Document

advertisement

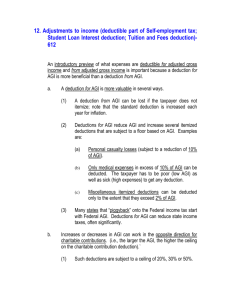

Module 27 Nonbusiness Deductions and Exemptions Menu Classification of deductible expenses Deductions for adjusted gross income Standard deduction and itemized deductions Personal and dependency exemptions Phaseout of exemptions Reduction of itemized deductions Classification of Deductible Expenses Key Learning Objectives Allowable deductions of individual taxpayers Order of deductions Relationship of deductions For AGI and From AGI AGI & Deductions From AGI Itemized deductions reduced by AGI Medical--7.5% Miscellaneous--2% Casualty--10% Charitable--total deduction limited by AGI §162 Trade or Business Expenses Generally deductible Must be Ordinary Necessary Reasonable §162 Trade or Business Expenses If self-employed Deductible for AGI If employee Deductible from AGI if unreimbursed Reimbursed--non-accountable plan Subject to 2% floor §212 Expenses for Production of Income Generally deductible Must be Ordinary Necessary Reasonable §212 Expenses for Production of Income For production/collection of income For property held for production of income Management/conservation/maintenance Determination/collection/refund of any tax §212 Expenses for Production of Income For AGI Rental and royalty expenses on Sch E From AGI Most investment related items Except taxes, interest expense Miscellaneous 2% §262 Personal Expenses Generally not deductible Exceptions for certain itemized deductions Deductions for Personal Items “Otherwise Allowable” Interest expense Charitable contributions Taxes Medical expenses Casualty losses AGI Limitations Medical--7.5% AGI offset Misc..-- 2% - 2% AGI offset Overall--3% AGI offset AMT Add-Backs 100% of taxes 100% of misc.... 2% Additional 2.5% AGI offset on medical Equity interest expense Deductions for Adjusted Gross Income Key Learning Objectives Introduction to deductions for AGI Moving expenses--covered in Mod 25 Alimony payments covered in Mod 25 Penalty on early withdrawal of savings Health insurance costs for self-employed taxpayers Interest on certain student loans Standard & Itemized Deductions Key Learning Objectives (1) Standard deduction Itemized deductions Medical expenses Taxes Standard Deduction 2000 Married, Joint--------------- 7,350 Married, Separate-----------3,675 Head of Household---------6,450 Single-------------------------4,400 If dependent-- at least 700 increased by earned income plus 250 but not to exceed 4,400 Note: several special rules for this group Standard Deduction Add On Blind and/or over 65 Taxpayer and/or spouse only Could be 4 add-ons per married, joint return 2000 amounts Married -- $850 Single and head of household -- $1,100 Medical Expenses Qualified expenses paid in tax year For self, spouse, dependents Also for would be dependent Who has too much gross income Qualified Medical Expenses Only prescription medicine Limited weight loss Not cosmetic surgery after 1990 Medical Expenses Capital Expenditures Qualified expense for Cost more than the increase in FMV Meet strict requirements as to need Medical Expenses Institutionalized Care Nursing home only if medical care is primary purpose Special schools--blind etc.... If special facilities are primary purpose Medical Expenses Reductions to Amount Spent Reduce by insurance proceeds Reduce by 7.5% of AGI Reimbursements generally not income Include in income if tax benefit in prior year Income Taxes All deductible Except U.S. Federal Optional credit treatment for foreign taxes Property Taxes Ad Valorem Real estate taxes (RE) Prorate RE tax when property sold Other taxes if assessed on value Not assessment for improvements Standard Deductions and Itemized Deductions Key Learning Objectives (2) Itemized deductions Interest expense Charitable contributions Casualty and theft loss deductions for personal use property--on last test only Miscellaneous itemized deductions Interest Expense Categories Active T/B Qualified residence interest Investment interest Tax exempt investments--N/A Consumer interest--N/A after 1990 Passive T/B--follow PAL rules To carry passive investment To run passive T/B General Limitations on Interest Deduction Payer must be obligated on debt Can't