OVERVIEW OF THE OECD TRANSFER PRICING GUIDELINES

advertisement

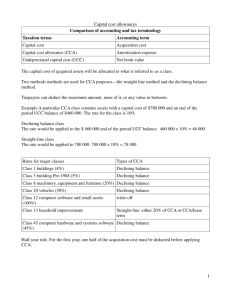

TRANSFER PRICING CASE STUDIES WORKSHOP SAN JOSE 31 MARCH - 4 APRIL 2014 6. Intra-Group Services and CCAs OECD freely authorises the use of this material for non-commercial purposes. All requests for commercial uses of this material or for translation rights should be submitted to rights@oecd.org. The opinions expressed and arguments employed herein are those of the author and do not necessarily reflect the official views of the OECD or of the governments of its member countries. Types of intra-group services • All business entities require administrative, technical, financial and other commercial services – Management, co-ordination and control functions for the whole group may also be needed • Such services may be provided by another entity within an MNE group, or • An entity may perform the services itself (in-house), or • An entity may acquire services from an independent party 2 Types of intra-group services • Intra-group services usually include services ordinarily performed internally (central auditing, financing advice, training of personnel) • Often include services that are typically available externally from independent enterprises (such as legal and accounting services) 3 Typical Arrangements Parental service arrangements Centralised service companies Cost contribution/sharing arrangements 4 Parental services • Provided by the parent company – often on cost recovery basis, i.e. with no profit element. • Examples are: • Group finance • Group tax • Legal 5 Parental services Parent company (Holdco) Subsidiary A Subsidiary B Subsidiary C Provision of services Management fees 6 Centralised services • Provided by a service company in the group – usually on a cost plus basis, i.e. including a profit element. • Examples are: • • • IT support Technical Finance and treasury 7 Centralised services Provision of services Management fee 8 Cost contribution/sharing arrangements • Provided by each group member for the benefit of the group as a whole always on a cost contribution basis commensurate with (expected) benefit. • Examples are: • Research and development • Procurement 9 Cost contribution/sharing arrangements Provision of services Allocation of costs 10 Key issues 1) Has an intra-group service has been rendered? – Benefit test – Shareholder activities? – Duplication? – Incidental benefits 2) If so, what is the arm’s length price for the services? 11 Has an intra-group service been rendered? Activity Service No service R&D administration Management of interest and exchange risks Issuance of parent’s shares Protection of intellectual property Raising funds for own new acquisitions Financial advice Supervision of cash flows Interview for director candidates of subsidiaries Obtaining high credit rating for belonging to MNE group 12 Benefit test • Activity performed must provide to the recipient with economic or commercial value to enhance its commercial position. • Consider whether an independent enterprise would: – Pay for the activity if performed by an independent enterprise; or – Perform the activity in-house – If not, no intra-group service 13 Rendering of intra-group services • Existence of an actual payment is useful, but does not prove that the service has been actually rendered • Description as a “management fee” is not prima facie evidence of management services • Absence of payment does not necessarily mean that no services have been rendered • Consider what an independent party would pay, and what an independent party would charge 14 Examples of services Planning Assistance in production, buying or distribution Coordination Budgetary control Financial advice Marketing Recruitment R&D administration Accounting Auditing Legal advice IP protection Market research Contract R&D * Factoring Computer services Financial services Provision of guarantees 15 Not services • Activities not constituting services: Shareholder activities Duplication of services Incidental benefits / Passive association 16 Shareholder activities • Costs related to juridical structure of the parent company itself • Costs related to reporting requirements of the parent • Costs related to raising funds for the acquisition of its participations 17 Duplicative services • Covers those services already performed by the recipient or by an arm’s length party on its behalf. • However, duplication could be accepted under certain circumstances, e.g. temporary duplication. 18 Incidental benefits / Passive association – Covers services performed by one group member (e.g. shareholder or coordinating centre) for a particular group member or a set of group member, and incidentally provides a benefit to other group members. – Examples in TPG para. 7.12 - 7.13 19 Special considerations • On call services – Frequency of use? – Degree of benefit obtained – Consider facts and circumstances • Aggregation/segregation – E.g. higher price for products because R&D is embedded in the product, rather than a separate service charge 20 Has an intra-group service been rendered? Activity Service No Service Business operation management through weekly television conferences Collect monthly financial, product and sales data of subsidiaries in order to make parent company’s internal reports Review budget plans drafted by subsidiaries Parent company’s internal auditor visit subsidiaries and give suggestions on business operations Check data transferred from subsidiaries for parent company’s consolidated accounts Check contract documents made by subsidiaries with third parties, and give legal advice External auditors attend subsidiaries audits for parent company’s consolidated accounts Develop and maintain IT system, which can deal with client complaints and connect the parent company and subsidiaries 21 The arm’s length price • Arm’s Length Price Setting Minimum price acceptable for provider Maximum price acceptable for recipient Range of AL prices 22 The arm’s length price • Transfer pricing methods most commonly used for services: Comparable Uncontrolled Price (CUP) Cost Plus Combination of methods or TNMM 23 CUP • Preferable when: There is a comparable service provided between independent enterprises in recipient’s market The associated enterprise providing the service also renders it to independent enterprise in comparable circumstances. • Examples: accounting, auditing, legal or computer services being provided. • Careful! Service infrastructure might impact the price! 