BASIC BANKING OPERATIONS Duration

advertisement

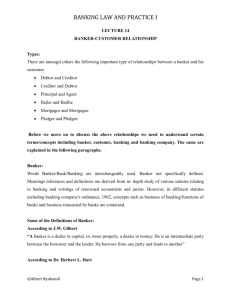

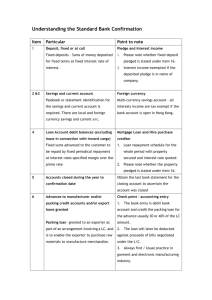

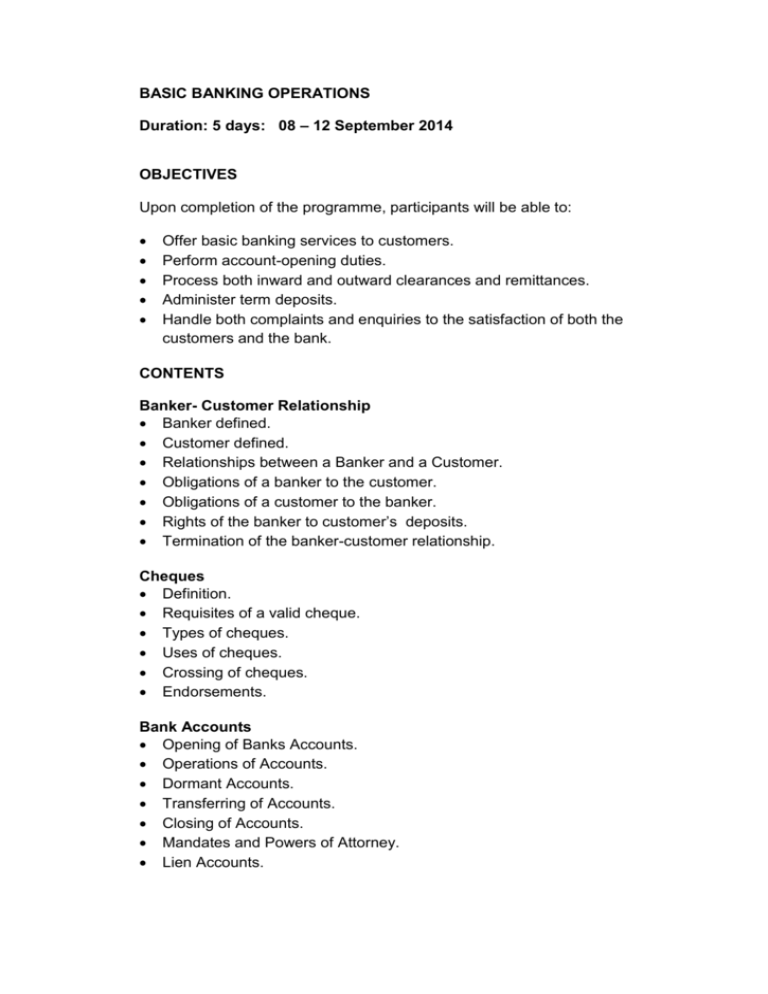

BASIC BANKING OPERATIONS Duration: 5 days: 08 – 12 September 2014 OBJECTIVES Upon completion of the programme, participants will be able to: Offer basic banking services to customers. Perform account-opening duties. Process both inward and outward clearances and remittances. Administer term deposits. Handle both complaints and enquiries to the satisfaction of both the customers and the bank. CONTENTS Banker- Customer Relationship Banker defined. Customer defined. Relationships between a Banker and a Customer. Obligations of a banker to the customer. Obligations of a customer to the banker. Rights of the banker to customer’s deposits. Termination of the banker-customer relationship. Cheques Definition. Requisites of a valid cheque. Types of cheques. Uses of cheques. Crossing of cheques. Endorsements. Bank Accounts Opening of Banks Accounts. Operations of Accounts. Dormant Accounts. Transferring of Accounts. Closing of Accounts. Mandates and Powers of Attorney. Lien Accounts. Flow of Accounting Work in a Bank Definition of Accounting. Accounting Vs Book-keeping. Double Entry System of Book-keeping. Why Debit and Credit in Accounting? Accounting Principles/Concepts. Sources of Accounting Entries in a Bank. Preparation of Financial Statements in a Bank. Clearances Outward Clearance. Inward Clearance. Accounting for Clearance. Remittances Mail Transfers. Telegraphic Transfers. Drafts/Bankers Cheques. Tanzania Interbank Settlement System (TISS) . SWIFT. Paying Out and Receiving Money Procedure for Receiving Cash. Procedure for Paying Cash. Security measures in the cubicle. Automated Teller Machine (ATM). Other Banking Services Stop Payment Orders. Bankers’/Standing Orders. Banker’s Payments. Safe Custody Services. Bankers’ Replies to Status Enquiries. Garnishee Orders and Summons. Injunctions. Effective Customer Service Who is a Customer? “Know Your Customer” (KYC) Concept. Customer Care. Understanding Customer Needs. Service Quality. Communication. Introduction to Credit Management Principles The 6Cs of Credit Analysis. Aspects of Loan Management. Frauds Definition. Detection. Prevention and Controls by Banks. BOT Control Measures and Prudential Regulations. Money Laundering Meaning and nature of Money Laundering. Stages of Money Laundering. Prevention. The Anti - Money Laundering Act, 2008. TARGET GROUP Clerks and Supervisors. Staff who are about to be assigned duties in deposits and clearing departments. Non-bank financial institutions staff who have no background in banking such as staff of Microfinance Institutions (MFIs). FORMAT Lectures, case studies and group discussions. VENUE TIOB Training Room, 10th Floor NIC Investment House, Dar es Salaam.