deduct prepaid interest Interest Expense “Follow the Money” Must track borrowing to show how money was used Interest expense limitations based on how funds spent Interest Expense Limitations Active T/B--no limits to deductibility Investment interest Current deduction limited To net investment income Excess carries over indefinitely Investment Income Investment income interest dividends Overpaid, refundable taxes Interest on the refund net capital gain if you give up special tax rates Investment Expense Investment all expenses related expenses real estate taxes on investment property management fees safety deposit box fees magazine subscriptions if subject to 2% limit, only that left in excess of the limitation Net Investment Income the excess of investment income over investment expenses Example 1: Deductible investment interest expense No deductions relating to investments $20,000 of interest expense on funds borrowed to buy stock Taxable income: $100,000 $ 8,500 W2 wages interest income Example 1: Deductible investment interest expense No deductions relating to investments Investment income _______ Related expenses _______ Net investment income _______ Investment interest deduction _______ Example 1: Deductible investment interest expense No deductions relating to investments Investment income Related expenses Net investment income Investment interest Deduction Carryover $8,500 0 8,500 8,500 11,500 Example 2: Deductible investment interest expense Deductions relating to investments RE taxes of $2,000 $20,000 of interest expense on funds borrowed to buy stock Taxable income: $100,000 W2 wages $ 8,500 interest income Example 2: Deductible investment interest expense RE taxes are fully deductible on Schedule A, so Investment income _______ Related expenses _______ Net investment income _______ Investment interest deduction _______ Example 2: Deductible investment interest expense Investment income Related expenses Net investment income Investment interest Deduction Carryover $8,500 2,000 6,500 6,500 13,500 Example 3: Deductible investment interest expense Deductions relating to investments Management fees of $2,000 $20,000 of interest expense on funds borrowed to buy stock Taxable income: $100,000 W2 wages $ 8,500 interest income Example 3: Deductible investment interest expense Mgt fees are deductible only if in excess of 2% of AGI Here AGI = $108,500 2% = $2,170 Since mgt fee was only $2,000 and no other misc 2% deductions, deduction = 0 Example 3: Deductible investment interest expense Investment income _______ Related expenses _______ Net investment income _______ Investment interest deduction _______ Example 3: Deductible investment interest expense Investment income Related expenses Net investment income Investment interest Deduction Carryover $8,500 0 8,500 8,500 11,500 Example 4: Deductible investment interest expense Deductions relating to investments Management fees of $8,000 $20,000 of interest expense on funds borrowed to buy stock Taxable income: $100,000 W2 wages $ 8,500 interest income Example 4: Deductible investment interest expense Management fees are deductible only if in excess of 2% of AGI Here AGI = $108,500 2% = $2,170 Since management fee is $8,000 and no other misc 2% deductions, deduction = $5,830 Example 4: Deductible investment interest expense Investment income _______ Related expenses _______ Net investment income _______ Investment interest deduction _______ Example 4: Deductible investment interest expense Investment income Related expenses Net investment income Investment interest Deduction Carryover $8,500 5,830 2,670 2,670 17,330 Special Rules for Qualified Residence Interest (QRI) Only 2 principal residences 1 million total acquisition indebtedness Plus 100,000 equity indebtedness Acquisition Indebtedness (ACQ) Loan secured by property Funds used to build/improve etc.... Limited to 1 million if after 10/16/89 Outstanding loans at 10/17/89 Grandfathered-in as QRI No limit as long as secured by property Equity indebtedness Excess of FMV over ACQ debt Funds can use for anything Must be secured by property Limited to 100,000 debt AMT add back Points Paid Points on acquisition of debt deductible if Purchase of