44 KB - Department for Employment and Learning

advertisement

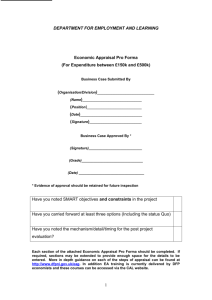

DEPARTMENT FOR EMPLOYMENT AND LEARNING Economic Appraisal Pro Forma (For Expenditure between £30k and £150k) (Organisation/Division)________________________ (Name)_________________________ (Position)_______________________ (Date)__________________________ (Signature)______________________ Business Case Approved By * (Signature)___________________________ (Grade)_______________________________ (Date) _________________________________ * Evidence of approval should be retained for future inspection Have you noted SMART objectives and constraints in the project Have you carried forward at least three options (Including the status Quo) Have you noted the mechanism/detail/timing for the post project evaluation? Each section of the attached Economic Appraisal Pro Forma should be completed. If required, sections may be extended to provide enough space for the details to be entered. More in depth guidance on each of the steps of appraisal can be found at http://www.dfpni.gov.uk/eag In addition EA training is currently delivered by DFP economists and these courses can be accessed via the CAL website. 1 1. Strategic Context and Assessment of need The strategic importance of the project should be established by referring to any relevant strategies or initiatives at the local or national level. You should then seek to identify any deficiencies or problems with the current service provision in order to establish the need for expenditure. Where possible seek to quantify the need by providing appropriate data/statistics showing levels of usage or demand. DFP GUIDANCE STATES THAT STRATEGIC CONTEXT SECTIONS SHOULD BE VERY SHORT AND NORMALLY NO MORE THAN 2 PAGES OF ANY BUSINESS CASE. Policy Overview and contribution of the proposed project document Northern The Programme for Government 2011-2015 (PfG) in Northern Ireland Ireland aims to highlight the actions the Executive will take to Executive, deliver its number one priority – “a vibrant economy which Programme can transform our society while dealing with the deprivation for and poverty which has affected some of our communities for Government generations”. (PfG) supporting economic recovery and tackling disadvantage. “Building a Priority areas include: The most immediate challenges lie in Better Future, Priorities and Budget” 2011 – 2015 “Growing a Sustainable Economy and Investing in the Future; Creating Opportunities, Tackling Disadvantage and Improving Health and Well-Being; Protecting Our People, the Environment and Creating Safer Communities; Building a Strong and Shared Community; and Delivering High Quality and Efficient Public Services”. Contribution of the proposed project: 2 Northern The overarching goal of this Strategy is to improve the Ireland economic competitiveness of the Northern Ireland economy. Economic This involves rebalancing the economy to improve the wealth, Strategy employment and living standards of everyone in NI. One of the ways identified in the strategy to achieve this is to improve the skills and employability of the entire workforce so that people can progress up the skills ladder, thereby delivering higher productivity and increased social inclusion. What has also been identified is that a world class education and skills system is critical for economic growth. Contribution of the proposed project: Department This document, the Skills Strategy for Northern Ireland, is for based on an analysis that links higher levels of skills (via Employment qualifications) as being one of the best means of achieving and Learning higher productivity, leading in turn to raised employment and (DEL): increased social inclusion. Success through Skills Contribution of the proposed project: Transforming Futures (2011) 3 Any other This section should include any strategy or policy document policy or specific to the Division/Sector/Organisation in question e.g. strategy the HE Strategy or FE means Business or the Skills Strategy documents specific to this case should be included here along the same format of those outlined above. 4 2. Objectives & Constraints You should seek to set SMART (Specific, Measurable, Agreed, Realistic and Time bound) objectives (or targets) for the project. Consideration of any identified technical, legal, political, or financial constraints associated with the proposed project should also be undertaken. You should seek to ensure that the objectives can be tracked from the evidence presented in the need 3. Identification of Options and Option Sift The range of options considered should generally be as wide as possible. Options can consist of various ways of meeting the need covering a range of levels of provision. A long list of options may be given initially, before being shortened to a more manageable list. Options should be clearly shortlisted based on their consistency with project objectives and constraints. This shortlist should contain the baseline case (or status quo) plus at least two alternatives. Option name Option Description Included (I) or Rejected (R) 5 Reason for rejection 4. Monetary Costs & Benefits This section should assess the costs associated with each of the carried forward options. You should seek to ensure that you present all costs in as much detail as possible whilst also ensuring that you present the source/basis/rationale for all costs. Note that in relation to benefits only monetary benefits should be included in this section, if no monetary benefits will accrue this should be stated. 