Sector: _______ Investment Management January 26, 2010

advertisement

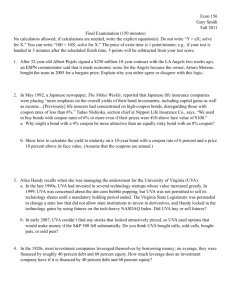

Sector: Technology EQUAL Investment Management Division January 27, 2010 Sector Head: Jason Kim jkim120@bu.edu Senior Analysts: Eric Carrera Ben Sommer ercarrera592@bu.edu bsommer@bu.edu INVESTMENT SUMMARY & OUTLOOK Technology started strong last week on strong earnings from Intel and Google. However investors were disappointed this week with earnings report from Apple and IBM, despite reporting a strong 3Q. This was a disappointing end as the Nasdaq rose 15% during the last 6 weeks. Notably, IBM reported that service contracts fell 7% in the 3rd quarter, hinting that companies are still wary of spending on infrastructure. However shares for EBay and Yahoo! rose as they reported better than expected 3Q income. HEADLINES Apple’s 4Q Earnings Beat Expectations ……….. Reported profits totaled $4.31 billion compared to $2.53 billion the previous year. Sales of iPhone 4 exceeded expectations, totaling 14.1 million sold. However, analysts were disappointed in iPad sales, totaling 4.2 million. This came after Verizon and AT&T announced sales of iPad in their retail locations starting at the end of October. IBM 3Q Earnings Beat Expectations ……….. IBM reported revenue of $24.3 billion compared to $24.1 billion the previous year. It exceeded analysts’ expected earnings of $2.75, by reporting $2.82 for 3Q. However shares fell 4% based on disappointing revenue from its core service business. It grew only 1% to $9.5 billion, hinting that companies are still reluctant to spend and outsource its IT services. Yahoo Shares Rises on Improved Income……….. Yahoo reported profits of $396 million for 3Q, nearly double the previous year. Shares rose to $15.80 on Wednesday. However, analysts note that sale of HotJobs mostly contributed to the gain, as revenue remained nearly flat at $1.6 billion (less than 2%). EBay Forecasting Improved Sales for 4Q ……….. Raised forecast to $2.39-2.49 billion for 4Q with earnings of 44 cents. This comes after reporting 3Q revenue of $2.25 billion beating estimates of $2.18 billion. Improved forecast comes on expected increased in usage of PayPal as more consumers conduct their shopping online. EA Acquires Mobile Publisher Chillingo ……….. EA purchased developer Chillingo for nearly $20 million, makers of “Angry Birds.” However it didn’t acquire rights to the brand name/game. This coincides with mobile gaming as the fastest growing video game segments in the industry. Games for smartphones is expected to rise 19% ($5.6 billion) this year, and forecast to grow $11.4 billion in 2014. STOCKS ON THE MOVE SECTOR: _________ Investment Management January 26, 2010 Quantum Corporation +18.7% $2.93 Quantum have been rising as there has been high volume in its stocks. Many analysts peg it as another take-over target in the aftermath of 3Par. VeriFone Systems, Inc. +3.7% $30.36 Stocks rose on Wednesday due to the company announcing a strategic partnership with Gemalto NV on a new chip card payment solution. S&P 500 VS. TECHNOLOGY COMPUTERS (6 MO) ADDITIONAL COMMENTS & READINGS We should focus on Yahoo! for the next few weeks, as rumors of merger with AOL are still in the air. With disappointing 3Q earnings, this will escalate into talks of even “partnership.” SOURCES http://www.businessweek.com/ap/financialnews/D9IUV1IG1.htm http://www.forbes.com/2010/10/19/apple-beats-earnings-estimates-but-ipadsales-disappoint-marketnewsvideo.html http://www.bloomberg.com/news/2010-10-19/ibm-shares-drop-after-servicecontracts-decline-for-third-straight-quarter.html?cmpid=yhoo http://finance.yahoo.com/news/Yahoo-shares-up-after-3Q-apf1654826498.html?x=0&.v=1 http://www.businessweek.com/news/2010-10-20/ebay-forecasts-revenue-profithigher-than-estimates.html http://www.reuters.com/article/idUSTRE69J4G020101020 SECTOR: _________ Investment Management January 26, 2010 http://www.reuters.com/finance/stocks/keyDevelopments?rpc=66&symbol=PAY &timestamp=20101020203000

![This article was downloaded by: [Rutgers University] On: 14 September 2010](http://s2.studylib.net/store/data/010797508_1-dc558f2a527fa0594e4b93daf9890587-300x300.png)