principal personal residence Not borrowed from lender OK if paid by seller Points N/D if rental or if refinancing Amortize over life of loan Charitable Contributions To qualified charitable organization Not individual Not foreign Not political organization Charitable Contributions Money Not value of services Related out of pocket costs OK Charitable Contributions Gifts of Property Ordinary income property Inventory Other held < 1 year Deduction limited to adjusted basis Unless FMV is smaller Generally subject to 50% of AGI limit Charitable Contributions Gifts of Property Long term capital gain property (CG) Deduction generally FMV if > basis Gift of tangible property limited to basis if Unrelated use by charitable organization Contributed to nonoperating private foundation Can deduct basis to avoid 30% limit Check List for Gift of Appreciated Property Ordinary income or “capital gains” property? If ordinary use lower of adjusted basis (AB) or FMV. If capital gains property Is charity’s use “related?” If yes use higher of AB or FMV If no use AB unless < FMV. Example 1: Gift of Appreciated Property Artwork is given to the local boy scouts for annual auction. Cost $ 9,000 FMV $11,000 Held as investment since 1994 What is taxpayer’s deduction Example 1: Gift of Appreciated Property Here gift is for public auction, so can’t be related use Deduct lower of AB and FMV ANSWER: $9,000 Example 2: Gift of Appreciated Property Boat is given to the local boy scouts for summer camp. Cost $ 9,000 FMV $11,000 Used personally since 1994 What is taxpayer’s deduction Example 2: Gift of Appreciated Property Here gift is for use in summer camp, so should be related use Deduct FMV ANSWER: $11,000 Charitable Contributions Limitations on Current Deduction Overall--50% of AGI Appreciated CG property 30% of AGI if deduction is FMV 50% if elect adjusted basis To private foundation--20% AGI Charitable Contributions Excess Contributions Carry over for next 5 years Retain character as to AGI limits No carry back available Charitable Contributions Documentation for Cash Over $250 charity must substantiate Charity must disclose value of goods/services received in exchange if FMV > $75 Charitable Contributions Documentation for Property FMV > 500--attach Form 8283 FMV > 5,000 need formal, written appraisal Cost of appraisal is misc..... 2% deduction Casualty and Theft Losses Sudden, Unexpected, Unusual Loss on disposal of personal-use asset is generally not allowed Casualty loss is exception Use lower of basis or decline in FMV to determine loss Casualty and Theft Losses Insurance Claims Adjust for actual or expected insurance reimbursement Gain could result if insurance > basis See involuntary conversion rules Insurance claim must be filed to deduct loss Casualty and Theft Loss Personal-Use Property Each casualty loss reduced by $100 Net casualty gains and losses Net gain for the year is capital gain Net loss for the year is ordinary loss Reduce by 10% of AGI floor Deduction from AGI Casualty and Theft Events Business or Investment Asset Return of capital doctrine Partial destruction Complete destruction Use lower of basis or decline in FMV Use basis Adjust for actual or expected insurance Casualty and Theft Events Business or Investment Asset Business losses deductible for AGI Net loss for the year is ordinary loss No 100 or 10% floor Net gain for the year is §1231 gain or Ordinary gain Depending on holding period Miscellaneous Itemized Deductions Employee business expenses §212 expenses except Rents Royalties Total is reduced by 2% of AGI Employee Business Expenses Being an employee (em’e) is a recognized T/B T/B not that of job, but being em'e Must distinguish between personal and T/B expenses Statutory em'e--expenses for AGI Performing artist--may be for AGI Employee Business Expenses All others--deductions from AGI Included with other misc..... 2% items Exception if em’e reimbursed AND Em'e accounts to em'r Then em'r does not report in W2 Em’e does not report on tax return Miscellaneous Itemized Deductions Add together Meals & entertainment--reduced by 50% Other employee business expenses All §212 expenses except rent/royalty Reduce by 2% of AGI This is the amount