some-chapter-2-powerpoint-slides-spring

advertisement

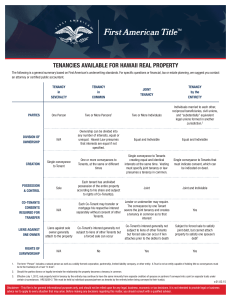

CHAPTER 2: PROPERTY RIGHTS AND LEGAL DESCRIPTIONS LEGAL FORMS OF LAND DESCRIPTION FORMS OF CO-OWNERSHIP 4-1 Legal Forms of Land Description 1. Metes and Bounds 2. Subdivision Plat Lot and Block Number 3. Government Rectangular Survey 4-2 Methods of Land Description: Metes and Bounds Metes=distances and bounds=boundaries Used for surveying land in the original 13 colonies and to describe irregular parcels of land originally described by rectangular survey. The beginning point is marked by a monument (natural or artificial) and may also point out one or two other markers as a means of triangulation. 4-3 Methods of Land Description: Metes and Bounds A sequence of directed distances: • Compass directed “walk around property” • Establishing point of beginning is critical 4-4 Oldest form of acceptable land description Most flexible form Most difficult to interpret Should be made or interpreted only by surveyors Metes and Bounds Description: Example 4-5 Methods of Land Description: Subdivision Plat Lot and Block Number Subdivision survey map in public records identifies lot by block and lot number Lot and block number sufficient to describe parcel Dominant form of urban land description Map shows numerous features 4-6 Subdivision Plat Lot and Block: Example 4-7 Methods of Land Description: Government Rectangular Survey Employed in most states to describe rural and suburban land with major exceptions being the 13 original colonies along with Hawaii and Texas Surveying with this system began in 1785 by direction of Congress and falls under the responsibilities of the Bureau of Land Management and Department of the Interior. Surveyors were instructed to locate and mark by monuments a series of 35 points. To date, 1.5 billion acres have been surveyed from the Florida Keys to Point Barrow, Alaska and East Liverpool, Ohio to San Diego with 2.6 million section corners marked. 4-8 Methods of Land Description: Government Rectangular Survey Basic reference points • Baseline • Principal meridian Measures of distance • Range lines (east and west boundaries of a township numbered consecutively from the principal meridian) • Tier lines (north and south boundaries of a township) Units • Township - six mile square (can be squarely oriented northsouth or can be six miles square but not both) • Section - a one mile square with 36 sections in a township • Check - a 24 mile square composed of 16 townships - used to correct for the expansion of the southern boundaries 4-9 Baselines and Principal Meridians of the United States 4-10 A Township 4-11 Tallahassee Principal Meridian Tallahassee T2N T1N Base Line Jacksonville T1S T2S NW 1/4 of NE 1/4 NW 1/4 SW 1/4 4-12 SE 1/4 R R R R 2 1 1 2 WW E E Township: Range 27 E, Tier 24 S 6 5 4 3 2 1 7 8 9 10 11 12 18 17 16 15 14 13 19 20 21 22 23 24 30 29 28 27 26 25 31 32 33 34 35 36 Orlando T 24 S T 23 S R 2 6 E R 2 7 E Subdividing a Section 4-13 Other Forms of Land Description 1. Reference to documents other than maps 2. Informal reference 3. Assessor’s parcel number • 4-14 Note that these are NOT legal forms of land description Advances in Surveying • The development of Global Positioning system in the 1980s for the military and its eventual civilian use has changed the nature of the way we navigate, create maps, and describe land. •Descriptions of land boundaries can be much more precise due to GPS technology but can also initiate more disputes over land boundaries 4-15 Forms of Ownership • • • • • • 4-16 Sole ownership (estate in severalty) Tenants in common Joint tenancy Community property Partnership Corporation Advantages of Sole Ownership •Flexibility •No sharing of profits 4-17 Disadvantages of Sole Ownership •Capital intensive •No shared expertise in decisions •Full responsibility and liability 4-18 Tenants in Common •Each owner has an undivided interest in the whole property. •Each owner’s interest does not have to be the same size. •Each owner can independently sell, mortgage, give away, or dispose his individual interest. •Tenancy in common is established in the deed by naming co-owners as tenant in common. •Each co-owner is responsible for his proportionate share of property taxes, repairs, upkeep, etc. •If a co-owner dies, his interest passes to his heirs or named devisees. •No right of survivorship (the remaining co-owners do not acquire the deceased’s interest unless they are named in the will). 4-19 Tenants in Common Tenants in Common One parcel of land; Three owners with unity of possession A C B What happens if C dies? A 4-20 B C’s heirs Joint Tenancy • • 4-21 Right of survivorship - when one joint tenant dies, his rights to the property are extinguished and the other joint tenants are left as owners. Four unities must be present: 1. Unity of time - joint tenancy must be created simultaneously 2. Unity of title - joint tenants acquire their interests from the same source (ex. Same deed or will) 3. Unity of interest - joint tenants own one interest together and each joint tenant has exactly the same rights 4. Unity of possession - all joint tenants have use of the entire property, and no individual owns a particular part of it (Note: unity of possession is the only unity essential to tenancy in common) Joint Tenancy Joint Tenancy with Right of Survivorship A B C One parcel of land; Three owners, four unities (PITT): Possession, Interest, Time, Title If C dies? A 4-22 C B Co-ownership in Marriage • Tenancy by the Entirety • Community Property • Separate Property • 4-23 Note: in the event of divorce, these forms of ownership convert to tenancy in common. Advantages of Tenancy by the Entirety •Protects one spouse from conveying or mortgaging the couple’s property without the knowledge of the other •Provides some protection against forced sale of property to satisfy a debt judgment against one of the spouses •Features an automatic right of survivorship 4-24 Disadvantages of Tenancy by the Entirety •Provides for no one except the surviving spouse •May create tax problems •Does not replace the need for a will to direct how the couple’s personal property should be disposed 4-25 Community Property •Ten states recognize community property (comes from Spanish and French laws) •Spouses contribute equally and jointly to the marriage and should share equally in any property purchased during the marriage. •Each spouse can name in his or her will the person to receive his or her 1/2 interest. It does not have to go to the remaining spouse but does in most cases by default if no other heir is stated. 4-26 Separate Property •Property owned before marriage and property inherited after marriage by gift, inheritance, or purchase with separate funds is known as separate property and is exempted from community property. 4-27 Other Forms of Ownership •Partnership •Corporation •Trust 4-28