FIN449 Valuation #3 Rubric In project #3, the whole valuation

advertisement

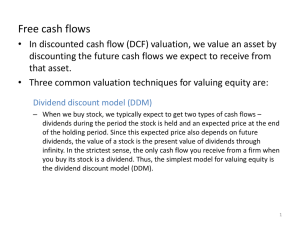

FIN449 Valuation #3 Rubric In project #3, the whole valuation process should be part of a comprehensive whole. In this project, specific line items being forecasted will be adjusted to get a more accurate valuation using FCFF & FCFE Valuation #3 will be graded on the following criteria: - Process (e.g. documented assumptions, robust analysis, follows accepted steps, etc.) - Legitimacy (e.g. inputs & outputs make economic sense, follow reasonable patterns, are due to identifiable causal relationships, etc.) - Technique (e.g. correct computations are chosen, computations are made properly) - Thoroughness (e.g. Double check results vs other methods) Please email me a copy of your workbook so I can help understand any issues I see in your work. Format your work similarly to the strawman exercise and title the file in this way: PG.your.name.xls Make sure your FCFF & FCFE are computed for all years, historic and forecast. Your valuation should be based on forecast years 2014-2018. For 2013 results, we will estimate the results in class based on published documents and other assumptions. All other financial data should come from the most recent 10-k s available. Your work should have all the elements of the previous assignments, as well as: Sales growth by segment and overall, attributing % growth to Volume and to “Pricing, etc.” as well as the resulting % revenue growth. COGS for overall company SG&A for overall company Cash for the whole company A/R for the whole company Inventories for the whole company PP&E for the whole company A/P for the whole company Include Degree of Operating Leverage in your useful ratios (use GP/OpInc to estimate DOL) Computation FCFF & FCFE without adjustments then… o Adjust for effect of inventory method (if appropriate) o Adjust for operating leases o Adjust for R&D Determine your best estimate of the Cost of Equity, including beta regression & bottom-up methods Determine the Cost of Debt to be used in WACC Computation of equity value by discounting adjusted FCFE with Ke AND computation of the enterprise value (EV) by discounting adjusted FCFF with WACC Compute the market value of debt Estimate the equity value by subtracting the MV of debt from the enterprise value A comparison of the target firm to comparable firms, including the useful ratios and the P/E, P/S and EV/EBITDA for each. In addition, show the relative valuation of the target firm from the P/E and P/S of an index of the comparable companies.