deduct from AGI If itemized > standard deduction In Class Exercise: Calculate the Miscellaneous 2% Amount Valid business entertainment Employee business expenses Tax Preparation fee Management fee on mutual stock fund 1,900 Total Calculate final deduction if AGI = 100,000 OR 500,000 8,000 7,500 250 17,650 Solution: In Class Exercise: The Miscellaneous 2% Amount If AGI = 100,000 Final deduction = 11,650 Reduce entertainment by 50% Deductions before 2% = 13,650 2% of AGI = 2,000 13,650 reduced to 11,650 In Class Exercise: Calculate the Miscellaneous 2% Amount If AGI = 500,000 Final deduction = 3,650 2% of AGI = 10,000 Reduce entertainment by 50% Deductions before 2% = 13,650 13,650 reduced to 3,650 Use standard deduction if no other deductions from AGI Personal and Dependency Exemptions Key Learning Objectives Personal exemptions Dependency exemptions Personal Exemptions 2,800 per allowance--2000--for Taxpayer And spouse if joint return N/A if dependent on another's return Dependency Exemptions 2,800 per allowance -- 2000 Meet all of 5 of following tests Support Gross income Relationship Joint return test Citizenship/residency Multiple Support Agreements No One Provides > 50% Support Group, not individual, gives >50% of total support Group can decide who gets exemption Taxpayer getting deduction must have contributed at least 10% of total support Multiple Support Agreements No One Provides > 50% Support Individual being claimed must not Have too much gross income or Fail to meet Joint return test Citizenship/residency test Multiple Support Agreements No One Provides > 50% Support Members of groups must meet relationship test Relative or Non-relative dependent lives with In Class Exercise: Who Can Claim D? (1) D, age 15, parents deceased, lives with Grandparents D's support this year was provided as follows: Interest income--D’s account 1,000 Social security survivor's benefits 2,000 Grandparents 3,000 6,000 Solution--In Class Exercise: Who Can Claim D? (1) D would claim self since no one provides more than 50 of D’s support Note that most of D’s exemption is wasted since D’s income is only 1,000 Grandparents would have to spend an extra dollar to claim D In Class Exercise Who Can Claim D? (2) D, age 15, parents deceased, lives with Grandparents. D's support this year was provided as follows: Interest income D’s account 1,000 Social security survivor's benefits 2,000 Contributions by mother’s friend 500 Grandparents 3,000 6,500 Solution--In Class Exercise: Who Can Claim D? (2) D would claim self since no one provides more than 50% of D’s support Since D lives with grandparents, friend cannot meet relationship test, so not part of group Grandparents now need to spend $501 to get exemption In Class Exercise Who Can Claim D? (3) D, age 15, parents deceased, lives with Grandparents. D's support this year was provided as follows: Interest income D’s account 1,000 Social security survivor's benefits 2,000 Uncle Joe 500 Grandparents 3,000 6,500 Solution--In Class Exercise: Who Can Claim D? (3) Only the grandparents Grandparents and Uncle Joe are group since they meet relationship test Uncle Joe doesn’t meet the 10% test In Class Exercise Who Can Claim D? (4) D, age 15, parents deceased, lives with Grandparents. D's support this year was provided as follows: Interest income, D’s account Uncle Joe Grandparents 3,000 1,000 3,000 7,000 Solution--In Class Exercise: Who Can Claim D? (4) Now either grandparents or Uncle Joe Group must decide who gets exemption The other members of the group must sign written waiver agreeing to not take exemption Form 2120 Phaseout of Exemptions and Reduction of Itemized Deductions Key Learning Objectives Phaseout of exemptions Reduction of itemized deductions Phase Out of Exemptions The Steps To Follow Calculate AGI, if < threshold stop Calculate excess AGI AGI - Threshold Divide by 2,500 Round up for any fraction Multiply by 2%--this is the amount lost 1 - % = amount of exemptions allowed Threshold Amounts 2000 Single Head of household Married, joint Married, separate 128,950 161,150 193,400 96,700 In Class Exercise: Phaseout of Exemptions Part 1: Calculate AGI W2 Bank interest State bond interest Alimony paid 170,000 5,900 