Статьи – Статья 2 Trends in Post-Crisis Capital Flows in the CIS

advertisement

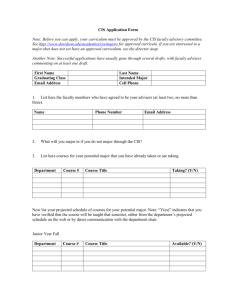

Издания и публикации -- Статьи – Статья 2 Trends in Post-Crisis Capital Flows in the CIS Elvira Kurmanalieva – Ph.D., head of Country Research Unit, Strategy and Research Department, Eurasian Development Bank. Evgeny Vinokurov – Ph.D., director of the Centre for Integration Studies, Eurasian Development Bank. Euromoney Emerging Markets Handbook 2011/12 www.euromoney-yearbooks.co.uk Trends in Post-Crisis Capital Flows in the CIS Elvira Kurmanalieva and Evgeny Vinokurov Elvira Kurmanalieva – Ph.D., head of Country Research Unit, Strategy and Research Department, Eurasian Development Bank. Evgeny Vinokurov – Ph.D., director of the Centre for Integration Studies, Eurasian Development Bank. The 2008-2009 crisis showed how strongly the world’s economies depend on each other. Back in 1998, capital flows were an issue of concern mainly for Asian countries; now they are a global issue. Regional supranational institutions develop ‘safety nets’ to protect themselves against sharp flows of ‘hot money.’ This short essay analyses capital flows to and from CIS countries and discusses government measures to prevent balance-of-payments crises. Capital Flow Dynamics in 2010 After the 1997-1998 crisis, a net inflow of foreign capital into CIS countries began in 2001 and peaked in the pre-crisis year of 2007 (see Chart 1). The global crisis then caused a significant capital outflow from CIS economies from 2008 until the end of 2010. Chart 2 shows average annual changes in capital flows in 2004-2007 and changes in balances of payments in CIS countries in 2010. It is interesting to note that energy exporters find themselves in the lower part of the chart, hence the reason for their net capital outflow in 2010. Azerbaijan and Kazakhstan experienced a net outflow in the “other investments” item of their balance of payments. This item includes short-term and long-term debt capital and payments on the current accounts of the balance of payments. For example, export payments are usually represented in the balance of payments as an increase in the foreign assets of commercial banks, which are recorded as negative values in balance of payments figures. Chart 1: Net capital inflow into the CIS (% of GDP) Chart 2: Net capital inflow into the CIS (% of GDP; Y-axis: 2010; X-axis: the 20042007 average) Source: IFS, IMF Capital flows into Armenia, Belarus, Kyrgyzstan, Tajikistan and Ukraine recovered very quickly: in 2010, net capital inflows in these countries exceeded the 2004-2007 average. In 2010, Kyrgyzstan had the highest external debt-to-GDP ratio (86.6%). In the same year, its external debt went down by 0.1% compared with 2009. The external debts of Armenia and Belarus grew by 32.2% and 29.2%, respectively. Public sector borrowings dominate in three countries. In the other countries, private sector borrowings prevail. Chart 3: External debt (% of GDP) Chart 4: External debt by economic sector (%) Source: JEDH Two other financial accounting items are shown in more detail on Charts 5 and 6. In 2010, the CIS countries (except for Russia) were net recipients of investment capital. In 2004-2007, Kazakhstan received the most foreign direct investment (FDI), with the average annual FDI exceeding 9% of GDP. In 2010, the Russian economy became a net investor and moved to the lower part of the chart. The main recipients of Russian investment in 2010 were Cyprus (36%) and the Netherlands (18%). This suggests that the investments either “return” to Russia or that they are reinvested in other countries of the region. Among the CIS countries, the main recipient of Russian direct investment was Belarus (US $1.4 billion). Chart 5: Net inflow of direct investment Chart 6: Net inflow of portfolio investment (% of GDP; Y-axis: 2010; X-axis: the 2004- (% of GDP; Y-axis: 2010; X-axis: the 2007 average) 2004-2007 average) Source: IFS, IMF Kazakhstan was ahead in terms of portfolio investment inflow in 2010 (6% of GDP). Ukraine also had a significant inflow of portfolio capital (3% of GDP). This is evidence that investors prefer to invest in economies through the stock market, buying shares and securities issued by local companies. This trend is not without risk: where external shocks occur, portfolio investors can rapidly export their capital, creating significant fluctuations in the country’s currency and stock markets. An overview of capital flows in CIS countries therefore reveals several important trends. Firstly, the net outflow of investment from the region continued in 2010. This reflects an increase in foreign currency holdings, the income generated from raw material and energy exports. Secondly, four of the region’s countries (Kazakhstan, Ukraine, Kyrgyzstan, and Belarus) saw their portfolio investment liabilities increase in 2010. Thirdly, in Armenia and Belarus, comparative external debt to GDP ratios increased rapidly in 2010. According to preliminary estimates released by the Bank of Russia, in the first half of 2011, the net outflow from the Russian economy was US$28.7 billion, including a net outflow of direct and portfolio investment totalling US$6.6 billion. According