banking * its definition and functions

advertisement

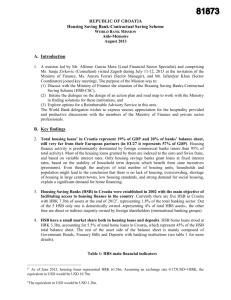

CHAPTER 1 The word Bank is derived from • Greek- ‘Banque’ • French-Banke means chest(deposit) • German-Banck means heap or mound( a group/collection of things) • Italians-Banco means accumulation of money or stock According to The Banking Companies (Regulation) Act of India,1949. Banking means “The accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft and otherwise”. 1. 2. 3. 4. 5. 6. 7. Commercial Establishment Accept Deposits Repayment of Accepted Deposits Financial Intermediary Withdrawable by Cheques, drafts or otherwise Advancing Loans to public Earning profits FUNCTIONS OF COMMERCIAL BANKS Primary functions Secondary functions Developmental functions Modern functions PRIMARY FUNCTIONS OTHERS ACID TEST FUNCTIONS Accepting Deposits Advancing Loans Credit Creation Cheque sysem of payment of funds The Deposits withdrawable by cheques which distinguish a commercial bank from certain other non banking institutions A bank accepts non-chequable deposits also, it must accept chequable deposits Deposits are accepted from the public at large and not merely from its shareholders or members Different types of accounts are Fixed deposit, savings bank deposit, current & flexible a/c. A commercial bank must lend the deposits or make advances to the public directly or indirectly. Methods to make advances are a. Money at call b. overdraft c. Cash Credit d. Discounting of bills e. Term Loans f. Credit to Govt. Banks are able to create credit because the demand deposits i.e. a claim against the bank is accepted by the public in settlement of their debts. As these claims, against the banks are accepted by the publec for settling their debts, it is an important part of money supply This topic will be taken up later in detail 4. CHEQUE SYSTEM OF PAYMENT OF FUNDS Agency functions SECONDARY FUNCTIONS General utility services Collection & payment of credit and other instruments e.g. cheques,BOE, hundies. Purchase and sale of stock exchange securities Administration of wills and trusteeship Remittance of funds- remit funds on behalf of clients through cheques, drafts, main transfers etc Representation and correspondence Bullion trading Receiving of valuables for safe custody Acting as a referee Issuing letters of credit Acting as underwriters Acting as information banks Issuing of travellers cheques Dealing in foreign exchange Merchant banking services 1. 2. 3. 4. Mobilisation of savings Extension of banking services in rural area Providing loans to weaker sections Assisstance to capital market 1. 2. 3. 4. 5. 6. Automatic teller machines cum debit cards Credit cards Mail transfer and telegraphic transfer Tele banking Internet banking Round the clock banking 1. 2. 3. 4. 5. Helpful in mobilisation of savings Assist in innovations Role in implementation of monetary policy Directing funds into desired channels Implementation of the policies of the govt.