4,500 5,000 Solution--In Class Exercise Part 1: Calculate AGI AGI = 170,900 [170,000 + 5,900 - 5,000] State bond interest excluded Alimony paid is deduction for AGI Now calculate taxable income IF Single Married, joint Head of Household In each case, taxpayer gets two exemptions Solution: In Class Exercise Single, Exemption Phaseout AGI THRESHOLD EXCESS 170,900 (128,950) 41,950 ÷2,500 16.78 -> 17 17 times 2% = loss amount (34%) 1 - .34 = deduction amount (66%) Exemptions = 2,800 x 2 x .66 = 3,696 Solution: In Class Exercise Single, Taxable Income AGI 170,900 SD (4,400) EXS (3,696) TI 162,804 2,800 x 2 x .66 Solution: In Class Exercise Married, Exemption Phaseout AGI THRESHOLD EXCESS 170,900 (193,400) N/A Exemptions = 2,800 x 2 = 5,600 Solution: In Class Exercise Married, Taxable Income AGI SD 170,900 (7,350) EXS TI (5,600) 157,950 2,800 x 2 Solution: In Class Exercise Head, Exemption Phaseout AGI THRESHOLD EXCESS 170,900 (161,150) 9,750 ÷ 2,500 3.9 = 4 4 times 2% = loss amount ( 8%) 1 - .08= deduction amount (92%) Exemptions = 2,800 x 2 x .92 = 5,152 Solution: In Class Exercise Head, Taxable Income AGI STD 170,900 (6,450) EXS (5,152) TI 159,298 2,800 x 2 x .92 3% of AGI Reduction All Itemized Deductions Except Medical Casualty Investment interest expense Gambling losses 3% of AGI Reduction Threshold is same as the exemption phaseout for single filers For 2000, threshold is 128,950 Know which deduction it applies to Know how to calculate 3% Reduction Never Reduces to Zero Taxpayer always gets the largest of (1) Limited - offset + unlimited (2) 20% of limited + unlimited (3) Standard deduction In Class Exercise: Itemized Deduction Phaseout (1) AGI 200,000 Mortgage interest paid = 10,000 What is the deduction from AGI? Apply all other limits first Reduce entertainment by 50% of cost Reduce medical by 7.5% of AGI Reduce miscellaneous by 2% of AGI Reduce casualty loss by 10% of AGI Solution: In Class Exercise: Itemized Deduction Phaseout (1) (1) Calculate the 3% Reduction AGI Threshold Excess Reduction 200,000 128,950 --> same for all 71,050 x .03 2,132 Solution: In Class Exercise: Itemized Deduction Phaseout (1) (2) Compare the 3 Limits Taxpayer gets the largest of (1) 10,000 - 2,132 (2) 20% of 10,000 (3) Standard deduction 7,868 2,000 7,868 > all standard deductions, so all filers would use 7,868 In Class Exercise: Itemized Deduction Phaseout (2) AGI 200,000 Medical expenses paid 20,000 What is the deduction from AGI? Remember to apply all other limits before 3% reduction Medical reduced by 7.5% of AGI Solution: In Class Exercise: Itemized Deduction Phaseout (2) (1) Calculate the 7.5% Reduction Reduction = 200,000 x 0.075 = 15,000 Medical Reduction Deductible 20,000 (15,000) 5,000 Solution: In Class Exercise: Itemized Deduction Phaseout (2) (2) Calculate the 3% Reduction Medical is not 3% limited, SO Taxpayer gets > (1) 5,000 (2) Standard deduction Only single/married separate use 5,000 Others would use standard deduction In Class Exercise: Itemized Deduction Phaseout (3) AGI 200,000 Medical expenses paid 20,000 Mortgage interest paid 10,000 What is the deduction from AGI? Remember to apply all other limits before 3% reduction Medical reduced by 7.5% of AGI Solution: In Class Exercise: Itemized Deduction Phaseout (3) This is a combination of first two cases. Here taxpayer gets largest of (1) 7,868 + 5,000 = 12,868 (2) 2,000 + 5,000 = 7,000 (3) Standard deduction 12 ,868 > all standard deductions All filers would use 12 ,868 In Class Exercise: Itemized Deduction Phaseout (4) AGI 200,000 Business Entertainment 52,000 What is the deduction from AGI ? Remember to apply all other limits before 3% reduction Entertainment reduced by 50% of each dollar 2% of AGI Solution: In Class Exercise: Itemized Deduction Phaseout (4) (1) Reduce Entertainment by Limits Reduce entertainment by 50% 52,000 x .5 = 26,000 Reduced entertainment by 2% of AGI 26,000 - [200,000 x .02] = 22,000 Solution: In Class Exercise: Itemized Deduction Phaseout (4) (2) Apply 3% Offset Rules 3% reduction is still 2,132 Taxpayer gets the largest of (1) 22,000 - 2,132 = 19,868 (2) 22,000 x .20 = 4,400 (3) Standard deduction 19,868 is > all standard deductionsAll filers would use 19,868