to preliminary estimates from the National Bank of Kazakhstan, during the first quarter of 2011, the net inflow of investment totalled US$3.7 billion, including a net inflow of FDI worth US$2.8 billion, while the inflow of portfolio investments has slowed down. According to the National Bank of Ukraine’s preliminary estimates, the net inflow of investments in January-May 2011 was US$4.5 billion, including US$2.6 billion of direct investment. Openness to Capital Flows Chart 7: De-facto openness to capital flows A country’s openness to capital, and the economic Azerbaijan and institutional barriers Belarus they erect, undoubtedly Kazakhstan influence long-term and Kyrgyzstan short-term capital flows. Moldova 2000 Russia, Kazakhstan, Russia 2007 Armenia and Kyrgyzstan Tajikistan have the most liberal Turkmenistan approach to capital flows, Ukraine while Turkmenistan and Uzbekistan Tajikistan are less openi. 0.0 0.5 1.0 1.5 2.0 2.5 The updated database of so-called de-facto Source: Lane and Milesi-Feretti (2009) openness to capital establishes the openness of Kazakhstan and Russia and adds Ukraine and Moldova to the list of open economies ii (see Chart 7). Armenia The de-jure index is a similar openness indicator, which is prepared using the IMF’s data on restrictions on current and capital accountsiii. This index comprises indicators of restrictions on the import and export of foreign currency based on reporting by the countries’ central banks. A comparison of the CIS countries’ indicators for 2007 and 2010 (see Chart 8) shows that the postcrisis situation is very similar to the pre-crisis one, except that Belarus became less open to capital flows and Azerbaijan, conversely, more open. Another indicator, the so-called Trilemma index, shows how the countries deal with the ‘Impossible Trinity’: the impossibility of adhering to currency and monetary policies simultaneously given fluctuations in the global movement of capitaliv. As shown above, in the context of globalisation, legal restrictions on capital movement do not seriously affect the flow of ‘hot money’ into or out of a country, therefore countries should focus on the other two types of macroeconomic regulation. For instance, in 2007 Azerbaijan, Belarus, Tajikistan and Ukraine preferred to fix their exchange rates. At the same time, other countries in the region, particularly Russia and Kazakhstan, pursued an independent monetary policy, although arguably not resolutely enough to protect themselves from the negative consequences of the global crisis. After the 2009 crisis, the pattern changed to a certain degree. The central banks of Azerbaijan, Tajikistan, Kazakhstan, Kyrgyzstan and Ukraine chose to prioritise the stability of their national currencies. The Bank of Russia was less stringent in regard to the flexibility of the rouble. The countries also relaxed their independent monetarism, which may have been one of the triggers of the rise in inflation. In Armenia, Belarus, Moldova and Ukraine, increasing uncertainty regarding the policies of the financial regulators brought excessive volatility to the markets, which was accompanied by high inflation. Chart 8: De-jure openness to capital flows and the ‘Impossible Trinity’ 2007 2010 Source: Aizenman, Chinn, and Ito (2008). Crisis-Induced Integration The 2009 crisis showed that, despite legal restrictions on capital flows and their geographic remoteness, the CIS economies are very strongly affected by the inflows and outflows of shortterm capital. In addition, volatility in the movement of ‘hot money’ requires that some kind of protective mechanism be created to act as a ‘safety net’ where currency crises occur. The objectives of monetary and foreign economic policies should be made very clear in these circumstances. It is important for countries to ensure that their domestic macroeconomic policies are coordinated with those of other countries and that there is cooperation between the central banks of all the countries in the region. The global crisis made that logic clear and induced the countries of the region to implement a large-scale initiative, which addresses the need for a protective financial mechanism. In 2009, the post-Soviet countries, led by Russia and Kazakhstan, established the EurAsEC Anti-Crisis Fund with the capital in excess of $8.5 billion aiming to provide a ‘safety net’ to the members of the Community.v Up to date, the Fund has already provided financing for Tajikistan ($70 million) and Belarus ($800 million, with another $2.2 billion to follow). i Lyubskoi M., Rykhtikov O. (2010) Monetary Restrictions in the CIS. In: Golovnin M. (ed.) The Interaction of Financial Systems in the CIS. Moscow: Aleteya. In Russian. ii Lane P., Milesi-Ferretti G. (2007) The External Wealth Of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970–2004. Journal of International Economics. 73: 223-250. iii Chinn M., Ito H. (2008) A New Measure of Financial Openness. Journal of Comparative Policy Analysis. Vol. 10, Issue 3: 309 – 322. iv Aizenman J., Chinn M., Ito H. (2008) Assessing the Emerging Global Financial Architecture: Measuring the Trilemma's Configurations over Time. NBER Working Paper Series. 14533 (December 2008, updated in April 2009).