6 5. Risk Appraisal and Optimism Bias The presence of risks, which can be economic, managerial, legal or financial e.g. risk of a capital cover overrun, may influence the choice of option, therefore the implications must be thoroughly explored. It is crucial that potential risks are identified and their impact assessed across all options. Using the template below, please give details of any risks along with the countermeasures that will be put in place to minimise their impact on the project. Risk description Countermeasure Option 1 Option 2 Option 3 Option 4 Total Level of risk (low=1, med=2, high=3) 7 You should then use this section to provide a concise explanation for the scores you have allocated to each of the options in the table above. Adjusting for Optimism Bias You should provide historical evidence of cost overrun in similar size and cost appraisals (evidence based) if possible. The average of these cost overruns would then be summed as the OB amount (percentage overrun on similar past projects). The monetary costs identified in step 4 should then be adjusted with the OB figure. If no historical base is available then the Mott MacDonald framework can be used. http://www.dfpni.gov.uk/index/finance/eag/eag_resources/eag-optimism-biascalculator.htm . All supporting calculations should be presented or appendixed to the submission of the business case. 8 6. Non-Monetary Costs and Benefits Use the table below to identify any non monetary benefits or costs associated with the project and how these will be measured. The impact of each of the non monetaries should then be scored (in accordance with the impact scoring set out below the table) against each of your identified options. Benefit area/detail Measurement Steps Option 1 Option 2 Option 3 Option 4 Total Ranking Impact (I): 0 – neutral, 1 – Low, 2 – Minor, 3 – Moderate, 4 – Major Description of non monetary scoring You should then use this section to provide a concise explanation for the scores you have allocated to each of the options in the table above. 9 7. Calculate Net Present Values (NPVs) Where considering larger appraisals with a lifetime of more than three years it is important that future cost and benefits are valued in today’s terms Appraisals should include, for each option, a calculation of its NPV. This is the name given to the sum of the discounted benefits of an option less the sum of its discounted costs, all discounted to the same base date. Where the sum of discounted costs exceed that of the discounted benefits, the net figure should be referred to as the Net Present Cost (NPC). The time horizon for NPV calculations should reflect the economic life of the services being appraised, or the useful life of the relevant assets and should be sufficiently distant to cover all the important cost and benefit differences between options. The anticipated effects of general inflation should be removed from all figures before discounting. Optimism Bias adjustments (Section 5) must be made before the calculation of NPVS, that is, NPV analysis must be conducted on OB-adjusted figures. NPV analysis should be completed using the NPV Calculator available from the DFP website: http://www.dfpni.gov.uk/npc-calculator.xls If you have any queries about the completion of NPV spreadsheets please contact the Departments Economists. 10 8. Financing and affordability arrangements. This section should include an affordability analysis/statement of the preferred option. This will generally include a budget statement showing the resource costs over the lifetime of the project and a cashflow statement showing the cash requirement of the preferred option, including VAT and inflation. 1 Affordability should also include a funding statement to note who would provide the resources/cash required to deliver the option in question – including any contribution from the Department. The consideration of financing and affordability should be in line with the DEL financial year and for NDPBs must include OTV Budget considerations. Yr 0 Yr 1 Yr 2 Yr 3 Totals £000’s £000’s £000’s £000’s £000’s Total DEL Required: Capital DEL Resource DEL Allowance for depreciation/impairment (included in Resource DEL figures Existing DEL Provision: above) Capital DEL Resource DEL Allowance for depreciation/impairment (includedDEL in Resource DEL figures Additional Required: above) Capital DEL Resource DEL Allowance for depreciation/impairment (included in Resource DEL figures above) Funding Body Sum funded & % of total £ £ £ Funding secured? Yes/No If not secured, indicate status of negotiations ( %) ( %) ( %) 1 GDP deflators can be found at the following link https://www.gov.uk/government/collections/gdpdeflators-at-market-prices-and-money-gdp you should select the latest available statistics, the figures used to apply inflation can be found in the column ‘percentage change on previous year’ – consult Victoria Reid or John Kerr if further advice is required 11 9. Selection of the preferred option and detail on its management, monitoring and post project evaluation considerations A summary table may be included which covers all of the options detailing the results of the analysis of monetary costs and benefits, non-monetary factors benefits assessment, assessment of risk and uncertainty and affordability considerations. The proposed arrangements, dates and individuals responsible for project management, monitoring and evaluation of the preferred option should be documented by providing information on when, how and by whom these tasks will be undertaken. This section should also include details of the intended procurement process. This should also include the provision of a Benefits Realisation Plan for the project (overleaf). This table below summarises the appraisal process and justifies the preferred option selection. Option Cost (£) Rank Risk Score Rank NMB Score Rank Overall rank This section should note a specific date of which the PPE will be carried out (within the 6-12 month NIGEAE timeframe). 12 Benefits Realisation Plan Benefits here can be traced back to the objectives and the non monetaries established earlier in the appraisal, in general they can be: financial e.g. a reduction in management costs, non financial e.g. an improvement in the level of skills and/or outcomes e.g. Improved standards of teaching provision. Information should be included on how benefits will be measured, when will they be achieved and who will be responsible for monitoring the benefit(s) Benefit owner Benefit description Baseline Target 13 How will it be measured Who is responsible Dates/Timing Risk log for preferred option This section should identify all perceivable risks associated with the preferred option and can include those identified earlier in the risks analysis. Risk Description Category (funding, operating etc) Impact (low, medium, high) Probability (low, medium, high) Proximity (short, medium, long term) Counter-measures 14 Owner Author Date Identified Date Last Updated Current Status DEL Economist Contacts: Wendy Lecky John Kerr James Gordon (028 9025 7672) (028 9025 7775) (028 9025 7426) 15