term interest rate is the price paid for financial assets with short maturities, called money. Definition and Functions of Money Money is a highly liquid financial asset. Functions of Money 1. medium of exchange 2. unit of account 3. store of wealth Money Multiplier Reserve ratio = required + excess. Reserves are cash and deposits a bank keeps on hand or at the Fed. The reserve ratio is the ratio of reserves to deposits a bank keeps as a reserve against cash withdrawals. Banks can keep more reserves: excess reserve ratio. Eg. 1 c rc If people hold cash, the money multiplier in the economy is: r = the percentage of deposits banks hold in reserve c = the ratio of money people hold in cash to the money they hold as deposits Demand for Money : because 1. Transaction 2. Precautionary 3. Speculative Chapter16: Inflation and the Phillips Curve Phillips curve tells the relationship between unemployment and inflation. (inflation rate increase, unemployment rate decrease) The distributional effects of inflation - Unexpected inflation may redistribute income from lenders to borrowers. People who don’t expect inflation and who are tied to fixed nominal contracts are likely to lose in inflation period. People who get flexible income can gain in the period of inflation but people who get fixed income will lose in inflation period. Expectations of inflation = Nominal rate – Real rate 1. Rational expectation – economist’ model predict 2. Adaptive expectations – past eg. 2010(2%), 2011(4%), >> 2012 (= 3%) 3. Extrapolative expectation – assume a trend will continue eg. 2010(2%), 2011(4%), >> 2012(6%) Productivity, Inflation, and Wages - Changes in productivity and wages determine inflation may be coming There will be no inflation pressure if wages and productivity increase at the same rate Inflation = Nominal wage increase – Productivity growth The equation of exchange Quantity of money x Velocity of money = Price level x Real output Money Supply no. of times money Nominal GDP have spent (Fix) So, 𝑉𝑒𝑙𝑜𝑐𝑖𝑡𝑦 = 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐺𝐷𝑃 𝑀𝑜𝑛𝑒𝑦 𝑆𝑢𝑝𝑝𝑙𝑦 Theories of inflation (both theories agree that money and inflation are positively related, but they have different causes and effects) 1. The quantity theory – emphasizes the connection between money and inflation. MV>> PQ (Increase in money cause direct increases in prices) - The second assumption of the quantity theory is that real output (Q) is independent of the money supply. (Q is autonomous, determined by forces outside those in quantity theory.) - The third assumption is that causation goes from money to prices. >> If the central bank must buy government bonds to finance a government deficit, the money supply increases and inflation may occur. This inflation works as a kind of tax on individuals, and is often called an inflation tax because it reduces the value of cash. >>Central banks have to make a policy choice:1. Ignore inflation by bailing out their governments with an expansionary policy. Or 2. Do nothing and risk recession. 2. The institutional theory – emphasizes market structure and price-setting institutions and inflation. PQ>>MV (Increases in prices forces government to increase the money supply or cause unemployment) - The source of inflation is firms who pass on higher wages, rents, taxes, or other costs on to consumers in the form of higher prices. - If the government increases the money supply so that demand is sufficient to buy the goods at higher prices, inflation is the result. - If the government doesn’t increase the money supply, unemployment increase. Demand-Pull and Cost-Push Inflation 1. Demand-Pull Inflation occurs when the economy is at or above potential output. 2. Cost-Push Inflation occurs when the economy is below potential output. Addressing Inflation with Monetary Policy The Phillips Curve In short-run, it is negative relationship between Inflation and Unemployment rate (but in long-run, it is no relationship. Point A is the Institutional theory (higher inflation) and point B is the Quantity theory (lower inflation). The importance of Inflation Expectations PC0 is the short-run Philips Curve; each curve has it own expectation of inflation. Unemployment rate is fixed in the long-run. Inflation Expectation and the Phillips Curve These 2 graphs are the same situation; it tells us how the expectation of inflation plays a role in the economic system. At first, point A, people don’t think about Inflation, they think inflation is zero. But later on they realize that there is the inflation by 4%, so workers ask for the increasing wages, then the curve shift to the point B. After that, workers get higher income, the curve then shift to point C which shows the curve with the expectation of inflation in the long-run. Quantity Theory and the Inflation/ Growth Trade-Off - Quantity theorists believe that low inflation should be the priority of policy. They believe that low inflation leads to growth because 1. It reduces price uncertainty, making it easier for businesses to invest in future production. 2. It encourages businesses to enter into long-term contracts. 3. It makes using money much easier. Institutional Theory and the Inflation/ Growth Trade-Off - Institutionalists are less sure about a negative relationship between inflation and growth. They don’t agree that all price level increases start inflation. If inflation does get started, the government has tools to get rid of it relatively easily. Chapter 17 Deficits and Debt 1. Classical Economics 2. Sound Finance – the government budget should always be balanced except in wartime. Nuanced Sound Finance – a policy of sound finance should be maintained in a small recession, but a depression might require deficit financing. Functional Finance – government should make spending and taxing decisions on the basis of their effect on the economy. - If spending was too low, government should run a deficit. If spending was too high, government should run a surplus. Problem with Fiscal Policy – 6 assumptions of the AS/AD model lead to problems with fiscal policy 1. Financing the deficit has no offsetting effects – not true in reality 2. The government knows what the situation is – not true in reality - Data problems limit the use of fiscal policy for fine tuning (getting reliable numbers on the economy takes time. And we may be in the recession but we don’t know it) - The government has large econometric models and leading indicators to predict where the economy will be in the future, but the forecasts are imprecise. 3. The government knows potential income – not true in the reality - No one knows for sure the potential (full-employment) income. - Differences in estimates of potential income often lead to different policy recommendations. 