- Mark E. Moore

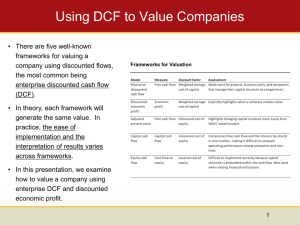

advertisement

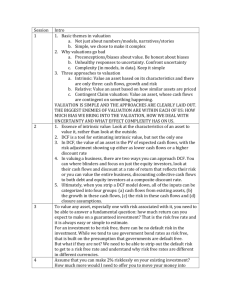

BV201: Introduction to Business Valuation CHAPTER 1 CHAPTER 2 Must Know and Understand: Professional Standards Premise of Value Standards of Value Variables Affecting Value Risk and Return Analysis Understand the elements (components) of Business Risk Operational Risk Turnover Risk Financial Risk Liquidity Risk Going Concern Risk Both Internal and External Environment Risk. You must be able to discuss various components of financial statements and understand their contribution to the value proposition (operating vs. non-operating; Financial vs. nonFinancial Assets or Liabilities). (pp 22 – 25 of Student Manual) Explain (briefly): Define the following terms and identify the main attributes of: Paid-in Capital, Retained Earnings, Equity, Invested Capital Workshop: Compute both Net Cash Flow to Equity and Net Cash Flow to invested Capital (Page 25 and 26 of Student Manual) For the next two questions, assume the following: Net income $7,000,000 Depreciation $700,000 Amortization $100,000 Interest expense $2,500,000 Income taxes $2,730,000 Capital expenditures $950,000 Increase in working capital $1,300,000 Net increase in long-term debt $400,000 1. Compute equity net cash flow. 2. Compute invested capital net cash flow. 3. Classify the following attributes as being key characteristics of: Operating Assets Non-Operating Assets Financial Assets Some of the above (at least 2 of them) None of the above (irrelevant) A. The Asset does not produce a significant amount of income B. The Asset not essential for continued functioning of the business C. The Asset can be liquidated at or near book value 4. Properties of Financial Assets and Financial Liabilities. They are marked up or down to current market value (T/F) They are valued at the present value of the future cash flows associated with the asset or liability (T/F) There should be contractual terms available to identify the future cash flows (T/F) Which is the appropriate discount rate to use: 1) The industry cost of capital; 2)The required rate of return; 3) The company’s capitalization rate; 4) The internal rate of return? 5. Rank-order the following business securities in order from the least risky to the most risky (In terms of investment risk). 1. Common stock 2. Short-term debt 3. Nonconvertible preferred stock 4. Long-term debt 5. Convertible Debt 6. Callable Debt 7. Treasury Stock COMMON-SIZED Financial Statement Analysis What are common-sized financial statements? How are they constructed? What are the potential Benefits of performing Analysis of common-sized financials? Typical Easy Question (on Chapter 7): • Using common-size analysis, determine the percentage for cost of goods sold (or operating profit margin, times interest earned, return on equity, net profit margin), to the nearest percent, using the following data: Distinguish Different Levels (Types) of Value and their Key Attributes: Fair Market Value Fair Value Strategic Value or Investment Value Liquidation Value Based upon: 1. Type of Buyer 2. Type of Seller 3. Willingness of Buyers or Sellers (willing or compelled) 4. Level of knowledge or sophistication of buyer and seller 5. Impact of State or Jurisdiction in which valuation is performed Impact of Purpose of Valuation: It may affect the standard of value (T/F) It may affect the valuation methods employed (T/F) Increasing the number and variety of appraisal methods in a report will increase the number of purposes for which the report can be used. (T/F) The purpose of the appraisal may affect the number of adjustments made to the financial statement. (T/F) The purpose of the valuation may affect which statutes, regulations and case precedents apply. (T/F) Precedence, guidance, and consistent clear-cut standards or statutes: A. Property tax B. Estate tax C. Charitable contributions D. Divorce