24 Allocation of costs • Management fees charged as percentage of sales of the service recipient, e.g. 5% of the sales of the service recipients, possible? • Management fees should be based on the cost of service rendered – Actual vs. budgeted cost • Direct and indirect allocation 25 Direct cost allocation – Group members are charged for specific services – Identify the costs incurred for a particular service to a specific affiliate – Provides greater transparency to the tax authorities – Costs and time associated with supplying the services will be straightforward to identify – Examples: –R&D performed by central R&D department for a specific company or client –Marketing from the central department provided for a specific market or region 26 Indirect cost allocation • Used where proportion of the value of services rendered to each entity cannot be exactly quantified • Identify all relevant costs and allocate them among all recipients using a sensible allocation key(s) • Indirect cost allocation method must: – Be sensitive to commercial features of individual case – Contain safeguards against manipulation – Follow sound accounting principles – Produce allocations of costs that are commensurate with actual or expected benefit 27 Cost allocation keys Intra-group service Cost allocation key? Technology services Central purchase of raw materials Marketing support CEO’s strategic advice Personnel advice Payroll services Central R&D Strategic product planning Financing, accounting Rental charges/property services An indirect charge method may need some adjustments to achieve an arm´s length price. Combination of allocation keys is sometimes useful. 28 The arm’s length price • Consider perspectives of both – Service Provider and – Service Recipient • Provider – How much does the service cost? • Recipient – How much is the service worth? – How much would it cost to provide the service in-house? – How much would a comparable enterprise pay for the service? 29 Cost plus • Applicable in the absence of a CUP where activities, assets and risks are comparable • Cost base is very important • Mark-up: special considerations 30 Cost plus mark-up? • Normally mark-up (comparison with independent enterprises) – Factors to consider: nature, significance of the service, efficiency of the service supplier… • In some cases no mark-up required (OECD Guidelines paras. 7.33 - 7.37): – – – – Group enterprise acting as an agent or intermediary The costs are already equivalent to the market price Unreasonable administrative burden Safe harbours for service mark-up in some countries 31 Cost Contribution Arrangements • Framework agreed among enterprises to share the costs and risks of developing, producing or obtaining assets, services, or rights, and to determine the nature and extent of the interests of each participant in those assets, services, or rights. • A contractual arrangement rather than a judicial entity or permanent establishment 32 Participants’ Shares • In a CCA, each participant’s share of contributions to the arrangement will be consistent with their share of expected benefits. • Each participant would be entitled to exploit their interest, without paying a royalty or other consideration. A typical CCA Joint development of an intangible and associated product 33 CCA: an illustration Participant Contributions Benefits CCA Contributions Contributions Benefits Participant Benefits Participant 34 Cost Contribution Arrangements • Resource and skills are pooled and the consideration is the reasonable expectation of mutual benefit • Benefits may be – known in advance or uncertain – immediate (e.g. services) or expected over a longer term (e.g. R&D) 35 Types of Cost Contribution Arrangements • Joint development of intangibles – each participant receives a right to exploit the resulting intangible property No royalties • Joint provision of services that each entity provides and receives Separate service company rewarded on an arm’s length basis – generally not a participant Acquisition of property for mutual use 36 Applying Arm’s Length Principle • The expectation of mutual benefit is fundamental to the acceptance by independent enterprises of an arrangement for pooling resource and skills without separate compensation • Each party’s contribution is determined by the expected benefits • Benefits are expected, but the CCA may not be successful 37 Is the allocation appropriate? • Estimating the share of benefits expected to be obtained by each participant, and allocating contributions in the same proportions. For instance: Based on the anticipated additional income generated or costs saved by each participant. Using the price charged in sales of comparable assets and services. Using an allocation key or a combination of allocation keys (sales; units used, produced or sold; gross or operating profit; the number of employees; capital invested; etc.) 38 Balancing payments • A participant may be required to make a payment to other participants to adjust its share of contributions • Balancing payments are used to maintain the arm’s length nature of the CCA • They do not constitute a royalty for the use of the intangible • Generally treated as a cost to the payer and a reimbursement to the recipients 39 Entry, withdrawal, and termination • A new participant to an existing CCA might obtain an interest in the results of prior CCA activity: any transfer of pre-existing rights from existing participants to a new entrant must be compensated a buy-in payment. • A participant who leaves a CCA may dispose of its interest in the results of past CCA activity a buy-out payment. • When a CCA terminates, each participant should receive a beneficial interest in the results of the CCA activity. 40 What if a CCA is not arm’s length? • When the consideration received / paid by a participant is inadequate, or excessive… The arm’s length principle requires an adjustment (often through a balancing payment) In some cases, part or all of the terms of a CCA may be disregarded if commercially the substance (reality) differs from the form 41 Arm’s length structuring of CCAs a) Participants include only enterprises expected to derive benefit from the CCA activity b) Arrangement specifies the nature and extent of each participant’s beneficial interest. c) No payment other than CCA contributions, balancing & buyin payments made for the beneficial interest. d) Proportionate shares of contributions determined in a proper manner. e) Arrangement allows for balancing payments or for the allocation of contributions to be changed prospectively. f) Adjustment made as necessary upon entrance, withdrawal and termination of the CCA. 42 CCA vs. Intra-group services CCAs on services not creating IP Intra-group services Agreement to share costs, risks and Limited to the provision or benefits where all participants acquisition of a service by members of the MNE Group. The contribute in cash or in kind. risk of not successfully and efficiently providing the service is generally borne solely by the service provider. If participants join or leave a CCA, shares should be adjusted or rebalanced in accordance with the arm’s length principle. Terminating or extending the service agreement to other participants has generally no implication on other service recipients. 43 CCA vs. Intra-group services CCAs on services not creating IP Intra-group services As all participants are contributing to a common activity and share costs and the contributions reflect the expected benefits; contributions are usually valued at cost. The allocation of the costs is based on the expected benefits for each participant from the CCA. The profit element charged by the provider of the service is usually a key element as the provider will not share profits with the recipients. The allocation key is based on the extent each company has requested / received or is entitled to the service. 44 Questions and/or comments?