4. The government has flexibility in changing spending and taxes- not true in the reality(need to ask for the congress before) - Putting fiscal policy into place takes time and has serious implementation problems. - Numerous political and institutional realities make it a difficult task to implement fiscal policy. - Disagreements between Congress and the President may delay implementing appropriate fiscal policy for months, even years. 5. The size of government debt doesn’t matter - increases in government debt has occurred because: 1. Early activists favored not only the use of fiscal policy, but also large increases in government spending. 2. Politically it’s easier for government to increase spending and decrease taxes than vice versa. 6. Fiscal policy doesn’t negatively affect other goals (it’s not true because it affects other goals. eg. GDP increases> people richer>price level increases>import more>net export decreased (side effect)> trade deficit>GDP decreased (so GDP that was increased at first, will increase just little) - A society has many goals: achieving potential income is only one of those goals. - National economic goals may conflict. Building Fiscal Policy into Institutions (to avoid the problems of direct fiscal policy) - - Automatic stabilizers (first aid kit) – any government policy that will counteract the business cycle without any new government action. Automatic stabilizers include: o welfare payments o unemployment insurance o income tax system How automatic stabilizer work: When the economy is in a recession, the unemployment rate rises. Unemployment insurance is automatically paid to the unemployed, offsetting some of the fall in income. Income tax revenues also decrease when income falls in a recession, providing a stimulus to the economy. Automatic stabilizers also work in reverse. (When the economy expands, government spending for unemployment insurance decreases and taxes increase.) State Government Finance & Procyclical Fiscal Policy 1. State Government Finance Government Fiscal, we can divide into expansionary and contractionary. - Recessions, states cut spending and raise taxes - Expansions, states increase spending and cut taxes 2. Procyclical Fiscal Policy Procyclical Fiscal Policy changes in government spending and taxes that increase the cyclical fluctuations in the economy instead of reducing them. (It will go follow the business cycle, if economic boom, correct more taxes. This is usually used in less develop country because they don’t know that it will cause more recessionary gap and bubble burst problem.) Countercyclical Fiscal Policy does opposite to the business cycle. New Classical Public Finance a theoretical approach to macroeconomics that revived many pre-Keynesian ideas. - It is centered on the Ricardian equivalence theorem. (deficits don’t effect the level of output. It is criticized because it assumes the aggregate economy is a single representative agent and ignores coordination problems. The Nuanced Keynesian and New Classical Views The Nuanced Keynesian New Classical Fiscal Policy is important Fiscal Policy is no need Incentive and Supply-Side Effects of Public Finance - The Republican party used New Classical macroeconomics to justify tax cuts. Supply-side economics emphasized the incentive effects of tax cuts that would lead to growth. Tax cuts were designed to prevent the growth of government spending. Chapter 19: INTERNATIONAL TRADE POLICY, COMPARATIVE ADVANTAGE, AND OUTSOURCING Balance of trade – the difference between the value of exports and the value of imports. - Trade deficit – imports > exports Trade surplus – exports > imports The law of one price – in a competitive market there will be pressure for equal factors to be priced equally. - If factor prices aren’t equal, firms reduce costs by reorganizing production in countries with lower factor prices. Convergence hypothesis – the tendency of economic forces to eliminate transferable comparative advantage. Methods of Equalizing - Adjustments eventually occur to make surplus countries less competitive and deficit countries more competitive. Wages rise in the surplus countries, making their goods more expensive. The exchange rate of the deficit country falls and makes its goods less expensive. Varieties of Trade Restrictions - Tariffs (taxes on imports) Quotas (quantity limits placed on imports) Voluntary restraint agreements Embargoes (a total restriction on import and export of good) Regulatory trade restrictions (government-imposed procedural rules that limit imports) Nationalistic appeals (e.g. “Buy American” campaigns) Tariffs When the Domestic Quotas When the Domestic Country is Small Reasons for Trade Restrictions - Unequal internal distribution of the trade gains Haggling by companies over the trade gains - Haggling by countries over trade restrictions - Specialized production: learning by doing and economies of scale - Macroeconomic aspects of trade - National security - International politics - Increased revenue from tariffs Why Economists Generally Oppose Trade Restrictions - Free trade increases total output globally. - International trade provides competition for domestic companies. - Restrictions based on national security are often abused or evaded. - Trade restrictions are addictive. Chapter 20: International Financial Policy Exchange Rate - An exchange rate is the rate at which one country’s currency can be traded for another country’s currency. *The exchange rate is determined by demand and supply in the forex (foreign exchange) markets where traders buy and sell currencies Supply – Demand for Euro Fundamental Forces Determining Exchange Rates 1. A country’s income 2. Changes in a country’s prices Income or prices increase in the U.S. > Imports increase > Demand for foreign currency to buy imports increase which means the supply of the dollar increases > The increase in supply of the dollar causes the price of the dollar to decrease 3. The interest rate in a country Interest rates in the U.S. increase > Demand for U.S. interest-bearing assets increases > Demand for dollars to buy U.S. assets increases > The increase in the demand for dollars causes the price of dollars to increase 4. A country’s trade policy - Expansionary Monetary Policy - - Contractionary Monetary Policy Direct Exchange Rate Intervention To avoid the problems caused by fluctuating exchange rates, governments sometimes intervene to fix exchange rates by buying and selling its currency. If it buys its currency, it can increase its exchange rate. If it sells its currency, its value decreases. Currency Support