Consumer Education Stock Market Game & Research Get into

advertisement

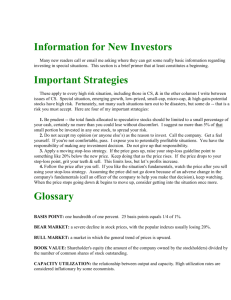

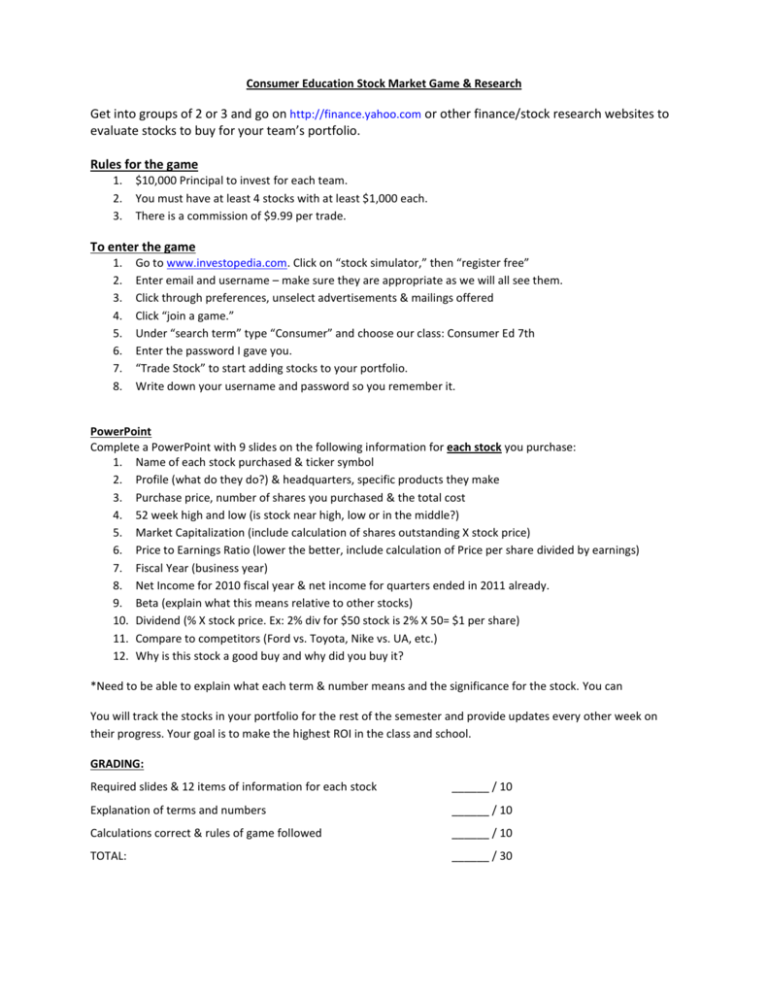

Consumer Education Stock Market Game & Research Get into groups of 2 or 3 and go on http://finance.yahoo.com or other finance/stock research websites to evaluate stocks to buy for your team’s portfolio. Rules for the game 1. 2. 3. $10,000 Principal to invest for each team. You must have at least 4 stocks with at least $1,000 each. There is a commission of $9.99 per trade. To enter the game 1. 2. 3. 4. 5. 6. 7. 8. Go to www.investopedia.com. Click on “stock simulator,” then “register free” Enter email and username – make sure they are appropriate as we will all see them. Click through preferences, unselect advertisements & mailings offered Click “join a game.” Under “search term” type “Consumer” and choose our class: Consumer Ed 7th Enter the password I gave you. “Trade Stock” to start adding stocks to your portfolio. Write down your username and password so you remember it. PowerPoint Complete a PowerPoint with 9 slides on the following information for each stock you purchase: 1. Name of each stock purchased & ticker symbol 2. Profile (what do they do?) & headquarters, specific products they make 3. Purchase price, number of shares you purchased & the total cost 4. 52 week high and low (is stock near high, low or in the middle?) 5. Market Capitalization (include calculation of shares outstanding X stock price) 6. Price to Earnings Ratio (lower the better, include calculation of Price per share divided by earnings) 7. Fiscal Year (business year) 8. Net Income for 2010 fiscal year & net income for quarters ended in 2011 already. 9. Beta (explain what this means relative to other stocks) 10. Dividend (% X stock price. Ex: 2% div for $50 stock is 2% X 50= $1 per share) 11. Compare to competitors (Ford vs. Toyota, Nike vs. UA, etc.) 12. Why is this stock a good buy and why did you buy it? *Need to be able to explain what each term & number means and the significance for the stock. You can You will track the stocks in your portfolio for the rest of the semester and provide updates every other week on their progress. Your goal is to make the highest ROI in the class and school. GRADING: Required slides & 12 items of information for each stock ______ / 10 Explanation of terms and numbers ______ / 10 Calculations correct & rules of game followed ______ / 10 TOTAL: ______ / 30 GRADING: Required slides & 12 items of information for each stock 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. ______ / 10 Name of each stock purchased & ticker symbol Profile (what do they do?) & headquarters, specific products they make Purchase price, number of shares you purchased & the total cost 52 week high and low (is stock near high, low or in the middle?) Market Capitalization (include calculation of shares outstanding X stock price) Price to Earnings Ratio (lower the better, include calculation of Price per share divided by earnings) Fiscal Year (business year) Net Income for 2010 fiscal year & net income for quarters ended in 2011 already. Beta (explain what this means relative to other stocks) Dividend (% X stock price. Ex: 2% div for $50 stock is 2% X 50= $1 per share) Compare to competitors (Ford vs. Toyota, Nike vs. UA, etc.) Why is this stock a good buy and why did you buy it? Explanation of terms and numbers ______ / 10 Calculations correct & rules of game followed ______ / 10 TOTAL: ______ / 30 GRADING: Required slides & 12 items of information for each stock 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. ______ / 10 Name of each stock purchased & ticker symbol Profile (what do they do?) & headquarters, specific products they make Purchase price, number of shares you purchased & the total cost 52 week high and low (is stock near high, low or in the middle?) Market Capitalization (include calculation of shares outstanding X stock price) Price to Earnings Ratio (lower the better, include calculation of Price per share divided by earnings) Fiscal Year (business year) Net Income for 2010 fiscal year & net income for quarters ended in 2011 already. Beta (explain what this means relative to other stocks) Dividend (% X stock price. Ex: 2% div for $50 stock is 2% X 50= $1 per share) Compare to competitors (Ford vs. Toyota, Nike vs. UA, etc.) Why is this stock a good buy and why did you buy it? Explanation of terms and numbers ______ / 10 Calculations correct & rules of game followed ______ / 10 TOTAL: ______ / 30 GRADING: Required slides & 12 items of information for each stock 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. ______ / 10 Name of each stock purchased & ticker symbol Profile (what do they do?) & headquarters, specific products they make Purchase price, number of shares you purchased & the total cost 52 week high and low (is stock near high, low or in the middle?) Market Capitalization (include calculation of shares outstanding X stock price) Price to Earnings Ratio (lower the better, include calculation of Price per share divided by earnings) Fiscal Year (business year) Net Income for 2010 fiscal year & net income for quarters ended in 2011 already. Beta (explain what this means relative to other stocks) Dividend (% X stock price. Ex: 2% div for $50 stock is 2% X 50= $1 per share) Compare to competitors (Ford vs. Toyota, Nike vs. UA, etc.) Why is this stock a good buy and why did you buy it? Explanation of terms and numbers ______ / 10 Calculations correct & rules of game followed ______ / 10 TOTAL: ______ / 30